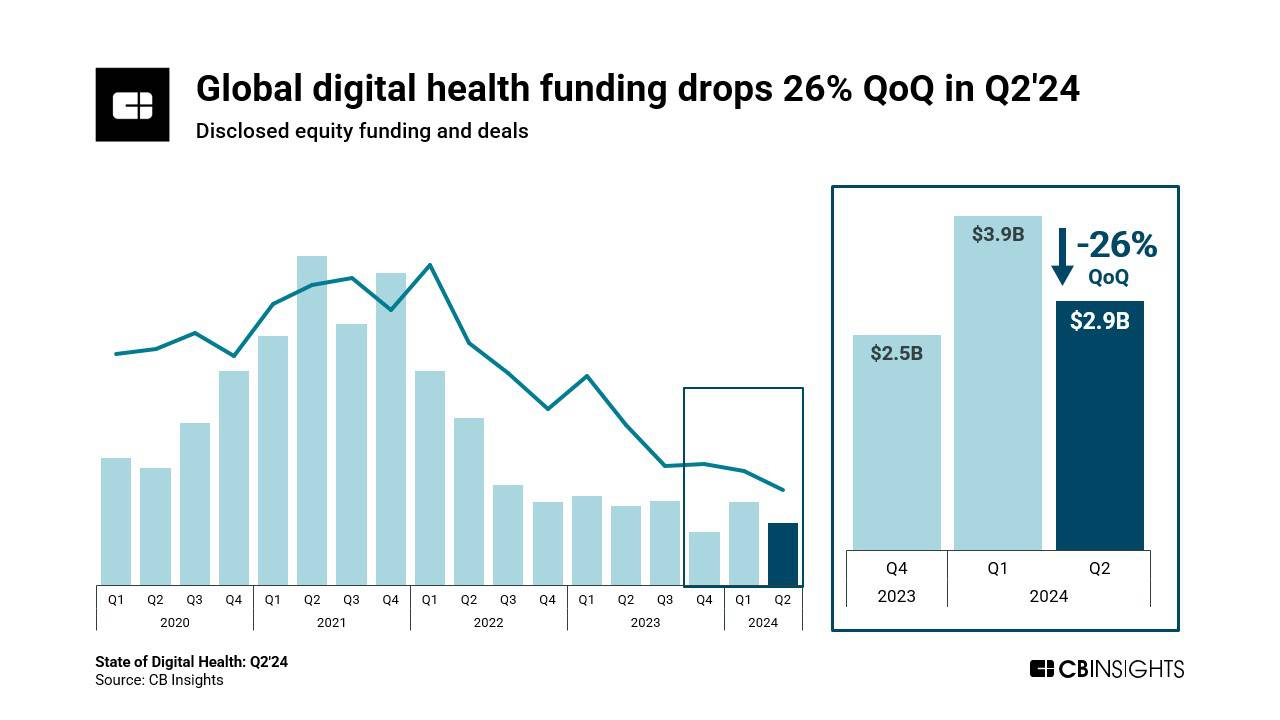

Funding in digital health drops, but larger check sizes and an uptick in exits highlight bright spots for the industry in Q2’24.

Investor dollars in digital health slowed in Q2’24, while deal volume dropped to its lowest quarterly level since 2014.

Amid the decline, investors have shifted their focus to writing fewer, larger checks for more mature companies in the digital health ecosystem. Meanwhile, their interest in early-stage companies has cooled.

Based on our deep dive in the full report, here is the TL;DR on the state of digital health:

- Global digital health funding declines by 26% QoQ, with funding falling to $2.9B across 235 deals in Q2’24 — the lowest quarterly deal volume seen since 2014. However, the annual average deal size globally is $16.7M in 2024 YTD, up 40% from the average for full-year 2023, signaling that investors are writing fewer but larger checks.

- US deal share grows to 61%, up from 54% in Q1’24. While digital health funding in the US declined by 18% QoQ in Q2’24, the US’ proportion of the global deal volume grew, marked by an increase in mid- to late-stage deal share. Median deal size is also up in the US in 2024 so far — sitting at $7.5M vs. $4.6M in full-year 2023.

- Mid-stage deal share jumps to 26% in 2024 YTD, while early-stage deal share falls by 14 percentage points. Early-stage deals have consistently accounted for 60%+ of all digital health deals in recent years. However, in 2024 YTD, early-stage deal share has dropped to 51% as mid- and late-stage deals have captured more investor interest. In the US, early-stage deal share has fallen to 45% in 2024 YTD vs. 62% in full-year 2023.

- $100M+ mega-rounds drop off in Q2’24 but are more varied across the digital health landscape. Digital health mega-rounds dropped from 8 in Q1’24 to 5 in Q2’24. While mega-rounds were focused on biotech in Q1’24, they were more spread out in Q2’24, spanning areas like care navigation, ultrasound tech, and value-based care tools. The largest deal of the quarter ($200M Series D) went to Foodsmart — a telenutrition company focused on chronic disease management.

Source: CB Insights — Foodsmart Funding Insights

- Digital health exits increase in Q2’24, rising from 26 to 32 QoQ. AI-driven platforms were the highlight here, with Tempus (precision medicine) and XtalPi (drug R&D) going public via IPO and Nuvo Group (remote pregnancy monitoring) going public via SPAC. Digital health M&A exit activity also picked up in Q2’24, especially in Europe, which saw M&A deals jump from 5 to 10 QoQ. Globally, virtual care, provider workflow tools, and drug R&D platforms were key categories for M&A in Q2’24.