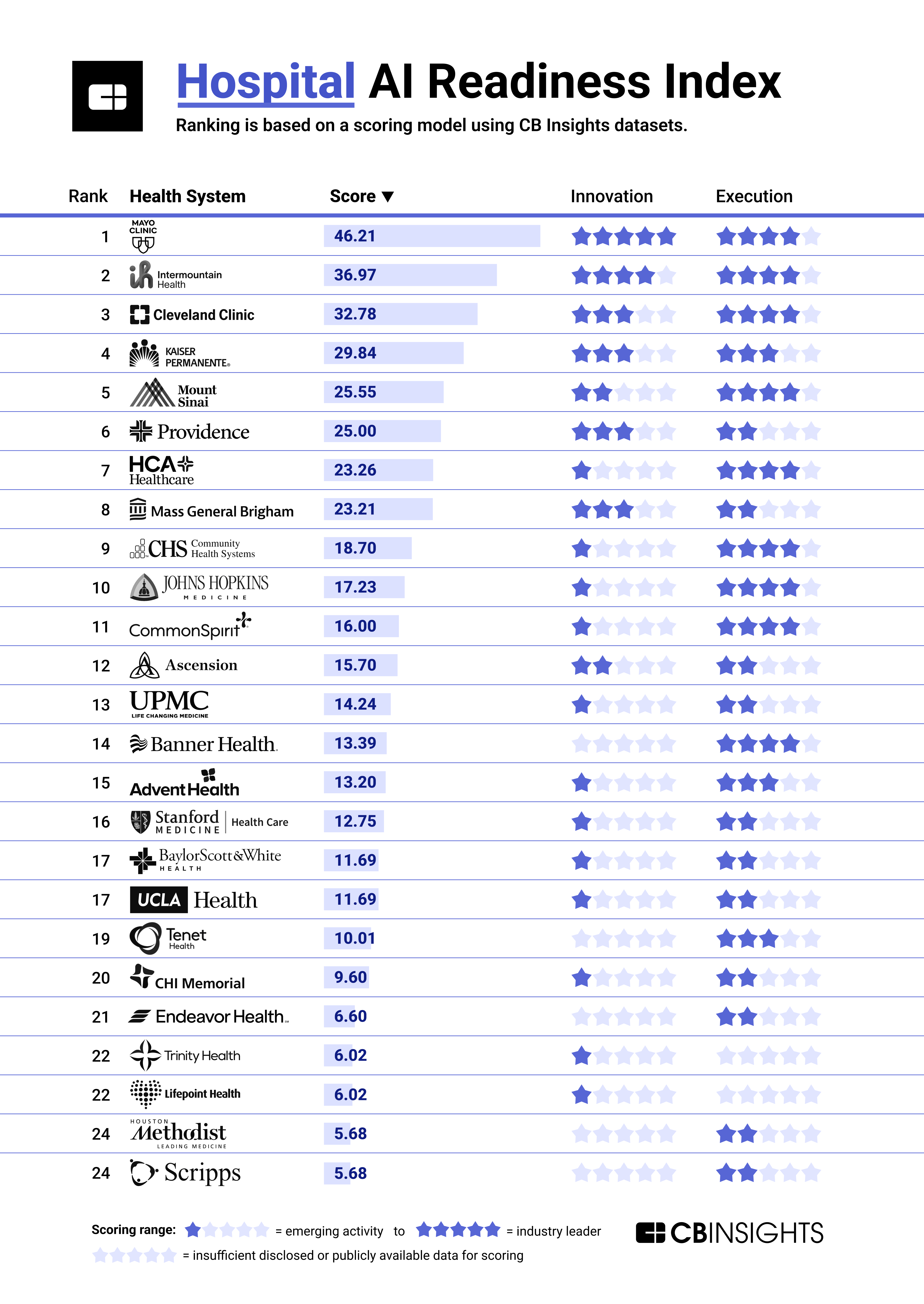

Assess how prepared US health systems are to adopt and respond to rapidly evolving AI technologies.

AI has been a feature of hospital tech for years, and generative AI has created a new flood of transformational solutions.

From ambient documentation to surgical tools and digital wound care, AI solutions are helping providers focus on patients, improve diagnostics, and find new ways to perform surgeries and other procedures.

To determine which health systems are most prepared for the shift, CB Insights has launched the Hospital AI Readiness Index.

We looked at the top private-sector health systems in the US (by hospital count) and ranked them based on how prepared they are to adapt to a rapidly evolving AI landscape across 2 key pillars: innovation and execution.

- Innovation: The innovation score measures a health system’s track record of developing or acquiring novel AI capabilities. This score is based on CB Insights data including patents, acquisitions, and deal-making activity. It also considers the presence of an AI-dedicated research center.

- Execution: The execution score measures a health system’s ability to bring AI-powered products and services into clinical practice as well as deploy AI internally across business and back-office functions. This score is based on CB Insights data including business relationships, product launch media mentions, and earnings transcripts.

Below, we present the 25 health systems (inclusive of subsidiaries and venture arms) most prepared for AI.

Want to dive into key data featured in this index? CB Insights customers can check out the links below:

Leaders

Mayo Clinic leads in AI readiness primarily due to its relatively high level of AI innovation.

Its innovative nature is reflected in part by its patent activity. For example, Mayo has filed 50+ patents across areas like cardiovascular health and oncology. It has also invested in AI-enabled companies addressing a range of use cases in healthcare, from clinical documentation to surgical intelligence.

Intermountain Health and Cleveland Clinic round out the top three.

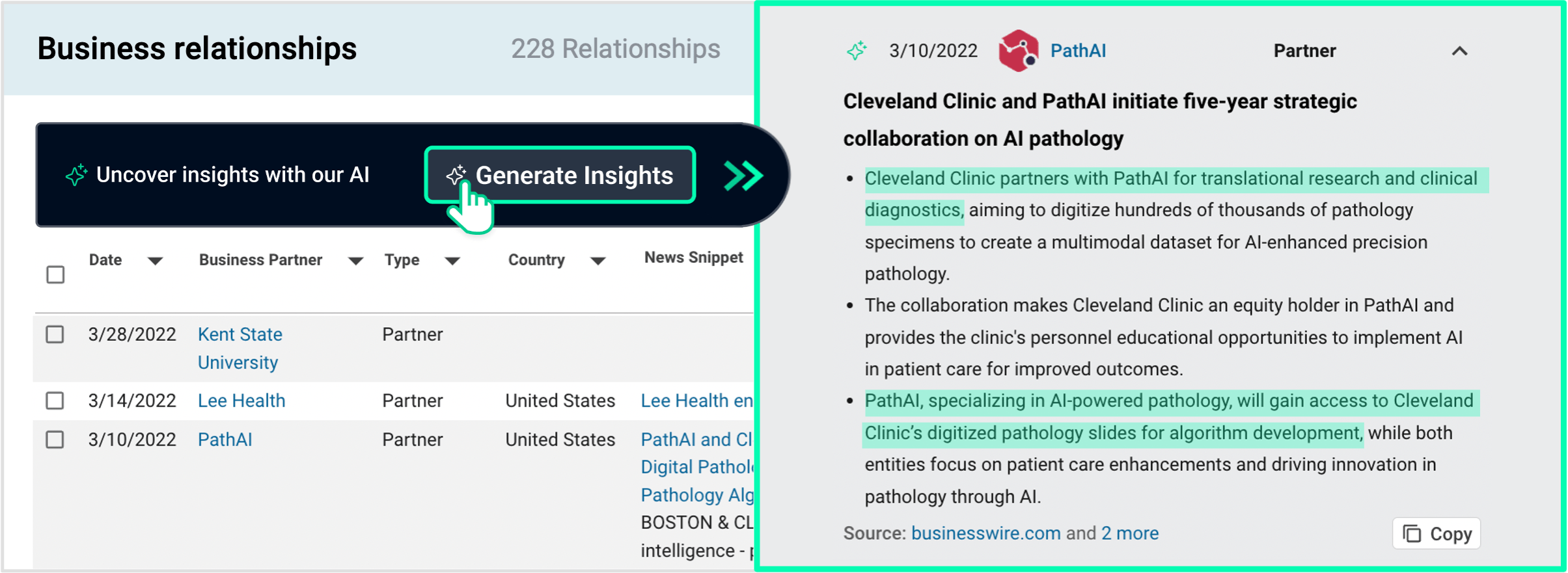

Notable activities for these players include Intermountain’s internal development of a real-time clinical decision support platform. Meanwhile, Cleveland Clinic stands out on the execution front due to its high volume of AI-focused business relationships, such as a partnership with PathAI focused on leveraging pathology algorithms to enhance translational research and clinical care.

Source: CB Insights — Cleveland Clinic Business Relationship Insights

Innovation

Innovation scores are based on the presence of an AI-dedicated research center and CB Insights data on AI-related patents as well as acquisitions and deal-making activity since 2019 (as of 5/29/2024).

The most active health system in terms of investment count is Mayo Clinic. Its investments highlight areas where AI is picking up steam in healthcare. For example, at the end of 2023, it participated in a funding round for Abridge — a startup that helps transcribe patient-provider conversations and create clinical notes using generative AI — alongside investors like CVS Health Ventures, the American College of Cardiology, and Kaiser Permanente Ventures. Mayo Clinic has also funded companies like Theator, which combines computer vision and AI to help surgeons draw and act on insights from videos of procedures.

Intermountain Health is the second most active AI investor among evaluated health systems. Via its venture arm, Intermountain Ventures, it backed AI-powered patient engagement platform Gyant, which has since been acquired. Most recently, its venture arm invested in Freenome, which develops blood tests for early cancer detection.

When it comes to patent count, Mayo Clinic and Cleveland Clinic lead the pack.

One focus area for Mayo Clinic is cardiovascular health. For example, in 2022, it was granted a patent for a system that uses a machine learning model to analyze electrocardiogram (ECG) data and predict the likelihood that a patient will have a stroke.

Source: CB Insights — Mayo Clinic patents

Meanwhile, Cleveland Clinic was granted a patent for a decision support system that utilizes machine learning to individualize radiotherapy doses, enhancing the precision and effectiveness of cancer treatments.

The evaluated health systems are not overly acquisitive — just one has inked an acquisition in the past 5 years: Providence. In 2019, it acquired Lumedic, which uses blockchain and AI to streamline healthcare revenue cycle management.

Execution

Execution scores are based on CB Insights data including AI-related business relationships, product launch media mentions, and earnings transcripts since 2019 (as of 5/29/2024).

The majority of the health systems evaluated for this ranking have established business relationships with AI-enabled companies.

For example, in 2024 so far:

- Mayo Clinic teamed up with Techcyte to develop a platform that will help healthcare organizations harness AI in their pathology practices.

- Meanwhile, Banner Health worked with Regard to ease the administrative burden on clinicians by automating key tasks, like notetaking and chart reviews.

- Johns Hopkins Medicine partnered with Healthy.io to offer digital wound care services to patients.

Few evaluated health systems have earnings calls, as many are non-profit organizations with different financial reporting requirements than publicly traded companies. However, earnings calls among systems that do hold them reveal how AI is coming into view in a hospital setting.

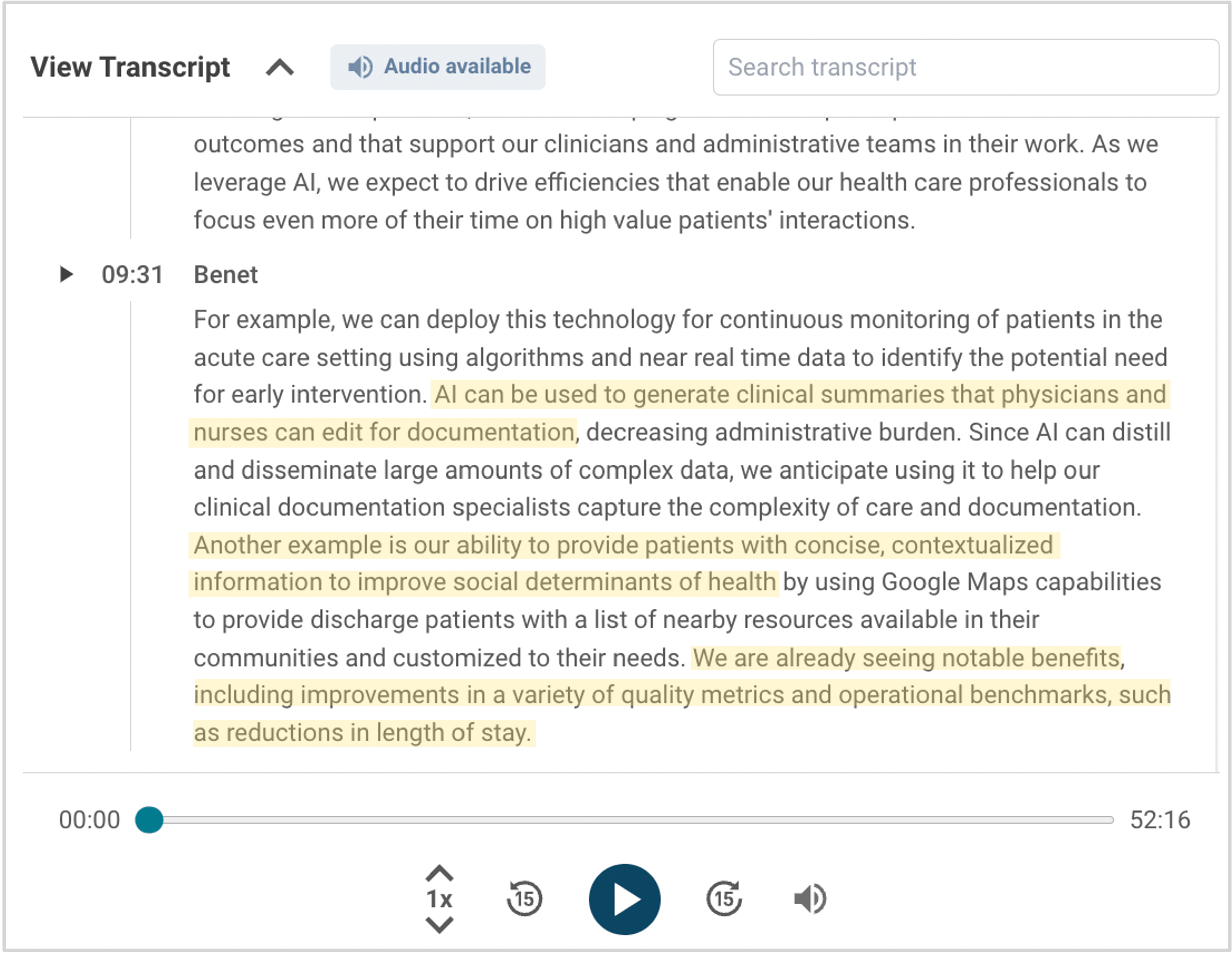

For example, Community Health Systems’ EVP of clinical operations, Miguel Benet, highlighted how AI could be deployed to streamline clinical documentation on an earnings call in Q4’23. He also discussed how CHS is using AI to provide patients with relevant information regarding local resources upon discharge — an initiative that has already yielded positive results, such as reductions in length of stay.

Source: CB Insights — Community Health Systems earnings transcripts

Four of the health systems on this list have launched AI-enabled products.

For example, last year, Intermountain Health developed a platform equipped with real-time clinical decision support tools that leverage AI to improve patient diagnosis and treatment. Just a few months ago, CommonSpirit Health launched Insightli, an internal AI assistant capable of generating written content.

If you aren’t already a client, sign up for a free trial to learn more about our platform.