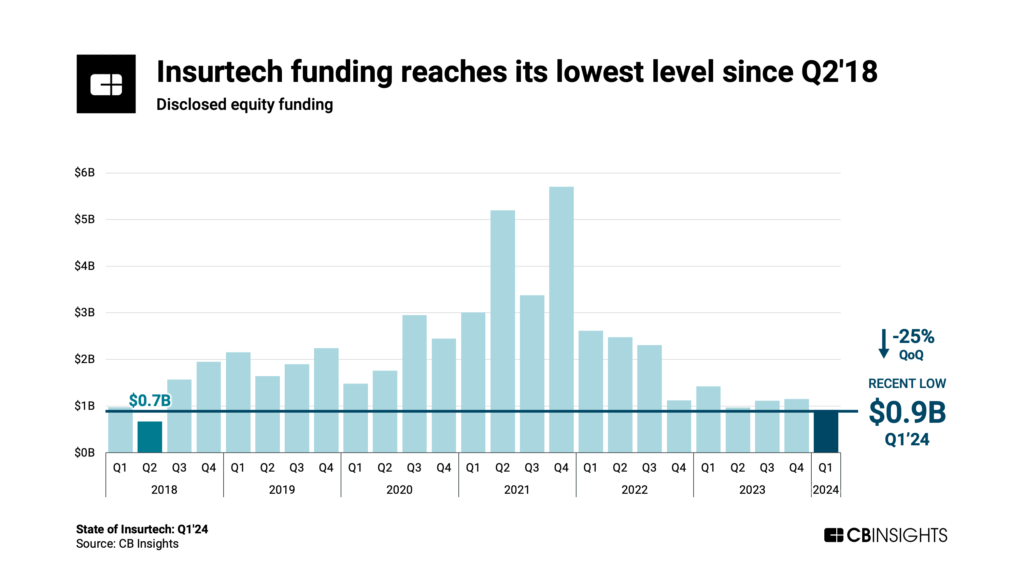

Global insurtech funding falls to its lowest quarterly level since 2018.

Despite growth in broader venture funding in Q1’24, insurtech funding declined 18% quarter-over-quarter (QoQ) to hit its lowest level in years ($0.9B).

Even so, median insurtech deal size is up in 2024 so far — signaling that investors are still willing to make notable bets where they see opportunities.

Here is the TL;DR on the state of insurtech:

- Insurtech funding falls 18% QoQ to hit $0.9B in Q1’24 — the lowest quarterly level since 2018. The decline was particularly pronounced in P&C insurtech, which saw funding drop by 25% QoQ. Meanwhile, broader insurtech deal count ticked up by 3% to reach 107 in Q1’24.

- No $100M+ mega-round insurtech deals are raised for the first time since 2018. Relatedly, late-stage deal share — which often comprises larger, mega-round deals — is down to 7% in 2024 so far. Hyperexponential, a pricing platform, raised the largest insurtech deal in Q1’24 — a $73M Series B round.

- Europe sees quarterly insurtech deal count rise for the first time since Q2’22. Europe-based insurtech startups raised 28 deals in Q1’24, up from 24 in Q4’23. Funding also more than tripled QoQ, rising to $284M in Q1’24. The region saw the 2 largest insurtech deals in Q1’24: Hyperexponential’s Series B round and embedded insurer ELEMENT’s $54M Series C round.

- Median insurtech deal size is $5M in 2024 so far, up 19% vs. $4.2M in full-year 2023. This elevated median deal size is partially linked to an uptick in median early-stage deal size, which sits at $3.2M in 2024 so far. Meanwhile, the average insurtech deal size in 2024 YTD ($9.8M) is down 17% from full-year 2023.

- Insurtech sees its fewest M&A exits since 2018. Exit activity has nearly halted in insurtech, with M&A exits declining from 13 in Q4’23 to just 5 in Q1’24. Comparatively, fintech M&A exits largely remained flat QoQ — ticking down from 153 in Q4’23 to 152 in Q1’24.