We use CB Insights data to break down the insurtech trends emerging from the conference.

InsurTech NY — an insurtech community association, incubator, and investor — held its 2024 Spring Conference on March 20 and 21.

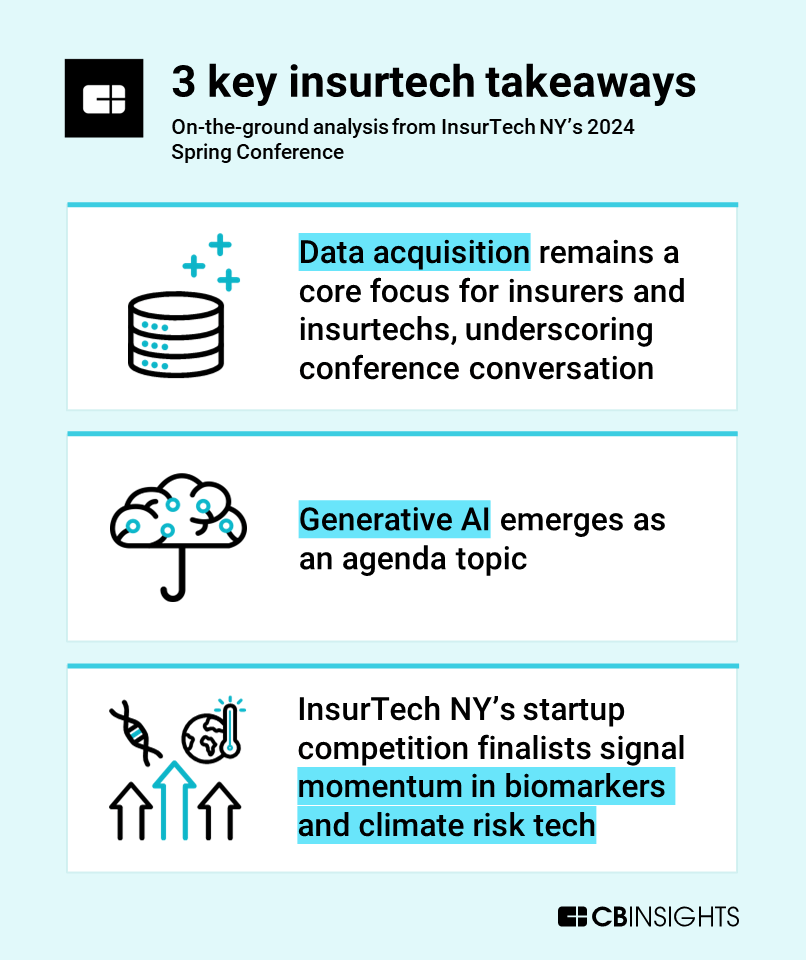

Presentations and panels centered on the new wave of opportunities from AI and data analytics within insurance.

We look at the key themes and use CB Insights data to dig into the underlying trends.

1. Data acquisition remains a core focus for insurers and insurtechs

Data acquisition opportunities were highlighted by conference speakers — particularly in the context of powering AI applications for underwriting, claims, and preventative risk management.

Two insurtech CEOs detailed data acquisition initiatives that support preventative risk management as central to their profitability strategies. Rick McCathron of Hippo, an insurtech managing general agent (MGA) focused on homeowners insurance, is targeting customers willing to implement internet of things (IoT) devices to help prevent claims. Meanwhile, Alex Timm of Root Insurance, a full-stack auto insurtech carrier, is going after loss ratio improvement via the acquisition of auto telematics data and actuarial pricing automation.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.