The explosion of generative AI saves the AI sector from the worst of the venture drought.

Although AI venture activity slowed down in 2023, the sector — and particularly, generative AI — remains the one clear bright spot in an otherwise somber fundraising environment.

Based on our deep dive below, here is the TLDR on the state of AI:

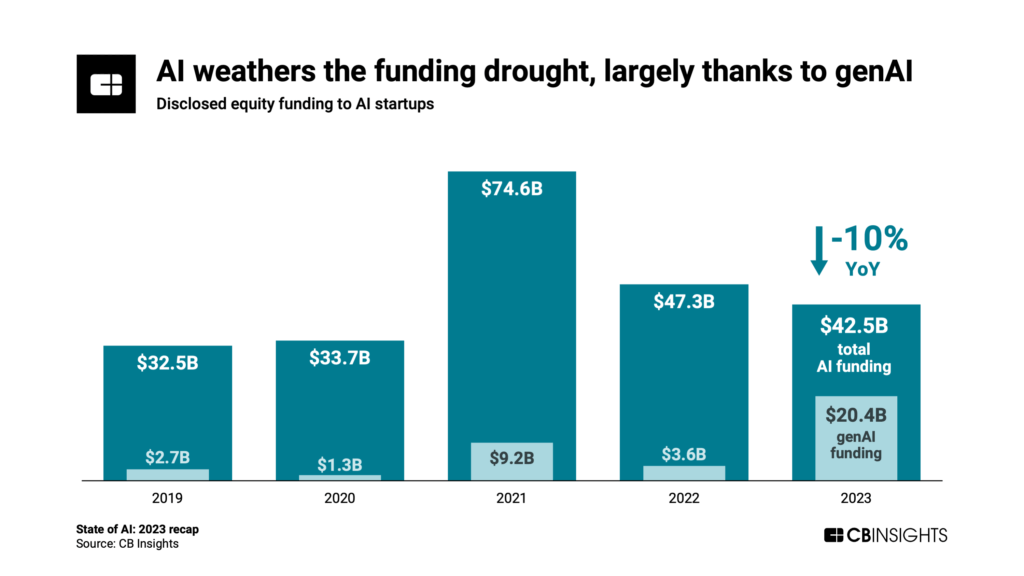

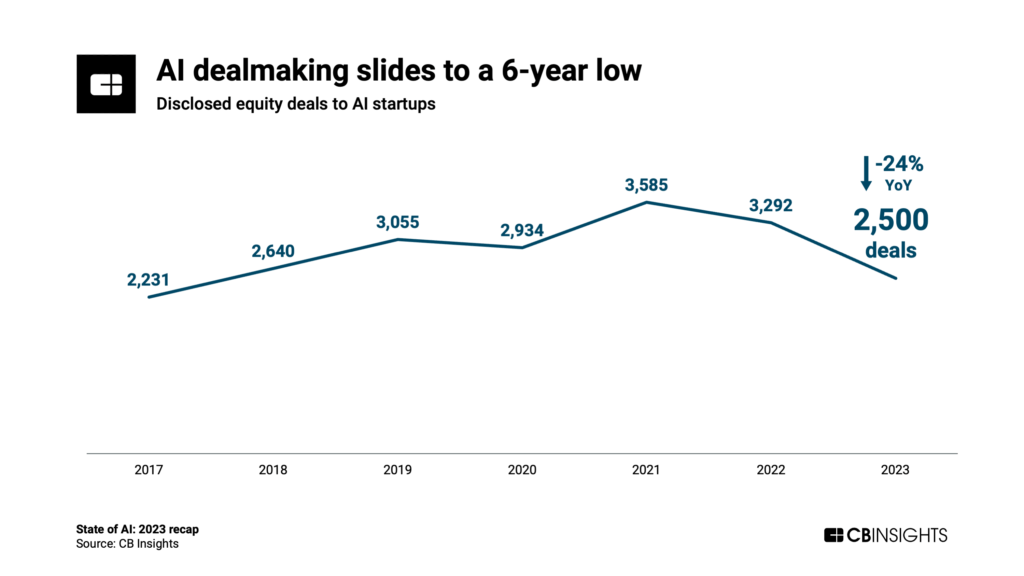

- In 2023, AI startups raised $42.5B across 2,500 equity rounds. Although down 10% year-over-year (YoY), AI funding fell far less than broader venture funding (-42% in 2023). AI deal volume decreased by 24% YoY — also less than the decline seen in venture as a whole (-30%). However, the year’s 2,500 deals marked the lowest annual deal count in AI since 2017.

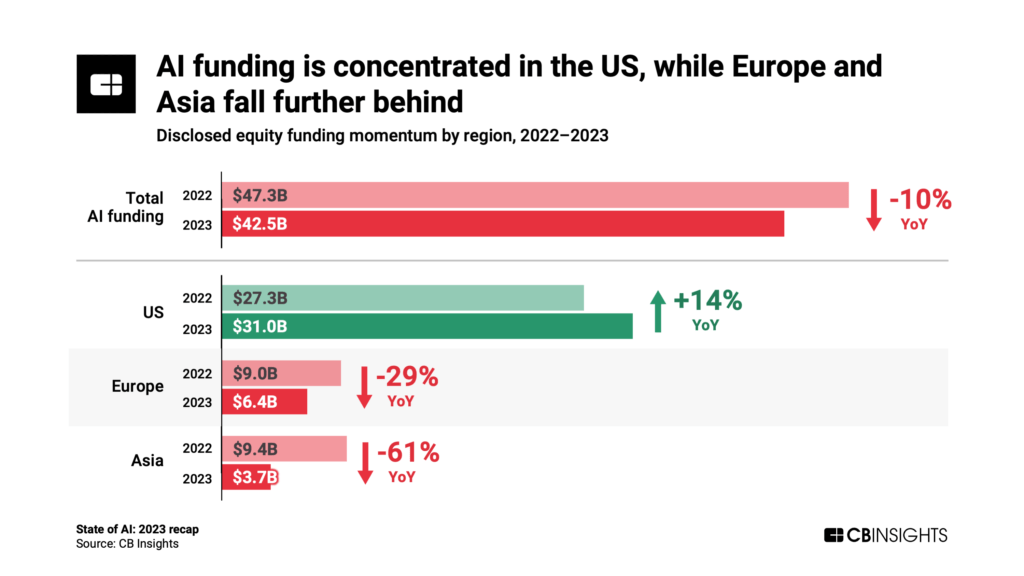

- The US saw AI funding jump 14% YoY in 2023, fueled by mega-rounds. AI funding in Europe, on the other hand, slipped 29%, while it fell a whopping 61% in Asia. The US continues to lead in AI deal share worldwide, with nearly half of all AI deals.

- Generative AI dominated in 2023, attracting 48% of all AI funding. This was up significantly from 2022, when genAI startups grabbed just 8% of the total. 2023’s surge was driven by massive rounds to large language model (LLM) developers like OpenAI, Anthropic, and Inflection.

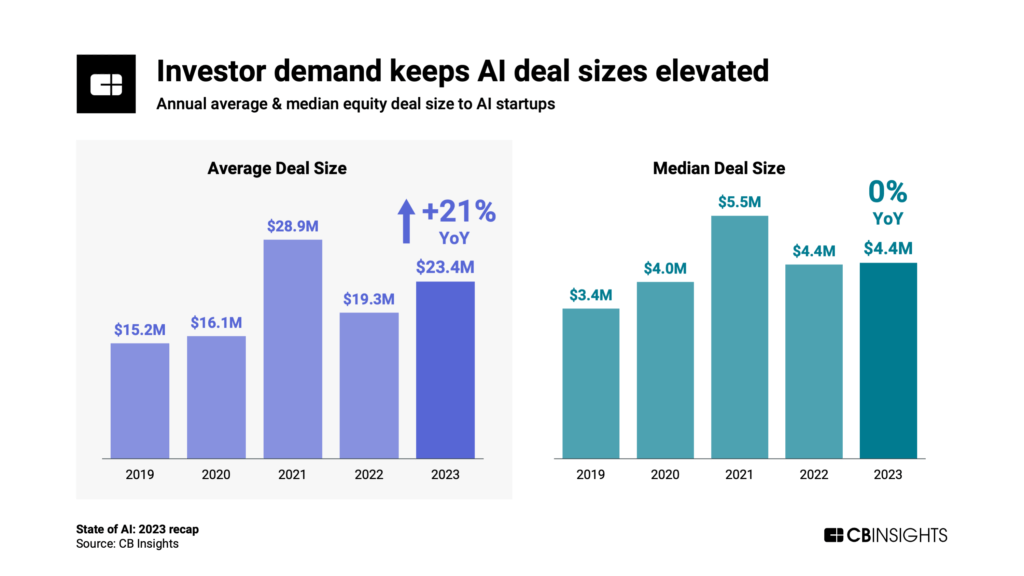

- AI deals got bigger in 2023, with the average deal size climbing 21% YoY to $23.4M. The median deal size also held steady YoY at $4.4M — the second-highest level on record — indicating that bigger checks are being doled out across the board, not just to a few AI heavyweights.

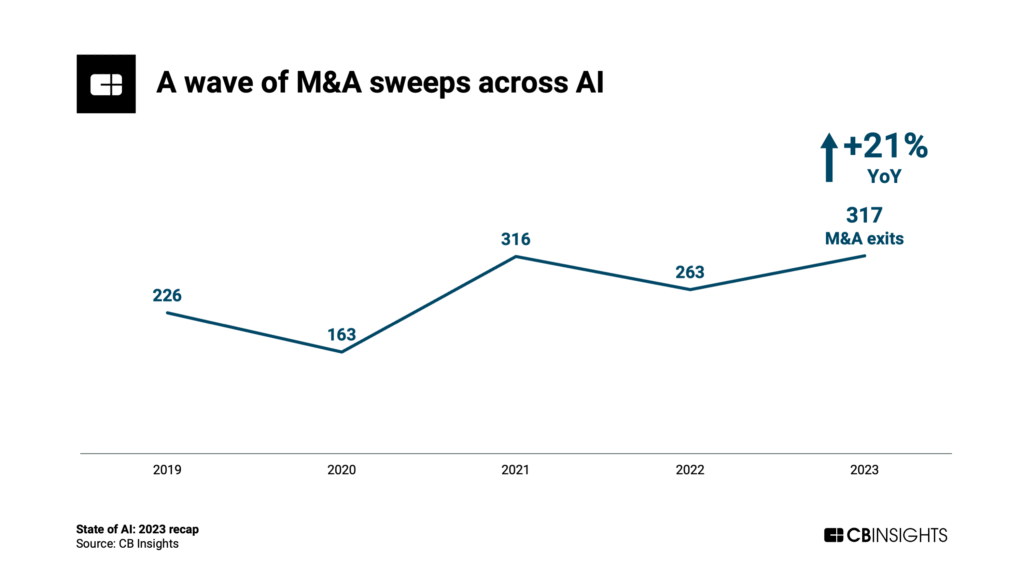

- M&A exits rebounded in 2023 to 317, a record high. The acceleration in M&A points to a wave of consolidation, as incumbents look to quickly bring AI capabilities on board so they don’t get caught on the back foot.

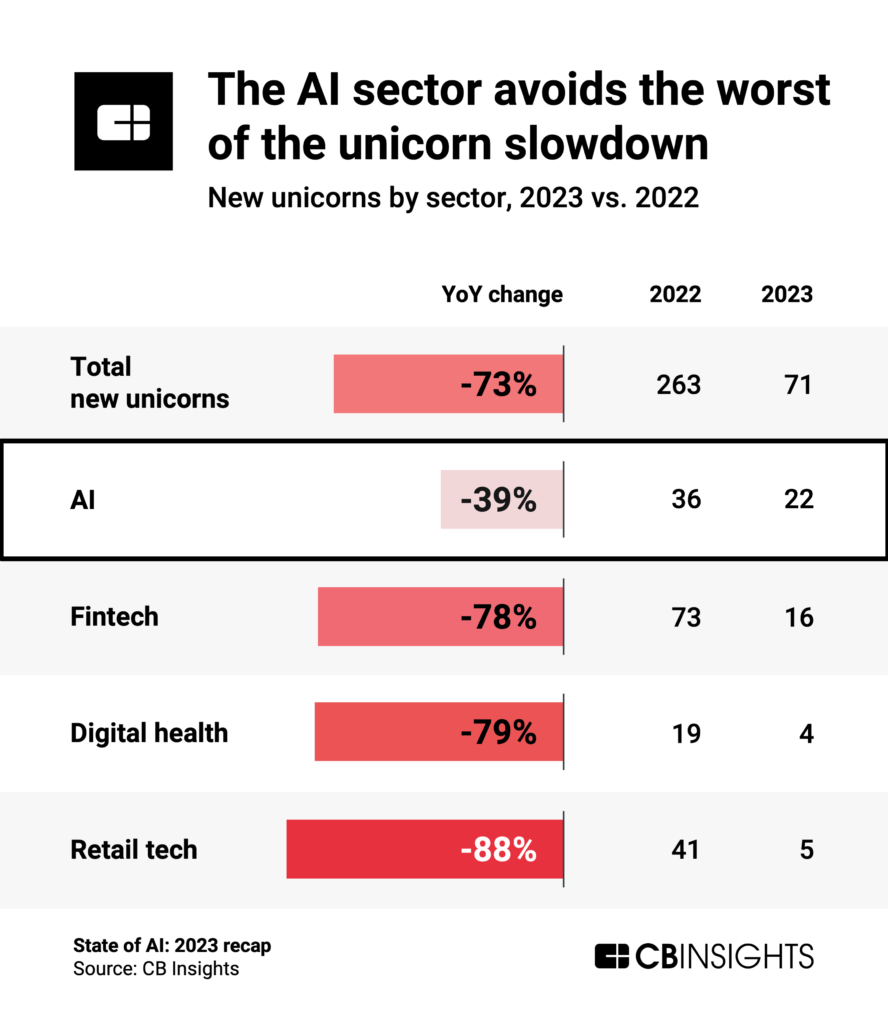

- The AI sector minted 22 new unicorns in 2023, down 39% from 2022. However, that’s a much softer decline than other sectors, like fintech and digital health, experienced over the same period. GenAI companies, in particular, are seeing their valuations soar as investors compete for access to deals.

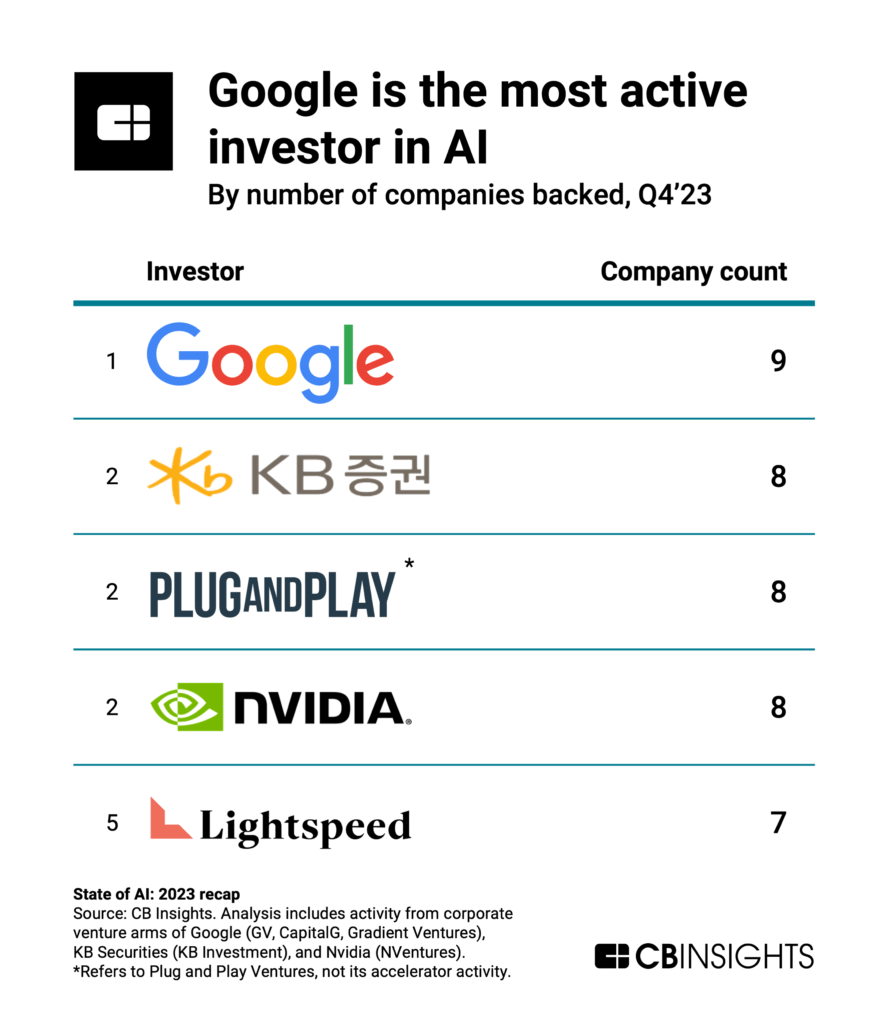

- Google was the most active investor in AI in Q4’23, backing 9 AI startups. It was followed by KB Securities, Nvidia, and Plug and Play Ventures with 8 companies apiece, and then Lightspeed Venture Partners with 7.

Below, we’ll explore these themes across 7 charts.

Amid sweeping declines in venture activity, funding to AI startups remained resilient in 2023, falling just 10% YoY to $42.5B. One-third of this ($14B) was raised by just 3 companies — OpenAI, Anthropic, and Inflection — as the race to develop more advanced LLMs heats up.

In 2023, generative AI startups accounted for 48% of total funding to the AI sector — a far greater share than in any prior year. We expect genAI startups to maintain or even increase this in 2024, as the genAI boom is far from over.

AI deal volume decreased by 24% YoY in 2023. While less severe than the drop in venture deal count more broadly (-30%), this brought AI deal count to 2,500 last year — its lowest level since 2017.

On a quarterly basis, AI dealmaking fell for a seventh straight quarter in Q4’23. At 554 deals, the quarter was the worst for AI dealmaking since Q2’17. Should this continue in 2024, it will have the effect of narrowing the AI field as investors home in on the companies they think will win out in the long run.

In 2023, US-based AI startups drew 73 cents of every dollar invested in the AI sector.

The country saw AI funding jump 14% in 2023 — largely because of the previously mentioned model developers, which are all based in the US. The US also accounted for nearly half (46%) of AI deals in 2023, followed by Asia with 25% and Europe with 24%.

In Europe, AI funding dipped 29% YoY to $6.4B, though the continent has seen a steady stream of its own substantial deals. This included 2 mega-rounds (deals worth $100M+) in Q4’23: Germany-based Aleph Alpha’s $500M Series B and France-based Mistral AI’s $415M Series A. Both Aleph Alpha and Mistral AI are model developers competing with the likes of OpenAI.

Meanwhile, funding to Asia-based AI startups tumbled 61% YoY to $3.7B. However, the continent saw funding trend up on a quarterly basis in 2023, suggesting growing momentum. In particular, the United Arab Emirates grabbed 2 mega-rounds in Q4’23.

The proliferation of colossal AI deals — at times stretching into the billions of dollars — has pushed up the sector’s average deal size significantly. In 2023, this came in at $23.4M, up 21% YoY.

However, the median deal size has also held steady YoY at $4.4M, suggesting that investor attention is spread across AI startups of all sizes and stages.

We’ve even seen early-stage rounds soar past the $100M+ mark — in Q4’23, 3 startups raised Series A mega-rounds:

- Mistral AI ($415M Series A)

- Baichuan AI ($300M Series A)

- Together ($103M Series A)

Notably, all 3 of these companies develop open-source models for generative AI. The deals come at a time when open-source models are closing in on closed-source ones in terms of performance.

AI excitement has not only gripped investors but also corporations and tech leaders, who are driving a wave of consolidation in the space. M&A exits rebounded in 2023 to reach 317 deals — inching past 2021’s previous all-time high of 316. In many cases, incumbents are looking to add AI capabilities to their platforms; in others, AI leaders are snapping up the competition to capture market share.

The shift toward consolidation drove M&A activity to a new peak in Asia, which saw 54 M&A deals in 2023 — nearly double 2022’s count.

The 2 largest M&A deals in Q4’23 went to US-based companies:

- Corvus Insurance was acquired by Travelers for $435M. Corvus builds cyber risk offerings on top of AI algorithms.

- Gameplanner was acquired by Airbnb for $200M. Launched by one of the founders of Siri, Gameplanner has been operating in stealth since 2020, but it’s expected to work on AI projects within Airbnb.

While there’s been a rapid slowdown in the number of new unicorns across sectors, the excitement around generative AI has helped cushion the blow in AI.

Annually, 2023 saw 22 new AI unicorns, down 39% from 36 in 2022. For comparison, venture as a whole saw new unicorn births plummet 73% YoY — a decline of nearly twice the speed. Other sectors saw even more pronounced declines: -78% (fintech), -79% (digital health), and -88% (retail tech).

Within AI, generative AI companies are reaching unicorn status at hyper speed. Among genAI unicorns, it took just 3.4 years on average to hit the $1B valuation mark — 50% less than the average time for all other unicorns.

The most active investor in private-market AI right now is tech giant Google, investing in 9 AI startups in Q4’23 across its various venture arms. This included a $500M corporate minority round to Anthropic, as Google ups the ante in the big tech battle over genAI.

Google was followed by Korean investment bank KB Securities, Nvidia, and Plug and Play Ventures — all with 8 companies backed — and Lightspeed Venture Partners, with 7.

Google and Nvidia’s inclusion in the top 5 points to the strong link between these tech giants’ investment activity and their internal growth priorities.

Many of their recent investments are customers — e.g., organizations buying Google’s cloud computing power or Nvidia’s chips — and so the tech giants are helping seed their own books of business via these investments. Because of the strategic alignment, with Google and Nvidia both heavily prioritizing AI innovation, those portfolio companies could also make for future acquisition targets.

If you aren’t already a client, sign up for a free trial to learn more about our platform.