While B2B dominates AI funding, the consumer sector is rapidly evolving. We look at some of the notable categories receiving investment.

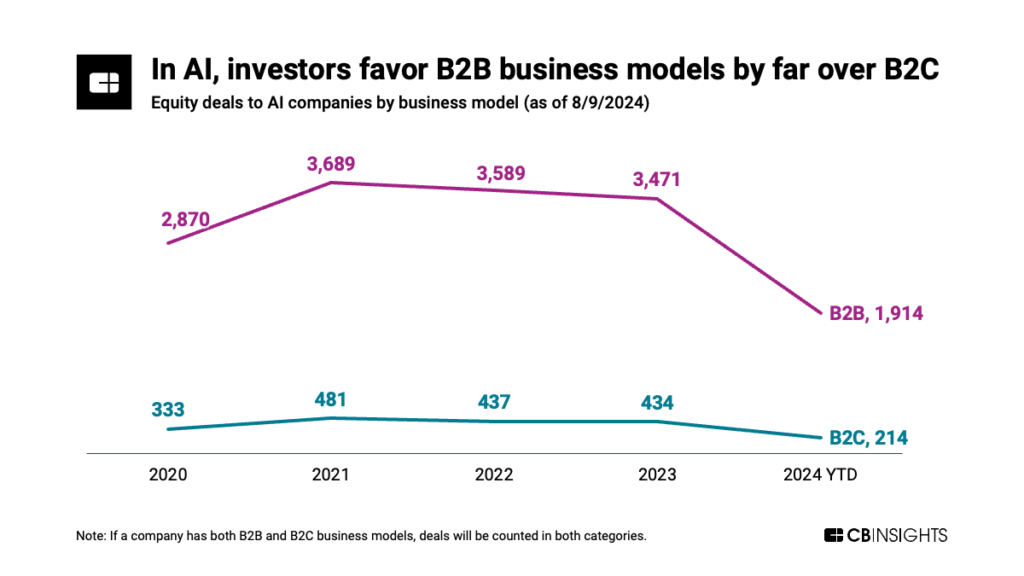

Investors like to back AI companies with B2B business models.

That’s at least partly driven by a wave of big companies racing to build AI into their roadmaps.

Source: CB Insights — customers can use the CB Insights platform search filters and our business model data to explore both B2B AI deals and B2C AI deals

But while B2B dominates AI funding, the consumer sector is rapidly evolving.

Big tech companies like Meta, Apple, Amazon, Microsoft, and Google are all exploring how to use AI to engage consumers with chatbots and other AI-powered features.

Meanwhile, OpenAI is embedding ChatGPT more deeply into consumers’ day-to-day lives by leveraging partnerships with device makers (like Apple) and auto manufacturers (like Peugeot).

The company is also looking for AI’s killer consumer apps.

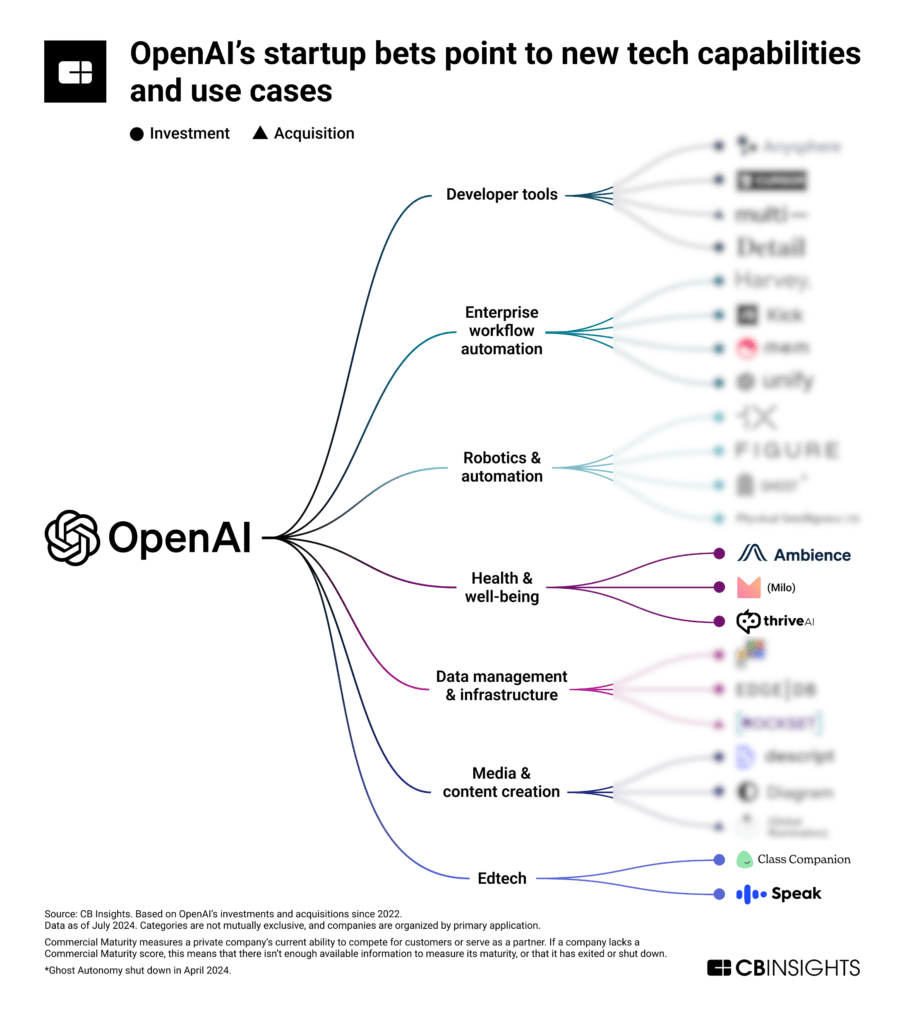

The OpenAI Startup Fund (a corporate venture fund backed by external LPs, including Microsoft) has zeroed in on learning and personal health based on its recent activity.

For example, it’s backed multiple deals to language-learning app Speak (last valued at $500M).

Source: CB Insights — OpenAI Investment Strategy Map

That tracks where we’re seeing AI B2C funding going so far this year.

Here are some notable categories where startups are developing B2C applications based on 2024 deal activity:

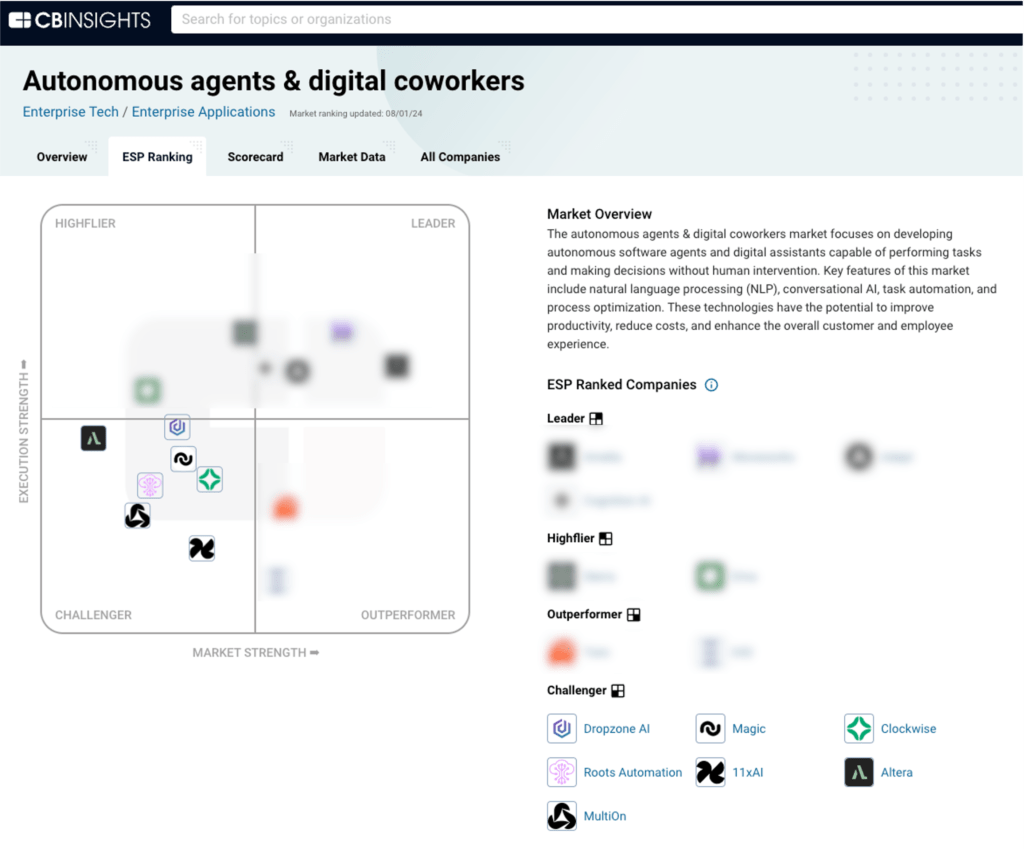

- Personal AI assistants and chatbots: This includes chatbots from some of the top-funded companies in the space (Anthropic, xAI) as well as early-stage agent startups (MultiOn, Altera). Both Altera and MultiOn are featured in our autonomous agents market on the CB Insights platform.

Source: CB Insights — autonomous agents & digital coworkers market

- Language learning & education: Companies are raising fresh funding amid natural language processing advances to offer AI tutors, including companies funded this year like Praktika.ai, Speak, Futura, and Buddy.ai.

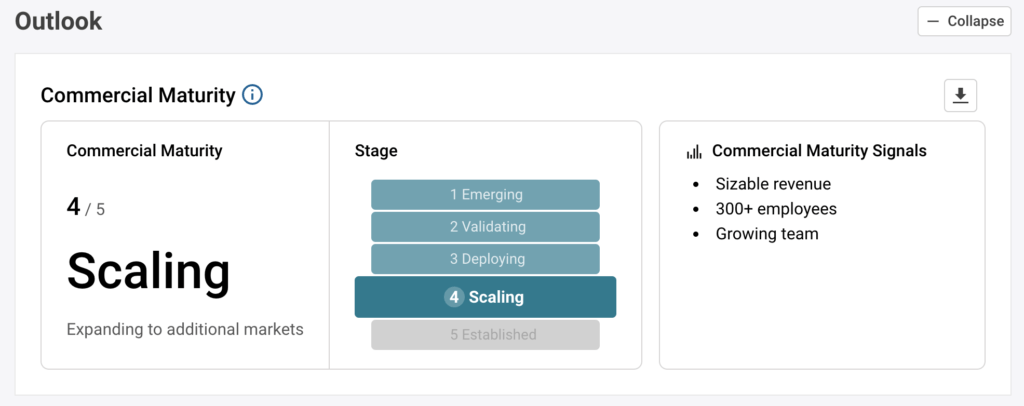

- Image generation & editing: This was one of the earliest genAI categories to gain attention in 2022. Notable deals to companies in this space in 2024 YTD include Ideogram ($80M) and PhotoRoom ($43M). It’s a space that also includes a bootstrapped player that we’d projected might be worth $10B (and likely more now). Another entrant into the space is YC-backed PhotoRoom, an AI photo-editing platform. The company is actively scaling as highlighted by its Commercial Maturity score from CB Insights shown below. The company hit $50M in ARR in 2023 per CB Insights revenue data.

Source: CB Insights — Commercial Maturity score on PhotoRoom’s company profile

- Mental health & wellness: Companies in this category are providing AI-powered mental health support, such as chatbots (Lore Health, Clare&me) and stress management techniques (SacredSpace.AI).

- Virtual characters & social interaction: This tracks with our January 2024 prediction that AI “friends” would become a bigger reality. A number of companies here (SOAI, Foxy) are targeting romantic companionship.

Personalization is paramount. Across almost all categories, there’s a strong emphasis on using AI to deliver personalized experiences.

From AI tutors to virtual companions, startups are racing to create the next game-changing consumer AI application.

However, the business models for consumer-focused AI companies may need to evolve beyond subscriptions, so expect to see significant innovation on both the business model and product fronts.

MORE AI RESOURCES FROM CB INSIGHTS:

- State of AI Q2’24 Report

- Analyzing OpenAI’s investment strategy: Where the ChatGPT maker is betting on AI disruption

- Future of the workforce: How AI agents will transform enterprise workflows

- The enterprise AI agents & copilots market map