This post was conducted by Blockdata and sponsored by Chainalysis. How Chainalysis' data, and the ecosystem as a whole, is shedding light on crypto's security and legitimacy and further clarifying its real world applications.

For financial institutions considering cryptocurrency adoption, Chainalysis’ blockchain data solutions bring transparency and trust to the compliance and risk assessment process. Their new Myth Busting Report addresses pervasive misconceptions about blockchain’s security, viability, scalability, and legitimacy.

In what’s been more than a decade of disruptive projects and front page news headlines, regulators and institutions have sought a deeper understanding of these decentralized and often anonymous blockchain networks.

As a result, the cryptocurrency ecosystem has been subject to many unfounded or antiquated perceptions from financial institutions, regulators, and broader enterprises. The absence of centralized verification opened the door for third-parties to make sense of unstructured data and identify its counterparties.

Chainalysis, a blockchain data solutions provider, offers a bridge between crypto companies, regulators, financial institutions, and law enforcement.

Their solutions have become a cornerstone to the compliance programs of businesses involved in cryptocurrency markets to various extents, ranging from direct market involvement such as America’s oldest bank, BNY Mellon, offering custody of digital assets; to less involved financial institutions with private wealth contingents that source crypto derived capital, or capital markets teams seeking to take cryptocurrency businesses public.

As a critical piece of the evolving blockchain ecosystem, Chainalysis’ team has dedicated significant time addressing prevailing myths and demonstrating the value of blockchain technology.

“When I first visited BNY Mellon in 2017, I truly think they thought I was up to no good,” says

Jeffrey Billingham, the Director of Strategic Initiatives at Chainalysis. “Five years later they’re a customer of ours and going into crypto custody.”

Continuing this effort, Chainalysis recently published its Crypto Myth Busting Report, tackling 40+ crypto myths held by compliance officers and investors alike when considering further integration of blockchain technology and its regulatory outlook.

“In reality, most concerns that prevent institutional involvement are either superfluous, or there are ways to build programs that address these challenges. There is a way for institutions to get involved,” says Jeffery. “Many would also argue that the current market trough is the best opportunity to do so. Oftentimes, crypto winters are when building programs and educating teams and compliance colleagues can set the stage for legitimate applications within the ecosystem.”

We sat down with Jeffery to discuss how Chainalysis’ data, and the ecosystem’s progress as a whole, is shedding light on crypto’s security and legitimacy and further clarifying its real world applications.

Crypto blockchain’s vs. tradition finance: visibility, security, and compliance

The report includes myths around the legal and security implications of decentralized networks and the risks they pose to, for example, KYC compliance.

These myths include:

- Crypto is anonymous and untraceable.

- There’s no way to prevent criminals from using Crypto.

- Crypto enables tax evaders.

- Miners could alter Bitcoin’s properties for their own gain.

- There’s no way to guard against hacks.

“Satoshi Nakamoto’s Bitcoin whitepaper contrasted the potential privacy of Bitcoin with that of bank transactions, while outlining a vision for cryptocurrency’s traceability. Bitcoin was never meant to be and has never been untraceable,” Chainalysis says in the report. Since 2013, further KYC regulations have been applied to cryptocurrency that ensure crypto-to-fiat transactions aren’t anonymous.

Blockchain architecture offers complete visibility so that every transaction is verified and viewable in an immutable public ledger. This transparency enhances the security of cryptocurrency for businesses, whether industry natives or traditional financial institutions looking to provide crypto offerings. Compliance teams can trace the origins of cryptocurrency to ensure they’re coming from a clean source, thereby enhancing their anti-money laundering efforts.

“There’s a huge degree of trust and transparency available for every blockchain with data service providers like Chainalysis,” says Jeffery. “We help regulators, institutions, and law enforcement understand all of the counterparts in the marketplace and the actual operating counterparties on otherwise anonymous transactions.”

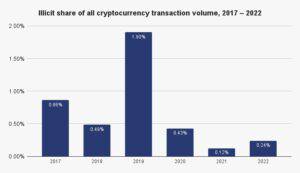

This full cycle visibility has enabled Chainalysis to work with many parties to maintain compliance and mitigate risk. The process has helped prove that 1.) criminal uses on blockchains are rare and declining, and 2.) that coordination between law enforcement and blockchain analysis tools can effectively track criminal activity to recover stolen funds and identify illicit activity.

Above: Chainalysis’ 2023 Crypto Crime Report shows that crypto crime represented less than 1% of overall transition volume in 2022.

For ensuring AML compliance, data solutions on top of immutable blockchain networks are able to track transactions from source to deposit.

Blockchain analytics have speculated around how many hops – or intermediary wallet transfers between source to destination – are needed between dangerous intermediary wallets to determine that a wallet is safe.

“This question comes up frequently with banks because they want some sort of standardization, but setting standards at any number of hops is conceptually irrelevant when the purpose is understanding the ultimate source of the money,” says Jeffery.

“You can’t have a compliance officer left in a scenario where crypto currency was moved through hundreds of wallets over an hour with no ability to view further, or where money was moved twice in the last four years and an alarm is set off. It depends on the scenario, whether it’s a money laundering case, a fraud incident, an account compromise, or a larger financial terror network. We’re not limited by the number of hops, and showing the path from source to deposit that’s a huge insight when you’re looking to uncover and prevent money laundering or illicit activity.”

Chainalysis calculates every blockchain entity’s indirect exposure to illicit activity, or funds received from or sent to illicit addresses regardless of the number of non-service addresses in between.

The data solutions visibility and trust allowance extends well beyond AML compliance.

“When our data can show transactions are coming from this exchange, miner or payment processor, that’s a different conversation than just flagging if transactions came from a sanctioned entity or a scam site,” says Jeffery.

Regarding concerns for tax evasion, blockchain transparency prevents hiding transactions, and users are required to report crypto transactions on tax returns. The primary way that crypto differs from fiat is that the IRS treats digital assets like property when assessing taxable gains or losses.

The blockchain’s immutable ledger is safer than some would believe, and security across the larger ecosystem is continually improving.

Attacks that compromise blockchains are another common fear. A 51% attack involves a single party controlling a majority of the blockchain, after which they could change the order of transaction processes, reverse unprocessed transactions to ‘double-spend’, and prevent the completion of new verification blocks.

Yet, a 51% attack has never occurred on a major blockchain, and such occurrences are increasingly difficult as network communities grow. The hashing power to maintain a blockchain is directly correlated with its size, making the power needed to do so inhibitively large. The alignment of economic incentives across all parties, especially on a major blockchain, is further risk mitigation.

The broader crypto ecosystem has been steadfast on improving security.

In the early days of the internet, prevailing wisdom said to never enter your credit card data on a website. Once SSL encryption technology came around and reputable payment gateways were established, e-commerce began to proliferate.

Cryptocurrency adoption is following a similar dynamic, where security safeguards are being solved over time, in pursuit of cutting edge applications for the technology.

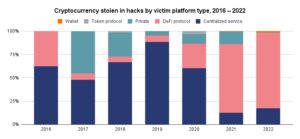

In just the last few years, improvements have reduced hacking frequency on major exchanges, and the majority of security threats are occurring on newer, unrefined technologies such as cross-chain bridges, or DeFi apps that port cryptocurrency across blockchains.

Above: Chainalysis’ 2023 Crime report shows volumes of cryptocurrency theft by platform

This new technology is more vulnerable than centralized services or wallets, but innovators are racing to improve its security. Chainalysis recently partnered with blockchain security firm Halborn to provide DeFi code audits for identifying and fixing vulnerabilities. Cryptocurrency security is increasing as the industry’s cumulative experience and adoption grows. Chainalysis sees this to be a persistent trend.

Regulation and Compliance: crypto companies and services

The Myth Busting report addresses myths surrounding risks associated with interactions with cryptocurrencies, and their regulatory oversight (or lack thereof).

These myths include:

- Crypto is completely unregulated.

- All cryptocurrency businesses are risky, and therefore banks can’t interact with them.

- It’s impossible for banks to know what crypto companies do with their crypto holdings.

The 1970 Bank Secrecy Act required all money services businesses (MSB) to implement Know Your Customer (KYC) and anti-money laundering (AML) programs.

All cryptocurrency businesses — such as exchanges, ATMs, brokers, custody providers, and more — needed to register as MSBs comply with BSA requirements since 2013, when the Financial Crimes Enforcement Network (FinCEN) considered “persons creating, obtaining, distributing, exchanging, accepting, or transmitting virtual currencies” as MSBs.

“There’s a lot of guidance that exists from the Department of Financial Services (DFS), the Treasury, the OCC , the SEC, and CFTC in terms of the KYC guidance, rules and requirements to comply with based on what you’re buying and selling,” says Jeffery.

“In most cases, the historical data points to the fact that problematic cryptocurrencies companies weren’t able to meet requirements that are already on the books today. FTX is a shining example of this.”

When supported by improving regulatory clarity and third party transparency, the inherent transparency of blockchains makes many of the risks associated with financial services more visible than with fiat. Crypto is the only asset class whereevery business transaction is viewable in real time.

As an example, crypto companies are beginning to publish proof-of-reserves, or third party verification audits that the equivalent value of client accounts are held in covered client assets.

Integrating Crypto into traditional financial services while meeting risk management standards is increasingly feasible. Chainalysis provides a Crypto Maturity Model for banks that are considering cryptocurrency adoption that steps in the process ranging from risk mitigation for KYC, AML/TL, sanctions, fraud, and compliance; to assessing customer interaction with in-depth on-chain metrics tools like Kryptos. They’ve used this model to support banks when taking on cryptocurrency businesses as clients, advising cryptocurrency businesses on IPOs and mergers and acquisitions, providing foreign exchange services, and offering synthetic cryptocurrency products or enabling deposits.

U.S. Regulatory Apathy: Crypto’s co-existence with the Financial System

“When you look at jurisdictions like Brazil, Singapore, and the European Union, there is no question that the US is lagging behind,” says Jeffery.

“Regulators around the globe are realizing the opportunity they have to utilize the blockchain’s inherent transparency to revolutionize the way they supervise markets and enforcement regulations. At Chainalysis, our policy team works with regulators around the world to demonstrate the art of the possible that comes with this technology. That approach is no different in the US.”

Jeffrey believes two myths in particular are contributing to current regulation trends and weighing on U.S. regulators’ minds:

- Crypto companies don’t want to comply

- Achieving consumer protection is best done through banning cryptocurrency and digital assets.

“The overwhelming majority of digital asset players want to be compliant and safe for consumers,” he says. “However, to do just that, they need clear regulatory guidelines that take into account the specifics of the underlying technology, and offer the certainty needed for further investment. We see digital asset firms’ deep investment in tools like Chainalysis as proof of this, and we’re constantly working with businesses to tamp down on illicit activity and take criminals to task.”

Blockchain data solutions and cryptocurrency companies have a role in facilitating progress.

“Agencies are in need of data sources that help them understand the difference between Bitcoin and Etheruem, or Bitocion and Stable Coins. And they’re relying on business to do well and explain their case and provide the data that helps them learn, educate and understand internally. There’s a huge education curve for regulators around this,” says Jeffery.

In tandem, frivolous and overly restrictive proposals in lieu of organized guidelines are harming U.S. competitiveness and progress towards many promising use cases.

“Our data at Chainalysis on the banning of cryptocurrency — things that countries such as Egypt and China have done — don’t work. In places with bans and without bans, consumers continue to enter the market,” says Jeffrey.

“U.S.-based firms are increasingly debating whether they should relocate to other jurisdictions where clear regulatory guidance exists. This harms U.S. consumers by limiting the market options available to them, and also by potentially pushing a revolutionary technology outside the bounds of U.S. law. Therefore, a comprehensive regulatory framework is the only sustainable path forward – if the goal is to actually achieve consumer protection.”

Recent actions by the U.S. government may improve clarity as focus turns toward digital currencies.

“Since 2022, the U.S. House of Representatives has been working on legislation that would improve regulatory clarity. The Chairmen of the House Financial Services Committee and House Agriculture Committee have recently released a joint discussion draft of legislation providing a statutory framework for digital asset regulation,” says Chainalysis in the report.

Maturing regulation outside the U.S. is moving faster. The inter-governmental Financial Action Task Force (FATF) is leading the establishment of global standards for rulemaking amongst participating countries. The EU parliament passed the first comprehensive legislation in its region for regulating digital assets, in April 2023. The Atlantic Council’s interactive map offers details for global progress.

As global regulators expedite their efforts to address cryptocurrencies and blockchain, misconceptions about the feasibility of a co-existential relationship between traditional financial systems and blockchain technology persist.

These myths include:

- Crypto can’t integrate with traditional finance.

- There’s only downside for governments integrating crypto into the financial system.

- CBDCs will make existing crypto obsolete.

In October 2022, America’s oldest financial institution, BNY Mellon, became the first large bank to custody cryptocurrency. In a global survey BNY Mellon commissioned of institutional asset managers, asset owners, and hedge funds, it found that 88% of institutional investors were still moving ahead with plans to adopt digital assets despite crypto winter, and 72% were seeking providers to support these needs.

Governments developing crypto literacy can reap benefits within their financial systems. Its traceability improves abilities for tracking criminal activity, recovering illegal gains, and using sanctions to prevent crime.

This potential has spurred a rush of research around the implementation of central bank digital currencies (CBDCs) to improve transaction processing, remittances, cross-border payments, and protect national security. CBDCs combine the benefits of fiat and crypto currency by putting national securities on a blockchain.

In March of 2022, President Biden signed an Executive Order on Ensuring Responsible Development of Digital Assets with the objective of expanding U.S. leadership on CBDC research and development.

These developments sparked speculation that the implementation of CBDCs could render current cryptocurrencies obsolete.

However, these speculations overlook some of the foundation goals of cryptocurrencies that differentiate them from national currencies, whether or not they are stored on the blockchain. Bitcoin for example, was invented and purposed as an asset class and store of value that shields users from monetary policy risks and inflation.

CBDCs would be a huge innovation in terms of the method by which a central bank delivers its asset, but it’s the same asset going from paper to digital. This is a very different proposition than an asset that was built by a white paper and community with a protocol that exists based on an agreement with all participants in that network. In that sense, CBDCs and crypto coexist, they don’t replace one another,” says Jeffery.

“There are many distinct considerations and risks for CBDCs,” he adds. “Our commercial banking infrastructure is in large part due to the central bank not wanting, or its inability to, keep records on the paper trail for hundreds of millions of citizens. We depend on commercial banks to do that work, and whether we should rely on CDBS to do that work is a question still being explored.

Real World Use Cases and Applications: a multifaceted ecosystem

Finally, the MYTH BUSTING REPORT addresses fallacies surrounding the numerous opportunities for blockchain, well beyond acting as a store of value and ledger.

These myths include:

- Crypto has no real-world use case.

- Blockchain doesn’t scale.

- All cryptocurrencies are alike.

- Blockchains have no business application.

“The myth that crypto has no real world use case tends to be founded on the assumption that it’s ‘crypto or nothing’. Cryptocurrency exists alongside central bank currency, gold and precious metals, commodities, equities, and rates products. These are all options for managing a diverse and conservative portfolio,” says Jeffery.

“It’s a diversifying asset that has been at work for over a decade, that operates on a network of rules separate from central banks, with supply growth that’s determined by a protocol and a community. It’s no better or worse, only different than the money in our pockets.”

Numerous examples of real world applications for crypto already include remittance, inflation mitigation, and retail purchasing.

Faster and less expensive than wire transfers, cryptocurrency is being leveraged to transfer money across borders and overseas. Over $56 million in crypto donations have been sent to Ukraine within the last year, and $5.9 million was sent to the victims in need within a month of the Turkey and Syria earthquake on February 6th.

In the 2022 Geography of Cryptocurrency Report, Chainalysis found that emerging markets are leading the world in grassroots adoption, and peer-to-peer (P2P) trade volume makes up a significant percentage of all cryptocurrency use in these regions.

Many investors are using crypto to diversify their portfolios against inflation. For example, Venezuelans have increasingly embraced crypto after Venezuela’s Bolivar depreciated more than 100,000% from December 2014 to September 2022. Venezuelans received $37.4 billion worth in 2022 alone.

According to a survey PYMNTS conducted of merchants with annual online sales totaling at least $250 million, 46% of merchants accept crypto as payment. PYMTS also found that “85% of businesses with more than $1 billion in annual online sales say they accept some form of crypto-enabled payment method. Deloitte’s 2021 Merchants getting ready for crypto study, which polled 2,000 senior executives at U.S. retail organizations, found that over 75% of merchants reported plans to accept stablecoin and cryptocurrency payments in the next two years.

While blockchains are most commonly used to facilitate value exchange, that’s not where their usefulness ends. The technology’s diversity goes far beyond value exchange, it can support use cases across banking, logistics, digital ownership and governance.

There are four different kinds of blockchains: public, private, hybrid and consortium. Under this umbrella are hundreds of blockchains and thousands of crypto currencies that serve varying functions and network operations.

A common criticism against blockchain’s real-world application, especially by large institutions, are the throughput issues of blockchain networks like Bitcoin – or how many transactions can be processed per second.

Referred to as the Blockchain Trilemma, the challenge of “balancing and maximizing scalability, decentralization, and security in one network”, highlights how the crypto ecosystem continues to overcome technical hurdles with purpose-built applications.

Indeed, Bitcoin’s transaction speed doesn’t allow developers to build apps on the network. This limitation was the impetus for Layer 2 networks, like Etheruem of Polygon, designed to improve scalability, environmental impacts, and other challenges.

“Bitcoin, Ethereum, and BNB have all managed to grow and attract millions of users precisely because they’re not interchangeable. Each one offers different benefits to both developers and end users, which stem from the choices made in how they were built, particularly in their tradeoffs between decentralization, scalability, and security,” Chainalysis Myth Busting Report

“Scalability may or may not be the most important factor for a specific network’s success, it depends on the purpose,” says Jeff. “When people compare Bitcoin to MasterCard the assumption is that Bitcoin is a payment network, but it’s also many other things. Its scale limits are features, not bugs. Meanwhile, other networks are being purpose built for handling large transaction volumes or as payment rails.”

Bitcoin’s Proof-of-Work consensus mechanism puts its emphasis on decentralization and security. Its purposeful scarcity enables it to act as a store of value and hedge against fiat financial systems, often referred to as “digital gold”. However, its block size and 10-minute block processing speed limit its transaction abilities per second.

Meanwhile, the Ethereum blockchain was built not only to support its native Ether token as a store of value, but to be programmable. Developers can use the Ethereum blockchains programming language, Solidity, to build smart contracts and apps as well as create non-fungible tokens. Smart contracts built on Ethereum, as self-executing contracts written into code, offer decentralized applications for borrowing, lending, and asset exchange. Ethereum’s recent transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) network allows it to process more transactions per second than bitcoin.

BNB, created and managed by Binance, is similar to Ethereum but uses Proof-of-Staked-Authority which lowers fees and improves scalability, but with more centralized control.

“While the kernel of innovation started with peer-to-peer networks like Bitcoin and Ethereum, these new methods of community building, whether in virtual reality or for buying and selling digital art, show that the ability to build on top of these networks is almost unlimited,” says Jeff. “Other examples like DAOs and DeFi are creating systems of economy that use assets in new and different ways without requiring a traditional broker.”

“Considering that a blockchain is a permanent, secure, traceable database, the business applications are endless — supply chain management, data management, logistics, healthcare, media, stock trading, auditing, internet of things (IoT), and more. For instance, Sustainable Shrimp Partnership (SSP) is using IBM’s Food Trust™ — a blockchain solution for supply chain intelligence — to ensure it produces shrimp sustainably. With tracking and tracing capabilities, SSP can also share information about its product’s origins with retailers and customers,” says Chainalysis in the report.

Applications of Blockchain Data Solutions Providers: expanding abilities for risk management in the ecosystem

As institutional adoption of cryptocurrencies continues, Chainalysis sees many avenues for further applications of blockchain data visibility beyond KYC cornerstones which have been most prevalent to date.

“Rather than just being data for compliance, sanctions exposure, and transaction monitoring – our belief is that this data will be helpful in many other areas of risk management – and understanding the overall health of cryptocurrency businesses and sectors,” says Jeff.

“Possible applications include counterparty analysis and liquidity risk. Once businesses have built their compliance cornerstone, they can look to this data to solve for many other market wide risks that have been unidentifiable up to this point.”

If you aren’t already a client, sign up for a free trial to learn more about our platform.