From sustainability ratings to risk management, we take a look at how BlackRock, Citigroup, and JP Morgan are investing in AI to solve ESG’s incomplete data problem.

ESG was the hottest trend in investing. Now it’s under fire.

ESG in investing is the general approach of putting money into companies, funds, and projects that adopt environmental, social, and governance (ESG) principles. It’s a framework for investors to identify opportunities and mitigate financial risks, with the ultimate goal of generating higher returns.

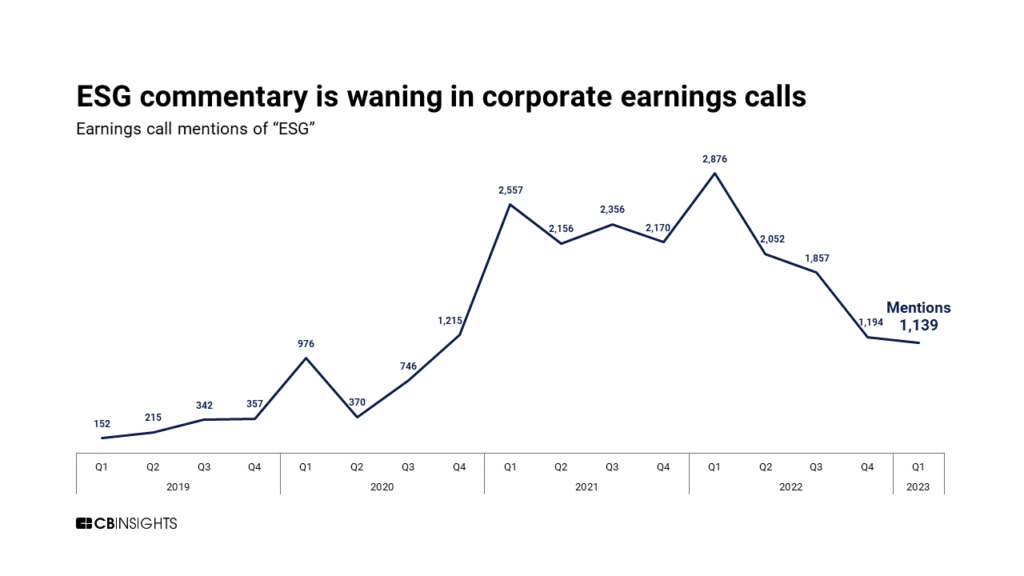

Asset and investment managers now feel mounting pressures concerning the accuracy, biases, performance, and even political motivations of ESG. The dramatic rise and fall of corporate interest in ESG can be seen in recent company earnings call mentions of the term.

A lack of comprehensive data lies at the heart of several ESG shortcomings, including the inaccuracy of ratings and corporate greenwashing (i.e., exaggerated claims of sustainability).

To solve ESG’s incomplete data problem, leaders in the space are using artificial intelligence (AI) to improve ESG data collection, analysis, and ratings.

In this report, we use CB Insights’ business relationship data to explore how 3 of the largest asset and investment managers in the world — BlackRock, Citigroup, and JP Morgan — are leveraging AI-powered data providers to increase the volume, speed, and accuracy of ESG analytics.

What are BlackRock, Citigroup, and JP Morgan doing with AI in ESG?

BlackRock, Citigroup, and JP Morgan are actively investing in and partnering with ESG-focused companies that use machine learning (ML) and natural language processing (NLP) to scale up sustainability ratings, risk analysis, and more.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.