We break down the cybersecurity landscape across funding trends, mega-rounds, M&A exits, and more.

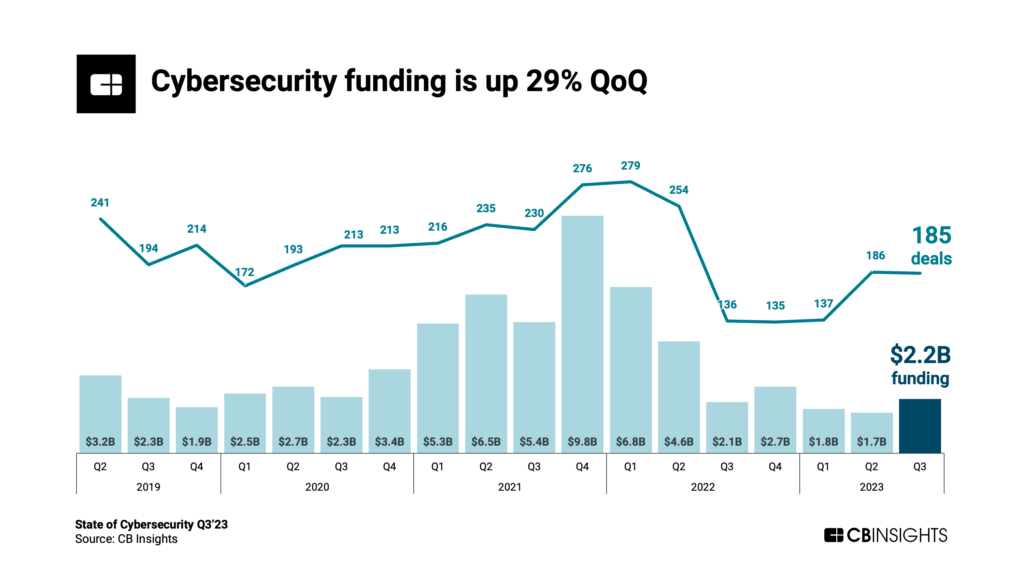

Cybersecurity funding rose while deal count largely remained flat QoQ in Q3’23.

Despite the increase, cybersecurity startups secured just $5.7B in the first 3 quarters of 2023, down 58% from the same period in 2022.

While cybersecurity M&A exits declined in Q3’23, the sector saw one of its largest M&A deals to date: Cisco acquired Splunk for $28B to beef up its AI capabilities.

Using CB Insights data, we dug into the cybersecurity landscape in Q3’23. Below, we cover:

- Equity funding and deal trends

- $100M+ mega-rounds and the top deals of the quarter

- Quarterly exit activity

- Looking ahead

Let’s dive in.

Equity funding and deal trends

Cybersecurity funding showed signs of life in Q3’23, rising QoQ for the first time since Q4’22. Meanwhile, deal count remained steady QoQ.

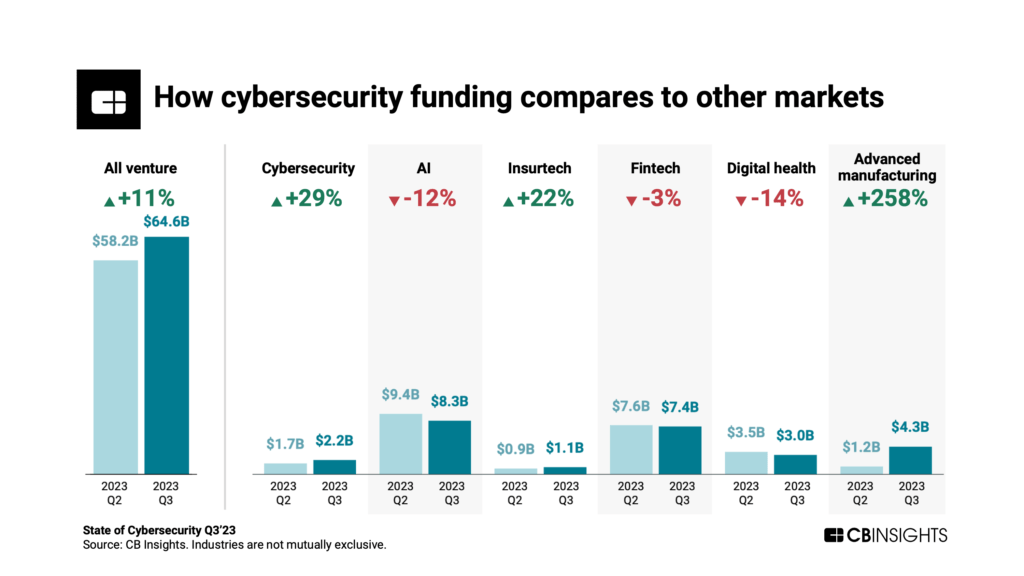

Cybersecurity’s 29% funding jump put it ahead of several industries and the broader venture market in terms of quarterly growth in Q3’23. The only space that saw more substantial QoQ growth in Q3’23 was advanced manufacturing with a 258% funding increase.

$100M+ mega-rounds and the top deals of the quarter

While cybersecurity mega-round count increased QoQ in Q3’23, it was still down significantly from its 2021 peak.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.