We break down the cybersecurity landscape across funding trends, M&A exits, most active acquirers, and more.

The cybersecurity space is starting to see some positive momentum.

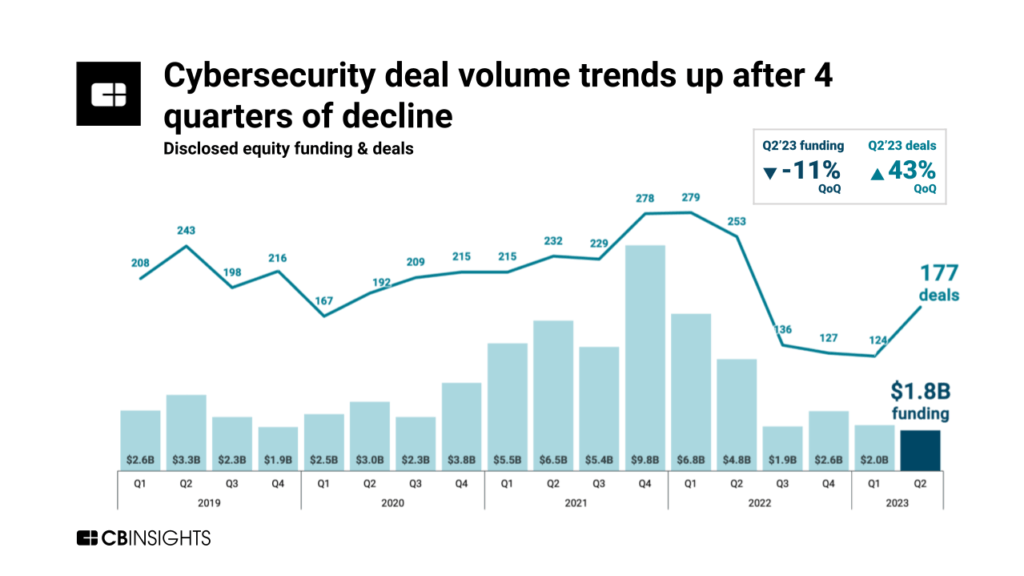

For the first time in over a year, quarterly deal activity showed positive gains quarter-over-quarter (QoQ) in Q2’23. This is even more significant in the context of the broader venture market, which saw deal volume decline over the same time period.

Another bright spot in the quarter was M&A exits, which jumped as enterprise tech behemoths snapped up cybersecurity startups to expand their capabilities.

Using CB Insights data, we dug into the cybersecurity landscape. Below, we cover:

- Equity funding and deal trends

- $100M+ mega-rounds and the top deals of the quarter

- Quarterly M&A activity and top acquirers in H1’23

- Looking ahead

Equity funding and deal trends

Like the broader venture market, cybersecurity equity funding remains muted. Quarterly equity dollars raised were down 11% QoQ in Q2’23. Nonetheless, deal activity surged 43% QoQ, reversing 4 consecutive quarters of decline.

The positive inflection in cybersecurity rounds is even more significant when compared to several other sectors across the venture market. With the exception of artificial intelligence (AI), all other sectors saw deals decline QoQ.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.