As competition heats up, we dig into how executives are deciding between cloud security solutions like Orca Security, Aqua Security, Lacework, and Wiz.

News emerged last month that Orca Security is suing its cloud security rival Wiz for patent infringement. Orca claims Wiz copied its product.

Wiz landed a $10B valuation in February just 3 years after its founding. Orca was last valued at $1.8B in 2021.

Both are part of a group of cybersecurity startups — like Aqua Security and Lacework — that have grown rapidly with the cloud computing wave.

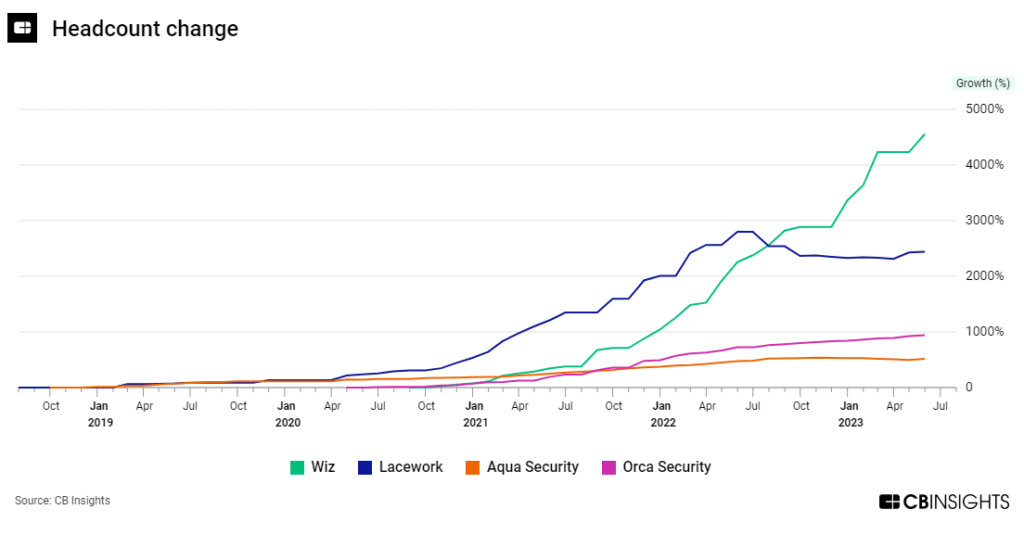

Wiz has sprinted ahead in valuation and with additional funding, it has also grown its team quite dramatically vs. its peers, as CB Insights headcount data below highlights.

To understand how enterprises are making cloud security purchasing decisions, we mined Yardstiq transcripts as well as Analyst Briefing surveys submitted to CB Insights by vendors.

You can dig into our full analysis here.

Below, we highlight excerpts from software buyer transcripts available on CB Insights.

Despite Wiz’s better UI, Orca Security’s data fidelity won this buyer over

Orca Security

I’ve looked at the market as a whole — Palo Alto, Aqua, Lacework, etc. — I’ve been customers of some of these tools as well in the past. And in a cloud environment, realistically it boils down to those two vendors, right? To Orca Security and Wiz as being the ones that you would consider in a modern company…Wiz has a better UI; it’s easier to use things like data discovery, environment discovery. What I found though, as I went deeper with the product and actually started to use it in integration with other teams is that the underlying data that Orca Security provided was superior. — C-level executive, $1B+ valuation technology company

Read the full transcript here.

With cybersecurity talent in high demand, Wiz’s “lightweight solution” beat out Orca, Aqua, and Lacework

Wiz

The main problem comes with the solutions which are…quite complex in terms of deployment, in terms of maintainability — and that consumes overhead. That was the problem with Lacework. Orca and Aqua are good solutions. They are agentless as well as graph-based. But again, they were found to be quite heavy. We wanted a very lightweight solution and the main challenge with the security solution is that you don’t get skilled resources very easily in the market…Because Wiz is agentless and it uses the cloud APIs for integration, we found it to be very, very useful. — VP, Fortune Global 500 company

Read the full transcript here.

In other news, cybersecurity company Rapid7 is laying off 18% of its workforce, or an estimated 470 employees.

In a blog post explaining the restructuring, CEO Corey Thomas noted the need to create a more integrated experience for customers but that Rapid7 and others in the industry have been “too slow to adjust.”

“In today’s complex hybrid environments with highly-capable and innovative attackers, customers demand efficacy and efficiency, and integration across solutions is becoming imperative.”

This is a sentiment we’ve heard come up time and again in our interviews with customers. For example, this buyer switched to Orca from Rapid7 for its more efficient and lightweight platform.

Orca security

So the deployment of Rapid7 initially took almost 6 months to get all the infrastructure, log collectors, everything that was needed. It took less than 2 weeks to get Orca set up within the entire environment. Once they proved that they were accurate and even more accurate [than Rapid7], it just became a matter of funding. We threw out Rapid7, we switched to Orca. And honestly, I’ve never looked back. — Chief Security Officer, Cybersecurity company

Read the full transcript here.

Other cybersecurity players are betting big on becoming one-stop shops for their enterprise customers via M&A.

In the past week, Check Point ($15B market cap) acquired network security company Perimeter 81 for $490M — a 51% discount on its unicorn valuation of $1B from a year ago.

Meanwhile, data security player Rubrik announced it’s acquiring cloud data security provider Laminar (which last raised a Series A in June 2022) for an estimated $100M+.

As funding dries up, expect more consolidation to come.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.