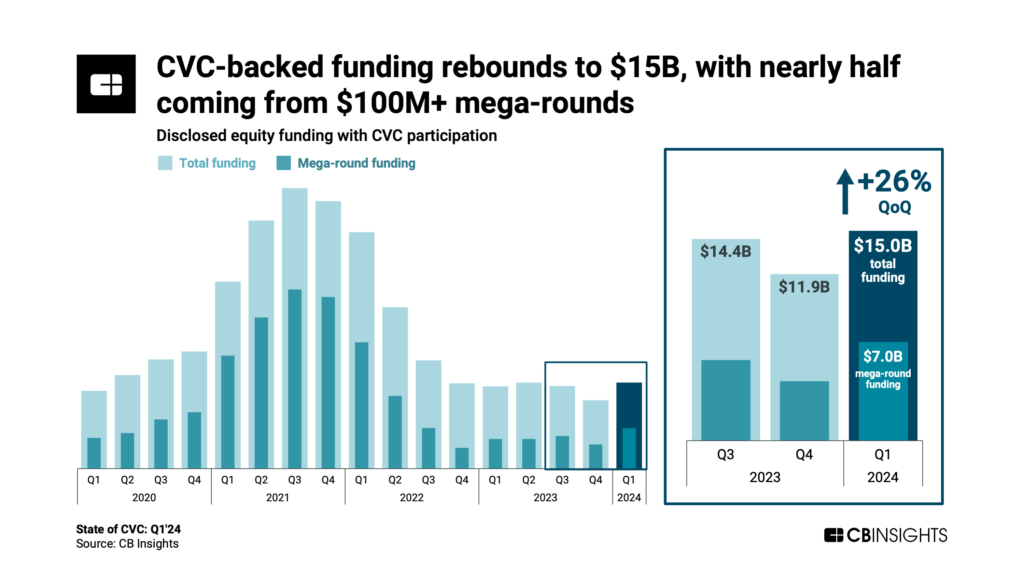

Corporate venture capital funding rebounds in Q1'24, driven by $100M+ mega-rounds.

Corporate venture capital (CVC) had a solid quarter in Q1’24, with CVC-backed funding increasing by 26% quarter-over-quarter (QoQ), greater than the venture market as a whole.

Driving this growth were mega-rounds (deals worth $100M+), which accounted for 47% of the funding — their highest share since Q1’22.

CVC deal count remained steady QoQ, again showcasing CVCs’ resilience compared to the broader venture market, which saw quarterly deals plummet to their lowest level in years.

Based on our 122-page report, here is the TL;DR on the state of CVC:

- Global CVC-backed funding rebounded 26% QoQ to reach $15B in Q1’24. Nearly half ($7B) of this funding came from $100M+ mega-rounds. Meanwhile, global deal volume was roughly flat, ticking up 1% QoQ to 851.

- CVCs participated in 33 $100M+ mega-rounds in Q1’24, tied for the highest total since Q3’22. The top 2 mega-rounds went to Wonder ($700M, with backing from American Express Ventures and Google Ventures) and Figure ($675M, with backing from Intel Capital, M12, NVentures, OpenAI Startup Fund, and Samsung Ventures).

- Early-stage companies have captured 66% of CVC deals in 2024 YTD, pacing at the highest share in over a decade. The increase is driven largely by Europe and Asia, which have seen 73% and 66% of deals this year go to early-stage companies, respectively. In the US, 59% of the year’s CVC deals are early-stage.

- CVC deals to fintech companies increased 41% QoQ to 165. This was the highest level since Q4’22. Blockchain investment firm OKX Ventures was the most active CVC across sectors, backing 27 total companies in Q1’24. Coinbase Ventures was also a top CVC last quarter with 11 companies backed, signaling a potential rebound in crypto-focused CVC activity.

- CVC-backed funding in China fell to $0.3B, a 40% QoQ decrease. Deal volume also fell 14% QoQ to 78, its lowest level since Q1’20. Sungrow New Energy, a developer of renewable energy hardware, raised the largest round for China-based companies at $48M, with backing from CVC Zhongan Capital.