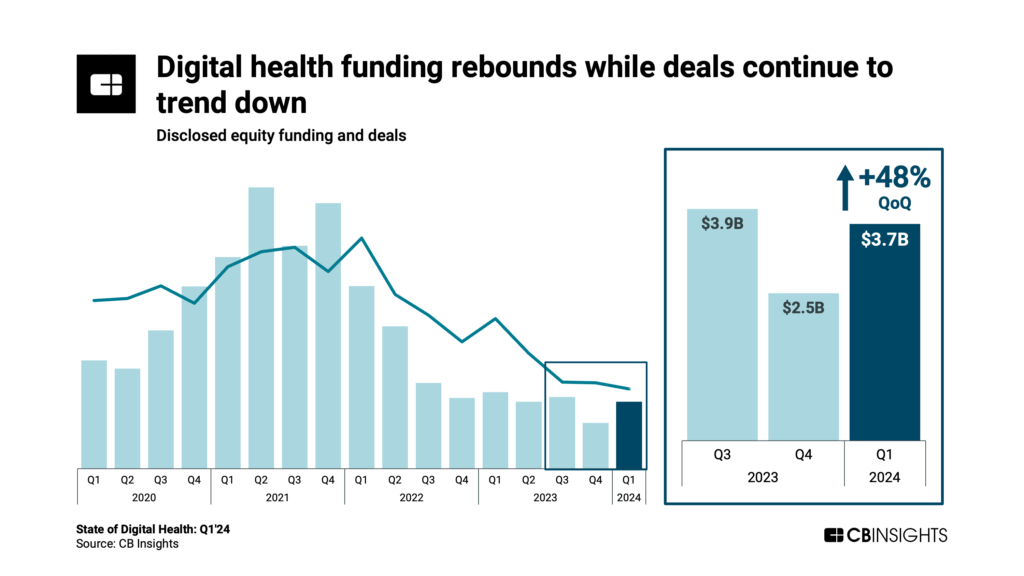

While digital health funding rebounds in Q1'24, deal count hits a multi-year low.

Q1’24 was a brighter spot for the digital health market, which has struggled amid the broader venture slowdown.

Digital health funding grew 48% quarter-over-quarter in Q1’24. This growth was supported by an increase in $100M+ mega-rounds, which were largely directed at biotech startups and other players leveraging AI.

Despite the increase, however, total funding still came in below pre-pandemic levels in Q1’24. Meanwhile, deal count continued to trend down.

Based on our deep dive below, here is the TL;DR on the state of digital health:

- Global digital health funding increases 48% QoQ to reach $3.7B in Q1’24. However, funding was still down 12% vs. Q1’23 and 63% vs. Q1’22. Meanwhile, digital health deal count declined in Q1’24, dropping to its lowest quarterly level since 2014.

- Funding to US digital health startups rises 44% QoQ. However, the US also saw deals drop to 144 — the fewest in a quarter since 2013. Despite the decline, the US still saw the majority of global digital health deals (53%) and funding (70%) in Q1’24. The US also secured 6 out of 7 digital health mega-rounds in the quarter.

- Average digital health deal size is up 38% in 2024 so far. After dropping from $23.1M in 2021 to $11.9M in 2023, average deal size is up to $16.4M in 2024 so far. This is being driven in part by the resurgence of mega-round deals. In Q1’24, these deals accounted for their second-highest share of quarterly funding since 2022.

- Digital health sees 7 $100M+ mega-rounds in Q1’24. Digital health mega-round deals rebounded QoQ in Q1’24. The largest digital health deal of the quarter went to Freenome — a biotech company focused on cancer detection. While biotech drove the top deals, Q1’24 mega-rounds were spread across the digital health industry, from biomedical NLP to robotics for microsurgery.

- No new unicorns (private companies valued at $1B+) emerge. While Freenome added $1B to its valuation following its Series F mega-round in February 2024, the company had already attained unicorn status in 2020. Among Q1’24 mega-round earners, Abridge saw the largest increase in disclosed valuation. It reached an $850M valuation — up 350% from October 2023.