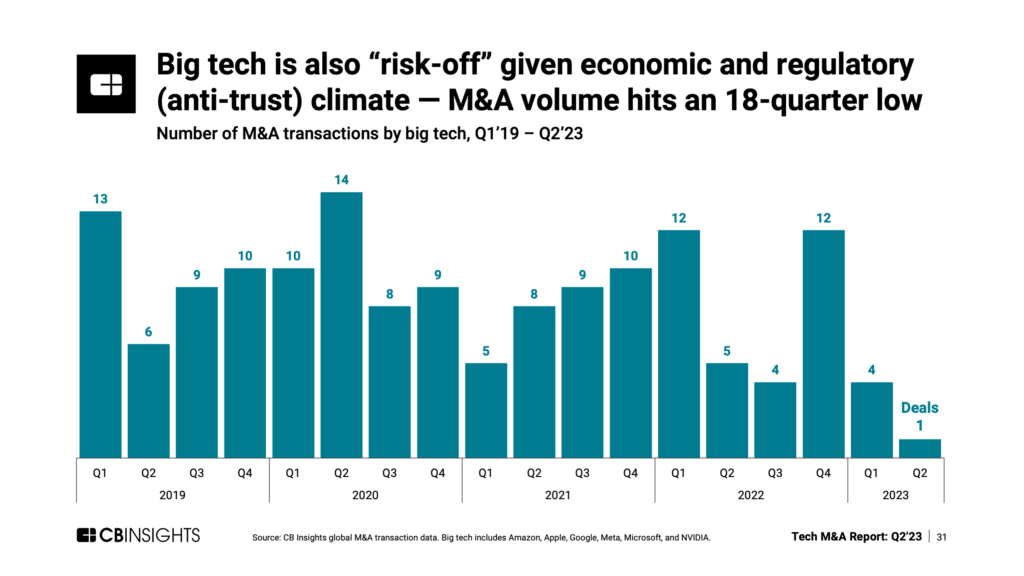

The economic and regulatory climate has brought big tech M&A activity to a near halt, with acquisitions reaching an 18-quarter low in Q2’23.

Big tech mostly shied away from M&A in Q2’23.

Historically, big tech players have snapped up startups to acquire tech talent and expand into new markets and product lines. However, they face a more challenging regulatory climate — especially in the US and Europe, where anti-trust pressure has been mounting.

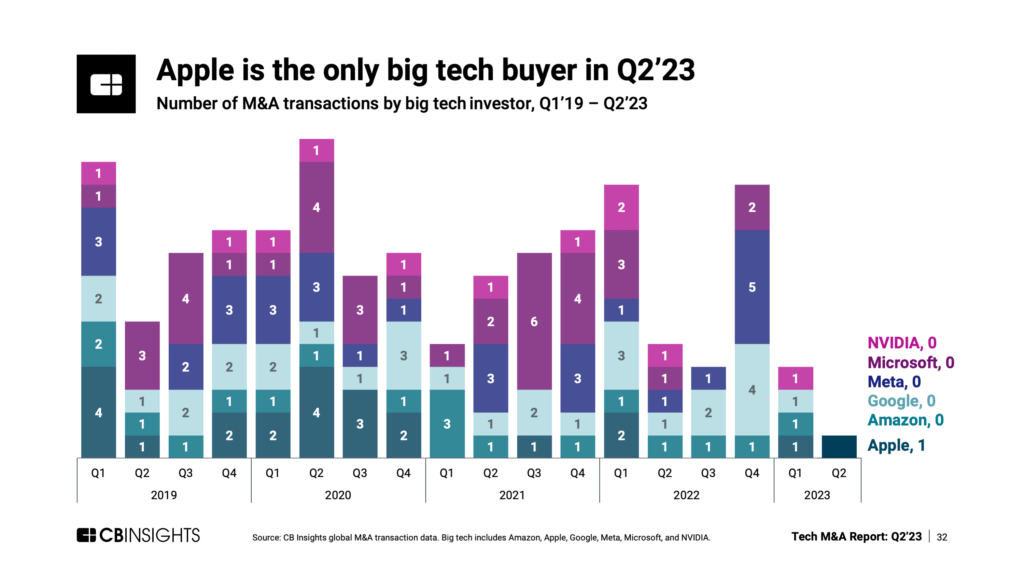

Combined with the prevailing risk-off mentality of strategic acquirers, this has led to a drastic decline in big tech acquisitions. Between Amazon, Apple, Google, Meta, Microsoft, and NVIDIA, only Apple disclosed an acquisition in Q2, according to the CB Insights Tech M&A Q2’23 Report.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from valuation per employee to cross-border M&A activity — in our full Tech M&A Q2’23 Report.

The only big tech M&A deal in Q2’23 was Apple’s acquisition of Mira, an augmented reality headset developer, for an undisclosed amount.

The quarter’s 1 deal marked a recent low for the big tech players, who had consistently done at least 4 deals every quarter going back to 2019.

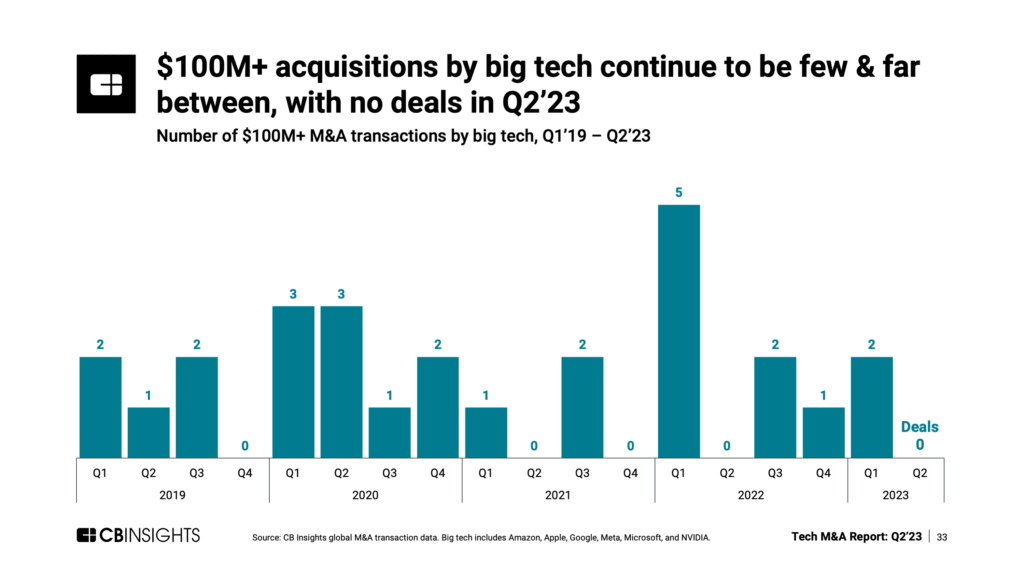

Furthermore, Q2 didn’t see a single $100M+ acquisition among these big tech leaders. These massive deals continue to be rare among this group of buyers.

However, it’s important to note that big tech tends to be tight-lipped about the details and motivations for their acquisitions, so it’s not surprising to see fewer disclosed mega-deals of this kind.

To dig into more global tech M&A trends, including a breakdown of strategic vs. financial buyer trends, download the entire Tech M&A Q2’23 Report here.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.