Activist investors are scrutinizing Twilio's Data & Applications business, home to its customer data platform (CDP) Segment. We dive into whether Twilio overpaid for Segment and what customers are saying about the acquisition.

Twilio is feeling the heat.

The communications API company will lay off another 5% of its workforce, after cutting 17% (or 1,500 employees) in February.

Activist investors are also pushing for the sale of Twilio’s Data and Applications business, which houses some of its new bets like customer data platform (CDP) Segment.

Twilio pursued an aggressive expansion strategy in recent years, including acquiring SendGrid for $3B in 2019 and Segment for $3.2B in 2020.

But now with revenue growth slowing, it’s focused on cutting costs.

And adding to the pressure is the emergence of activist investors including Anson Funds and Legion Partners who are scrutinizing the Data & Applications business.

And so we wanted to use CB Insights to look more closely at its biggest 2020 bet — Segment.

- Did Twilio overpay for Segment?

- And what are customers saying about the acquisition?

We dive into these questions below.

TWILIO’s ACQUISITION

Segment emerged as part of a cohort of CDPs founded in the last 15 years in response to the need to unify online and offline customer data.

It became one of the largest companies in the space.

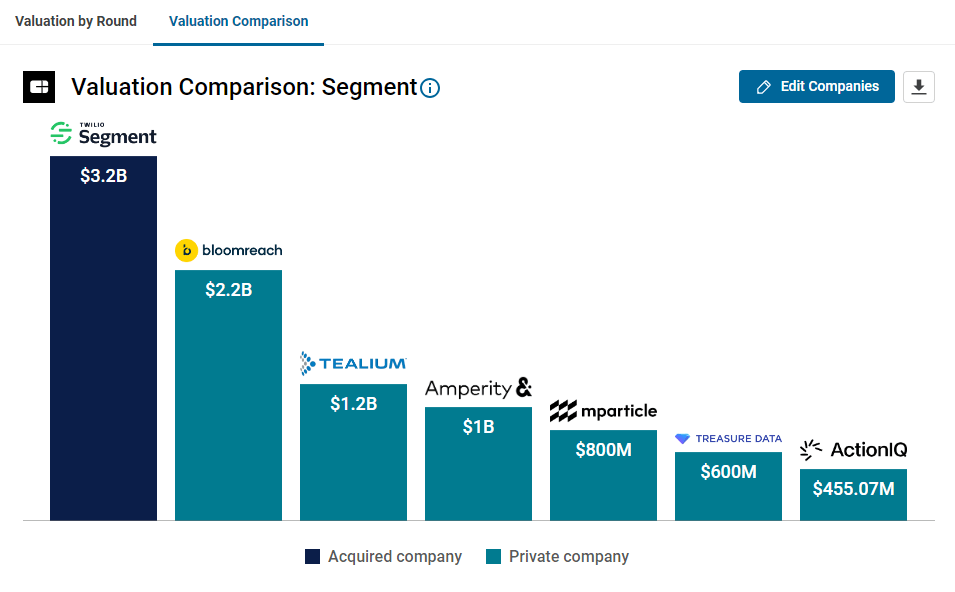

While many of its competitors are still private, we can glean some clues about how expensive the deal was.

Twilio reported Segment generated $201M in revenue in full-year 2021.

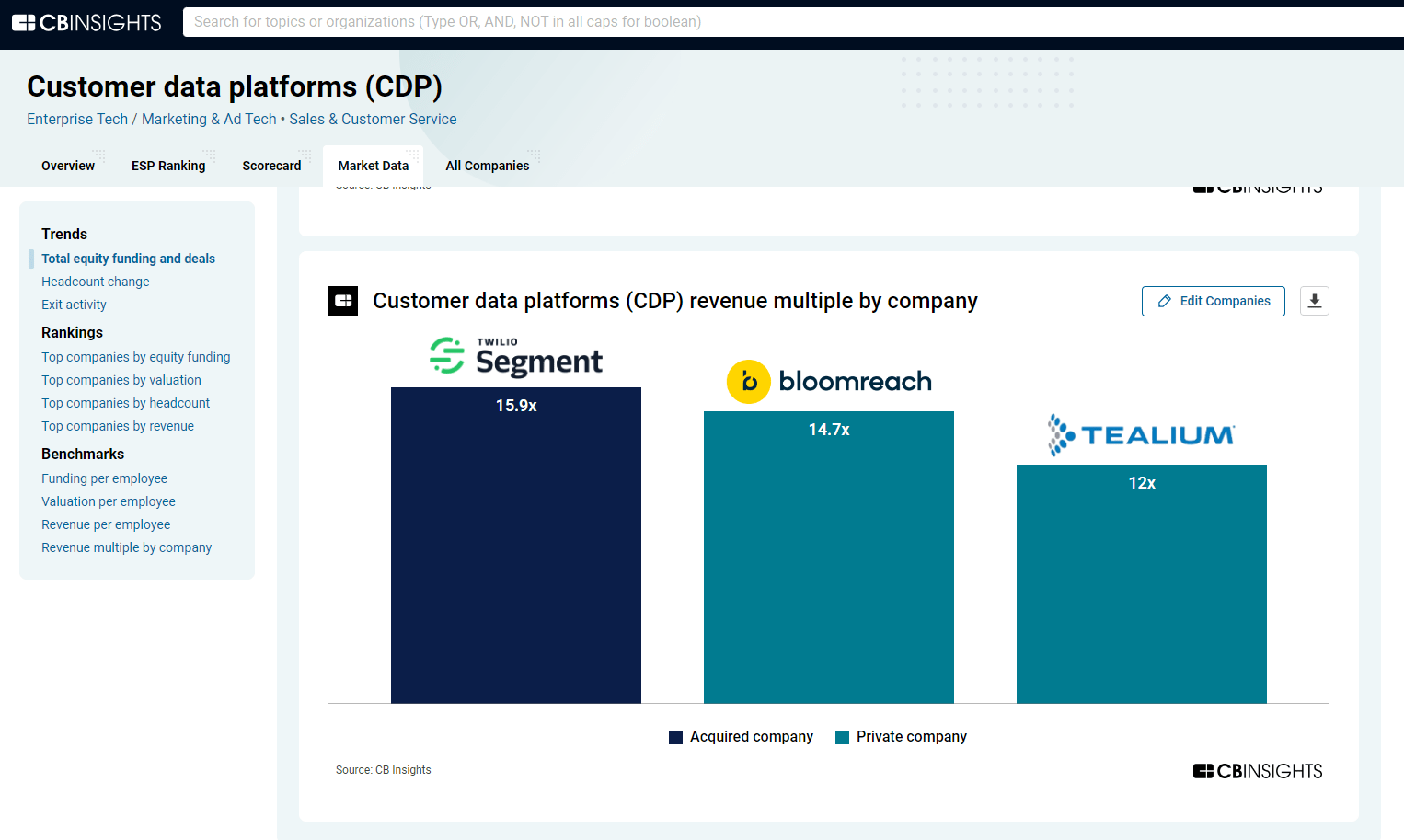

In a deal worth $3.2B in 2020, Twilio paid a forward multiple of 15.9x for Segment.

Comps

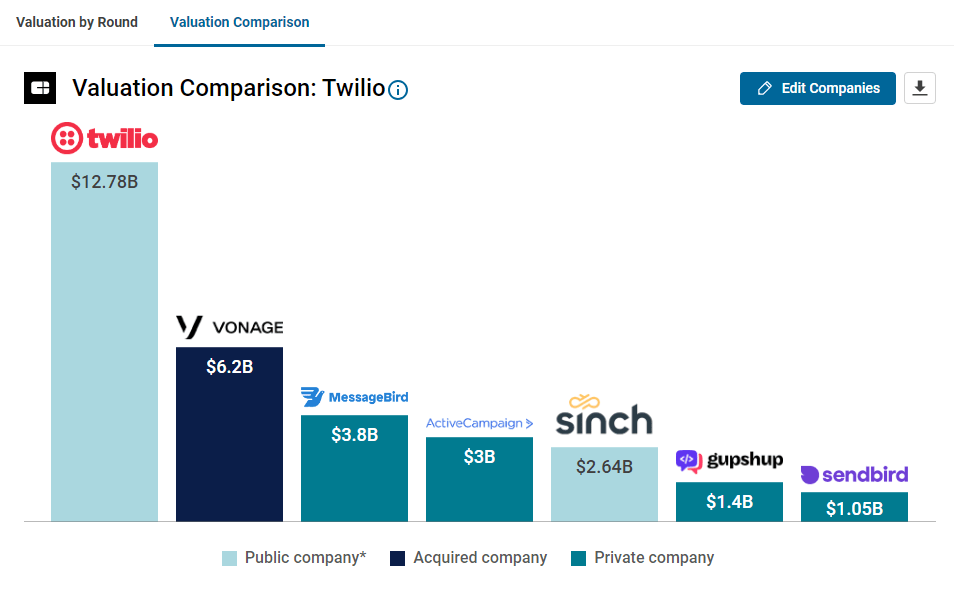

No other company among its closest competitors has achieved an exit of this scale, or landed a valuation near it.

- Tealium (last valued at $1.2B in February 2021) claimed over $100M ARR in 2020 — or a 12x multiple.

- Bloomreach (which acquired Exponea, a CDP, in 2021, nearly doubling the size of the company) reported over $150M ARR in 2022, up from $100M ARR in 2021. The company was valued at $2.2B in early 2022, or a 14.7x multiple based on $150M in ARR.

Against these comps, Twilio’s acquisition of Segment appears modestly overpriced looking back.

However, even Tealium’s and Bloomreach’s multiples likely don’t hold any more given the multiples compression that has occurred in tech.

LOOKING AHEAD

The Segment acquisition feels especially extravagant considering Twilio’s market cap has dropped from $45B to under $13B since the deal was announced.

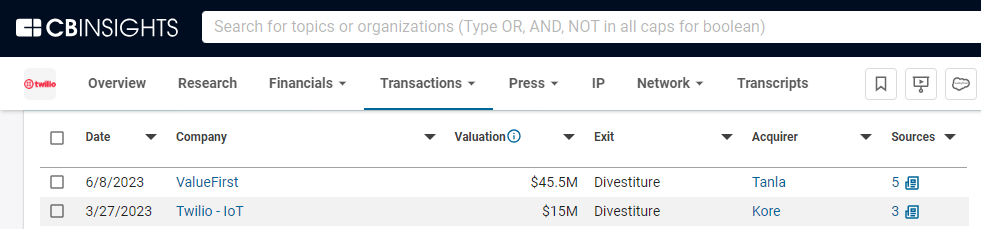

Twilio has already exited 2 businesses adjacent to its core communications business as this divestiture data from CB Insights below highlights.

While activist investors push to also sell Segment, Twilio leadership has so far resisted, arguing that Segment’s customer data will be key to future growth — and its AI tools.

From CB Insights Earnings Transcript Search Engine, we see CEO and co-founder Jeff Lawson espousing the “communications and data flywheel” that Segment + Twilio Communications offers.

And then of course, Twilio also faces more competition in its communications business from a host of companies — including many still private players.

TWILIO Customer perspectives

Segment helps solve data “weakness”

The one weakness, and potentially this is where their CDP Segment that they have purchased recently stands out, is that it is difficult to get the data to Twilio. You need to really only work in an automated fashion. You need to have robust data teams and data tools like a MuleSoft, a Dell Boomi…Without the middleware, it’s impossible to use. — Senior Director, Customer Experience, US health system

Read the full transcript here.

Becoming an “all-in-one” platform is attractive

[They are also] a leader or starting to build out some form of a customer engagement platform with Twilio Engage and their acquisition of Segment. They’re moving in that direction. That interested me. I knew that if we wanted to build out a standalone solution, an all-in-one, that Twilio did have that capability…That made it a pretty, pretty sweet selling point. — Director, Publicly traded e-commerce company

Read the full transcript here.

This buyer argues Twilio should build on its core business instead

They have made a decision to go for the software side of things, go for CDP, with their acquisition of Segment…If I were in Twilio’s management, I would continue building on top of the roots of the platform, which is the engagement APIs. However, again, just based on public information, I do believe that that decision has already been made by Twilio to move forward with the other side of their business. — CEO, CRM company

Read the full transcript here.

How much are executives paying for CDPs? Check out our analysis here.

If you aren’t already a client, sign up for a free trial to learn more about our platform.