From weather intelligence to AI inspections, we highlight the voice of the customer of some of the most promising private insurtech companies of 2023.

Our list of the 50 most promising private insurtech companies of 2023 is out now.

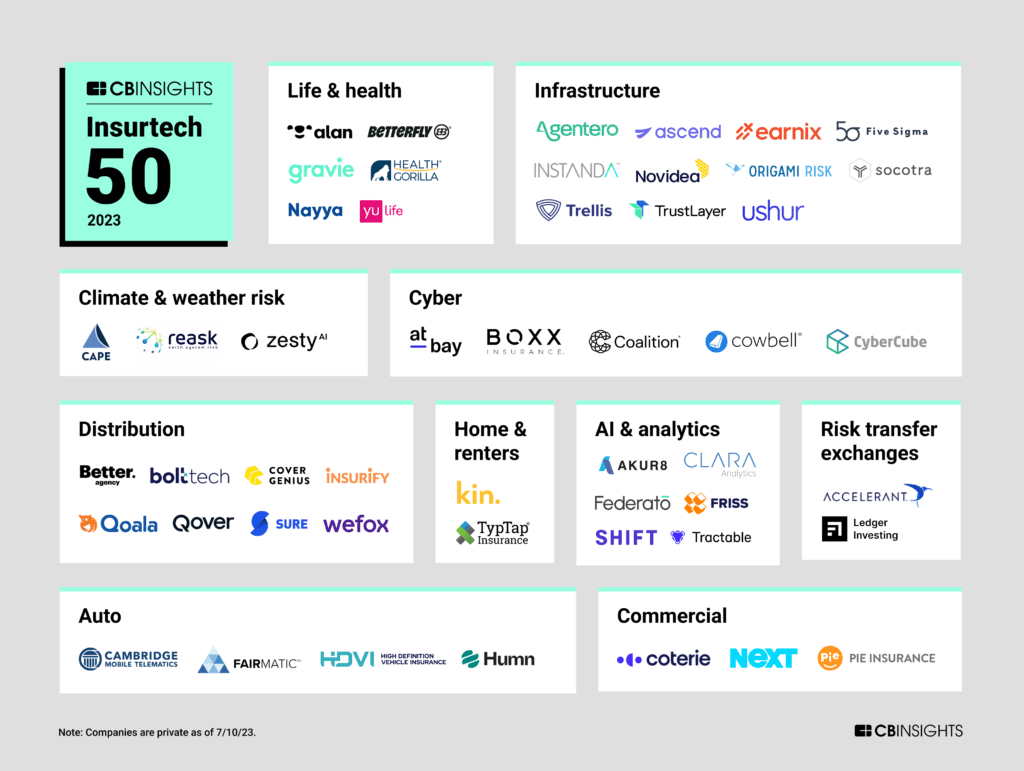

The winners — picked from a pool of 2,000 — are working on cyber insurance, climate risk, distribution, and more.

You can see our methodology and the full Insurtech 50 here.

This year, one of the new considerations was that we interviewed the customers of applicants to ensure we captured the voice of the customer.

Below, we break down the list and what customers are saying about some of the Insurtech 50.

Earlier-stage innovation

Twenty-three winners (46%) are in the earlier fundraising stages (seed/angel, Series A, or Series B).

While many startups in insurtech’s early years focused on selling directly to consumers instead of using agents, a growing number of early-stage innovators — like Agentero, Ascend, Better Agency, and TrustLayer — are looking to arm insurance agents with better technology in order to make this dominant distribution channel more efficient.

AGENTERO

We currently use a legacy system called EZLynks, which is not very technologically advanced. Agentero provides a tech-forward and tech-enabled way for us to reach our customers more quickly, send out quotes faster, and provide multivariate or comparison quotes. — C-level executive, Insurance firm

Read the full transcript here.

Global reach

This year’s winners represent 10 different countries across the globe.

This includes weather intelligence company Reask, which is based in Australia.

REASK

The specific strength of why Reask is viewed as our primary provider, where other vendors complement and sense-check the information we receive, is because it is based around a catastrophe loss model framework. We know it is based on a very similar framework…to the main commercial vendors and the transactional views of risk which we use throughout constructing and managing our portfolio. So it’s really the fact that the seasonal forecasting product is designed and built around a catastrophe risk model framework, which is the central premise of our analytics. —Partner, Asset manager

Read the full transcript here.

Top categories

Infrastructure holds the largest share of our winning cohort. These 11 companies are focused on digitizing the entire insurance value chain.

Ushur, for example, provides no-code insurance automation solutions. The company raised one of Q1’23’s largest insurtech mid-stage deals ($50M Series C).

USHUR

Ushur is exceeding the SOW expectations for the use case that we have deployed for email classification and routing, categorizing four different use cases at 70% or better per our SOW period. Ushur is actually achieving 80% or better for many of the use cases, which is very exciting. — Director, Insurance company

Read the full transcript here.

Funding & valuation trends

Overall, the Insurtech 50 cohort has raised $9B+ across 174 equity deals since 2018.

This year’s list features 12 unicorns with a $1B+ valuation, including AI auto & home inspection company Tractable.

TRACTABLE

We saw our accuracy go from approximately 85% with humans rating the cars to 90% with Tractable, but if we add humans to double-check Tractable and send a feedback loop to correct any wrong decisions, we go up to about 93%. — VP, Fortune 500 company

Read the full transcript here.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.