Open banking is reinventing financial services. We dig into what customers think of Plaid, TrueLayer, Yapily, and Akoya.

Open banking is ushering in a new era of financial services.

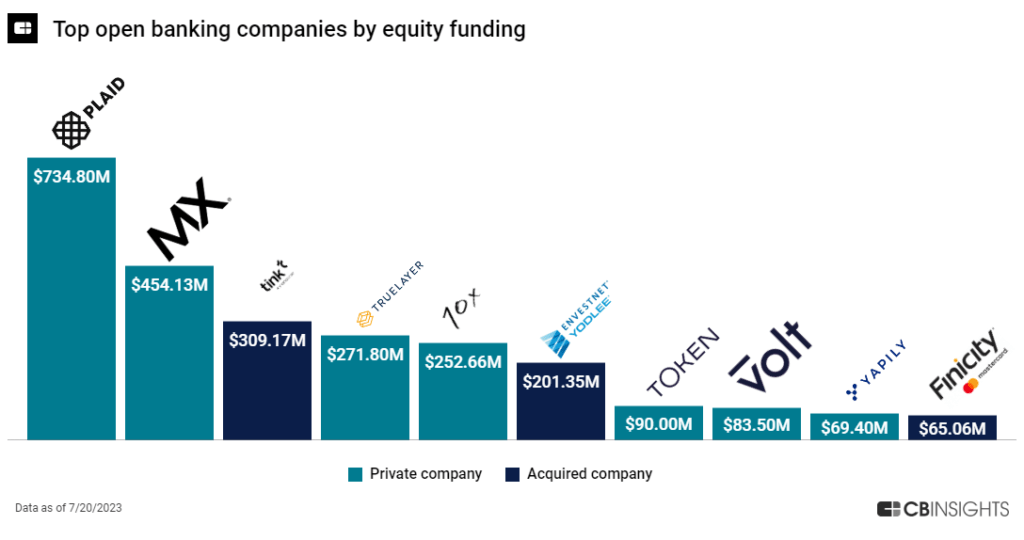

The industry — which relies on APIs to access and share banking data with other financial institutions — has also attracted billions of dollars in funding in the last few years.

Payments-focused open banking startup Volt raised a $60M Series B led by IVP in June, one of the top mid-stage fintech deals of Q2.

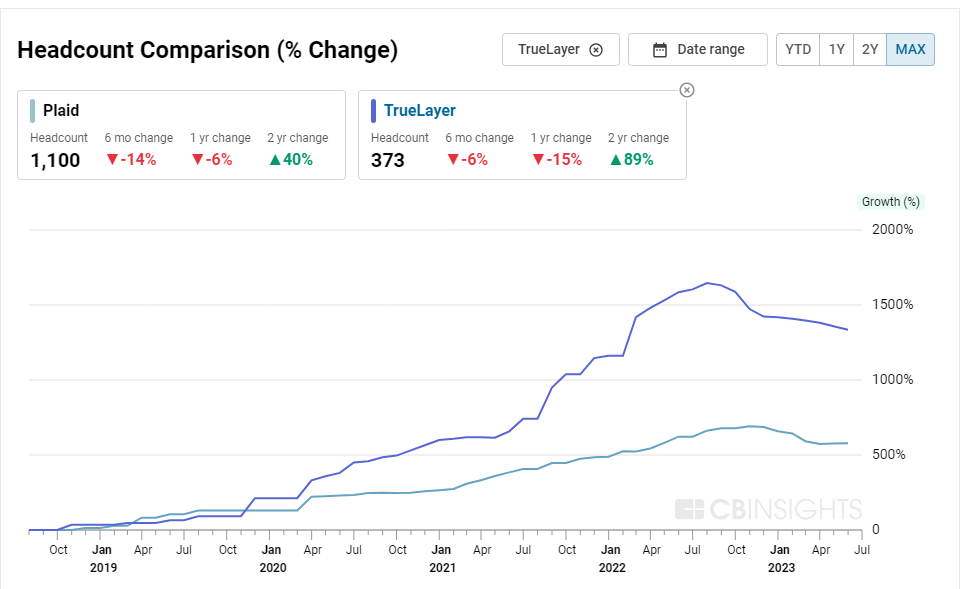

But while companies like Plaid have gained household recognition (and a $10B+ valuation), slowing growth in the fintech sector has increased pressure on the market.

Plaid laid off 260 employees in December 2022, saying it had “hire[d] and invest[ed] ahead of revenue growth.” Competitor TrueLayer has also seen headcount declines, according to CB Insights headcount trend data.

To dive deeper into the market, we mined Yardstiq’s analyst-led interviews with customers of Plaid, TrueLayer, Akoya, Yapily, and more.

Keep reading for their thoughts on product differentiators and the market outlook.

Coverage is key

TrueLayer

Yapily only has tie-ups to 22 banks across all of Europe I think, whereas TrueLayer supports more than 35, 40 different banks across Europe. If there was a vendor who can give us these services across at least 20-plus countries in Europe and also in other territories such as the US, Brazil, then definitely we would want to consider them. We’re even open to giving slightly higher margins in terms of cost provided our user experience becomes very seamless. — Senior Product Manager, $1B+ valuation fintech

Read the full transcript here.

Former Plaid customer wanted EU focus

Yapily

We also used Plaid, but then we decided to move to Yapily. One of the key criteria was that Yapily was more focused on the European market while Plaid caters to the US and added the European market later. We felt the interest of Plaid and the strategy might not always be the most important in Europe. — VP, $1B+ valuation fintech

Read the full transcript here.

Pricing is a pain point, but Plaid still has edge over competitors for this buyer

Plaid

Yes, we had an opportunity to renew in the recent past and we decided to continue to use Plaid. Relative to the other competitors, they’re still the best. And I think it’s very difficult to go switch to somebody else because most other folks are still not as good as what they do. So reluctantly, you don’t like the price, but the other competitors still don’t really match Plaid’s overall sophistication. — VP, Business Development, $1B+ valuation fintech

Read the full transcript here.

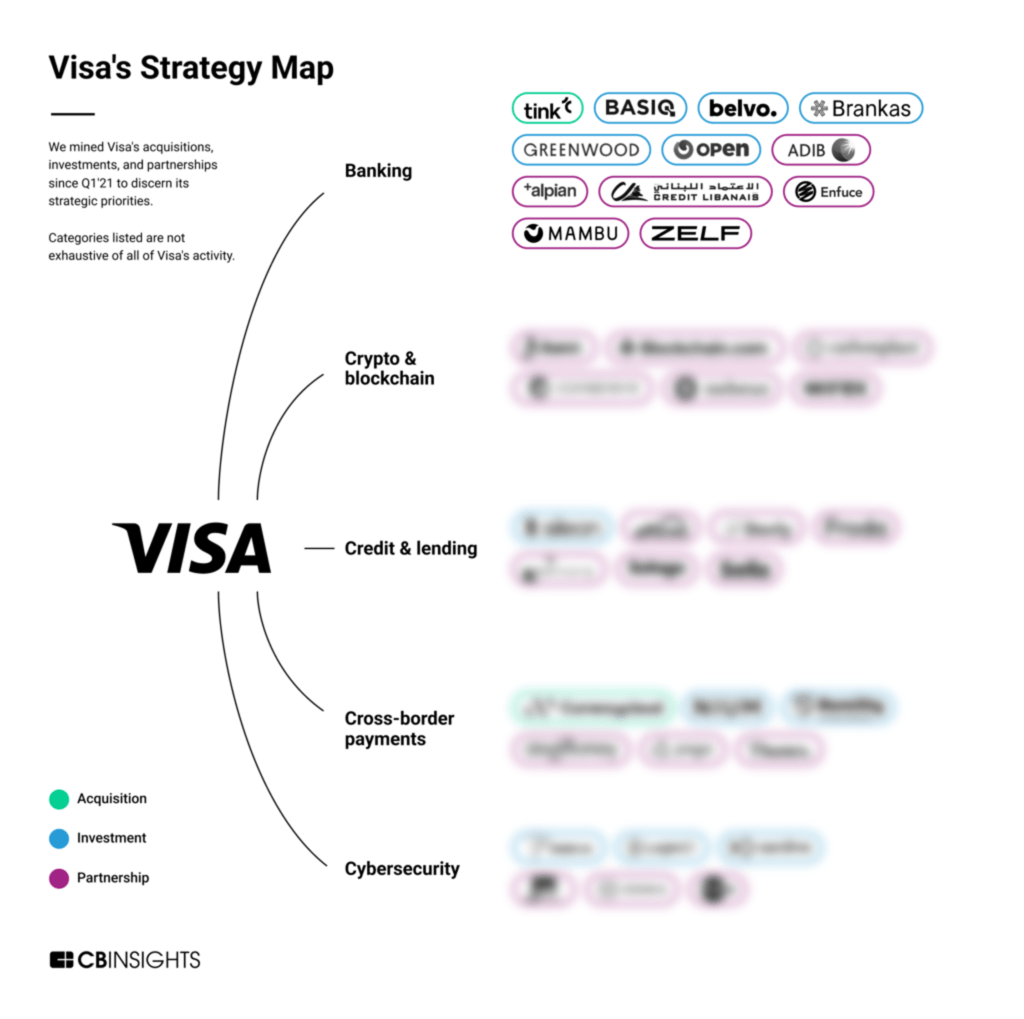

Over the past several years, the open banking industry has seen increased buy-in by major financial institutions, global regulatory change, and a growing partnership ecosystem.

For example, in 2021, Visa acquired Sweden-based Tink, the largest open banking company in Europe, for $2.2B. The acquisition came after Visa scrapped its $5.3B bid to acquire Plaid amid regulatory hurdles.

Meanwhile, Fidelity parent company FMR launched Akoya, a data access network to connect data providers (such as banks and financial institutions) to data consumers (like fintechs and aggregators) in 2019.

The network is jointly owned by Fidelity, The Clearing House Payments, and 10+ member banks including JP Morgan Chase, Bank of America, Citi, and Wells Fargo.

AKOYA

One of the great advantages when it came to Akoya [compared to] Plaid and MX was…we are not only sharing our data, but we will also be getting the data from [other organizations]….That’s the reason Akoya was an idea that really resonated with everyone, that this will be more like a consortium, and it will be like a co-owned product where everybody will see and exchange everybody’s data and it will be good competition to Plaid and MX. — SVP, Fortune 500 company

Read the full transcript here.

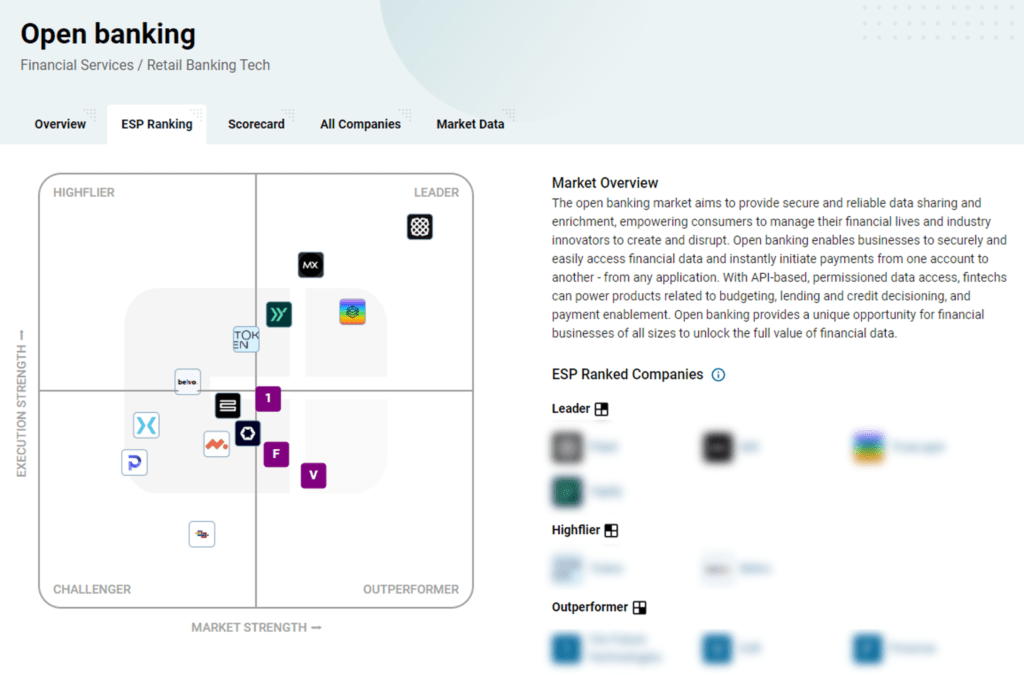

CB Insights customers can compare top-ranked companies in the open banking market report here.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.