We dig into customer perspectives on key account-based marketing (ABM) platforms, including ZoomInfo and 6sense, and where the market is headed.

The sales tech stack has mushroomed.

Buyer intent data — or signals that indicate prospects are actively considering purchasing a solution — is now another key component in the B2B sales tool kit.

As this 6sense customer highlights:.

You have your data tools, you have your call recording tools — you have all these different tools that make up the sales tech stack now, CRMs and sequencing and things like that. Now buyer intent has emerged as one of those tools. And like I said, we do get that through ZoomInfo, but it feels a lot more reliable through 6Sense and they’re just more usable because of the Slack and Salesforce integrations. — Head of Sales at $1B+ market cap software company

This is where account-based marketing (ABM) platforms come in (like 6sense), which provide B2B sales and marketing teams with detailed data on companies, prospects, and customers who are showing intent in their target market.

Who are the key players?

And who’s winning and why?

We recently partnered with Pavilion, a community of GTM leaders and their teams, and spoke to their members about their views on ABM vendors as well as conversational marketing platforms.

Those are summarized in this Vendor Scorecard.

Below, we look at highlights from our conversations about where they stack up. And keep reading for where the space is headed.

Customer success was a key selling point

Read the full transcript here.

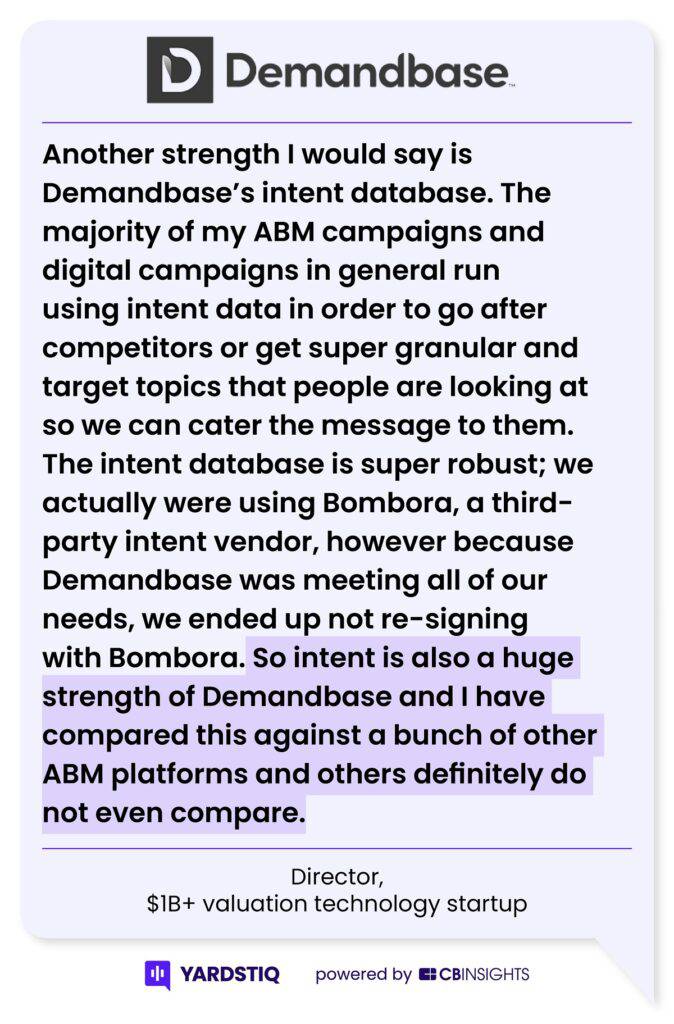

Demandbase wins out in intent data

Read the full transcript here.

6sense beat out ZoomInfo’s solution despite price differential

We previously looked at the competition go-to-market (GTM) intelligence leader ZoomInfo is facing here.

In conversational marketing/sales, Qualified won over former Drift customer

Read the full transcript here.

Tie the knot

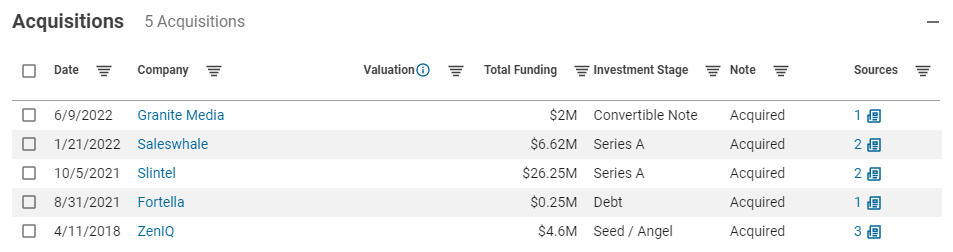

6sense — a leading ABM vendor — has acquired 6 companies over the last 5 years from sales intelligence (Slintel) to pipeline intelligence (Fortella).

It’s not alone.

A great rebundling is underway in B2B sales tools.

Top sales & revenue operations players are using M&A to build up their capabilities, taking on everything from sales engagement to forecasting.

We looked at where ZoomInfo is expanding here and where players like Outreach, Salesloft, and Gong are converging here.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.