What’s been going on at Coupa? We dig into our quantitative (M&A and headcount) and qualitative (software buyer interviews) information to provide a glimpse into what’s going on at the firm.

Long-time Coupa CEO Rob Bernshteyn is out.

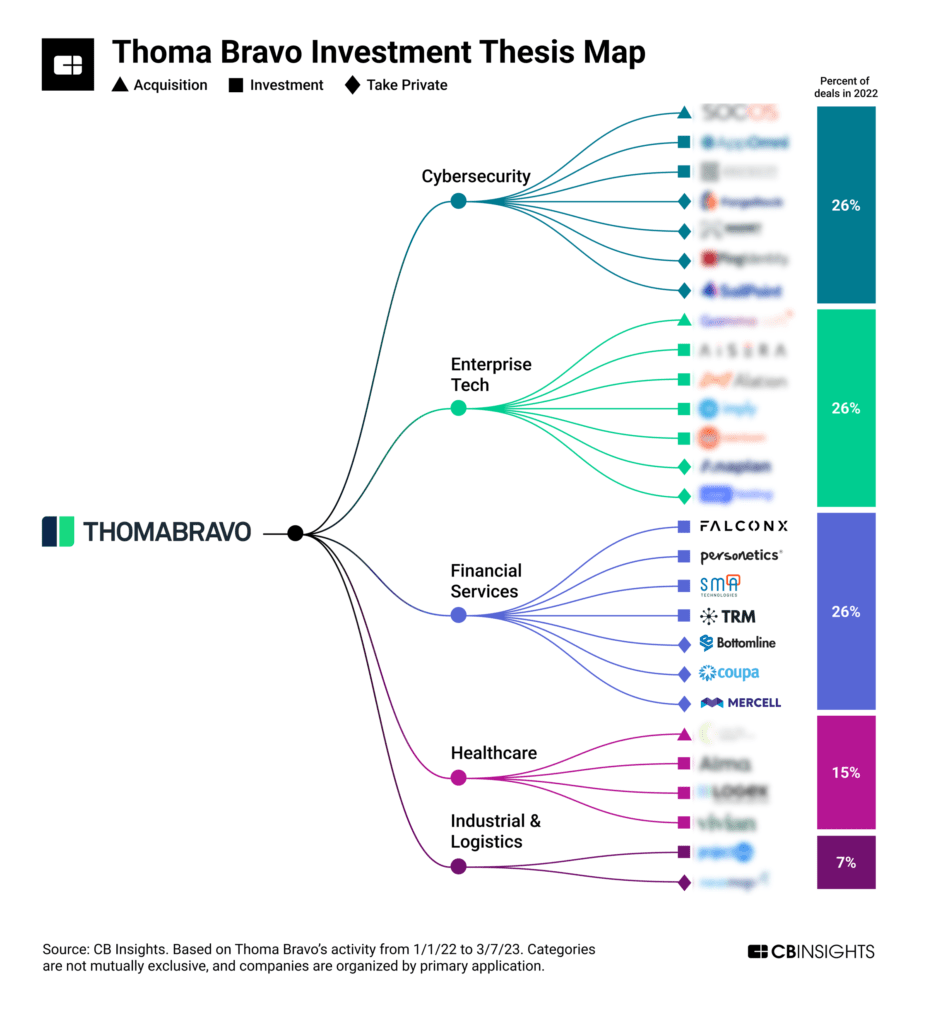

Private equity player Thoma Bravo announced it was taking Coupa, a spend management platform focused on procurement & supply chain, private in December 2022 for $8B.

We previously mapped out Thoma Bravo’s investment strategy here.

So what’s been going on at Coupa? We’ll dig into our quantitative (M&A and headcount) and qualitative (software buyer interviews) information to provide a glimpse into what’s going on at the firm.

Prior to Thoma Bravo’s acquisition of the company, Coupa itself had been an aggressive acquirer. It had, however, pumped the brakes on its own M&A engine, doing its last deal in 2021. Its largest deal was the $1.5B acquisition of supply chain design & planning company LLamasoft in November 2020.

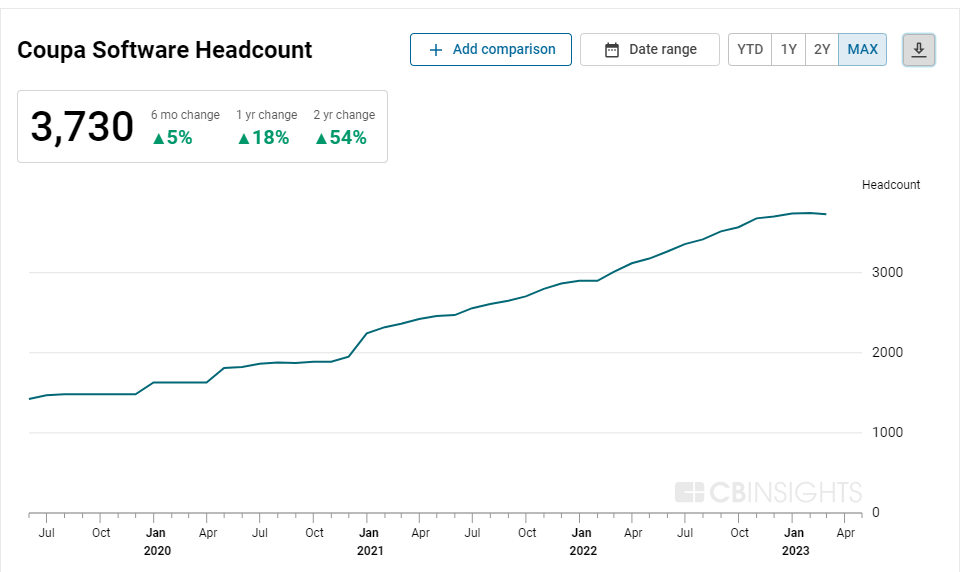

In addition to the pullback on M&A, the company has also slowed hiring. Since December, when the Thoma Bravo deal was announced, we’ve seen a slower growth rate in hiring at Coupa as the headcount data trend from CB Insights below illustrates.

Employee headcount data is coming to the CB Insights platform this month. See what it can do for you here.

You might think that this is the norm among tech companies, i.e. they’re all slowing hiring given the economic headwinds.

But that’s surprisingly not the case among all players in tech.

As we detailed here, 86% of US unicorns (456 out of a sample of 531) have actually increased headcount since Q1’22. In fact, 37% (198/531) of unicorns have grown headcount by more than 50% vs. this time last year, as the graph below illustrates.

So we see Coupa tightening up its M&A and hiring.

We also see an increasingly crowded and competitive enterprise spend management & procurement space.

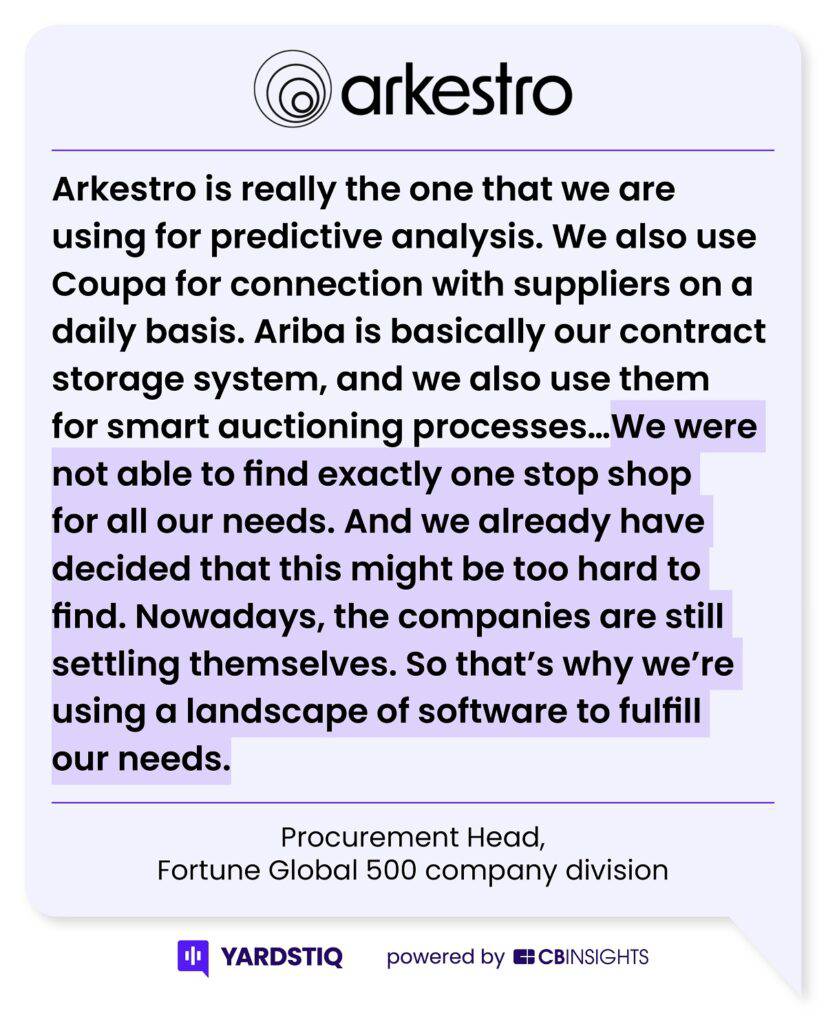

When we discussed competition and what customers think of the company, we got some great insights from Yardstiq’s interviews with software buyers.

They touch upon:

- Intent to renew

- Product fragmentation & innovation in the space

- Pricing

Satisfied Coupa customer doesn’t plan to renew

Read the full transcript here.

No one solution works for this buyer

Read the full transcript here.

Pricing model is a pain point

Read the full transcript here.

Strengths and weaknesses

Read the full transcript here.

What’s next?

At a macro level, the above highlights a number of trends we’re seeing now.

- Vendor consolidation by IT/technology buyers and finance teams is top of mind. Companies went crazy buying point solutions and now technology and finance teams have said that nonsense has to stop.

- There are a slew of flawed but fixable tech companies that PE will buy. This may require earlier VC investors take some hard medicine (plus common shareholders), but that’s the reality we live in. With the downward trend in valuations for private companies likely only intensifying, PE investors with lots of capital to deploy have a “target-rich” environment right now.

For Coupa specifically, competitive intensity is only going up. As a result, we can expect M&A to resume after the recent changes are absorbed.

Market Reports on CB Insights break down the space and key players, and our supply chain company collection may also be a good source to identify potential M&A targets.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.