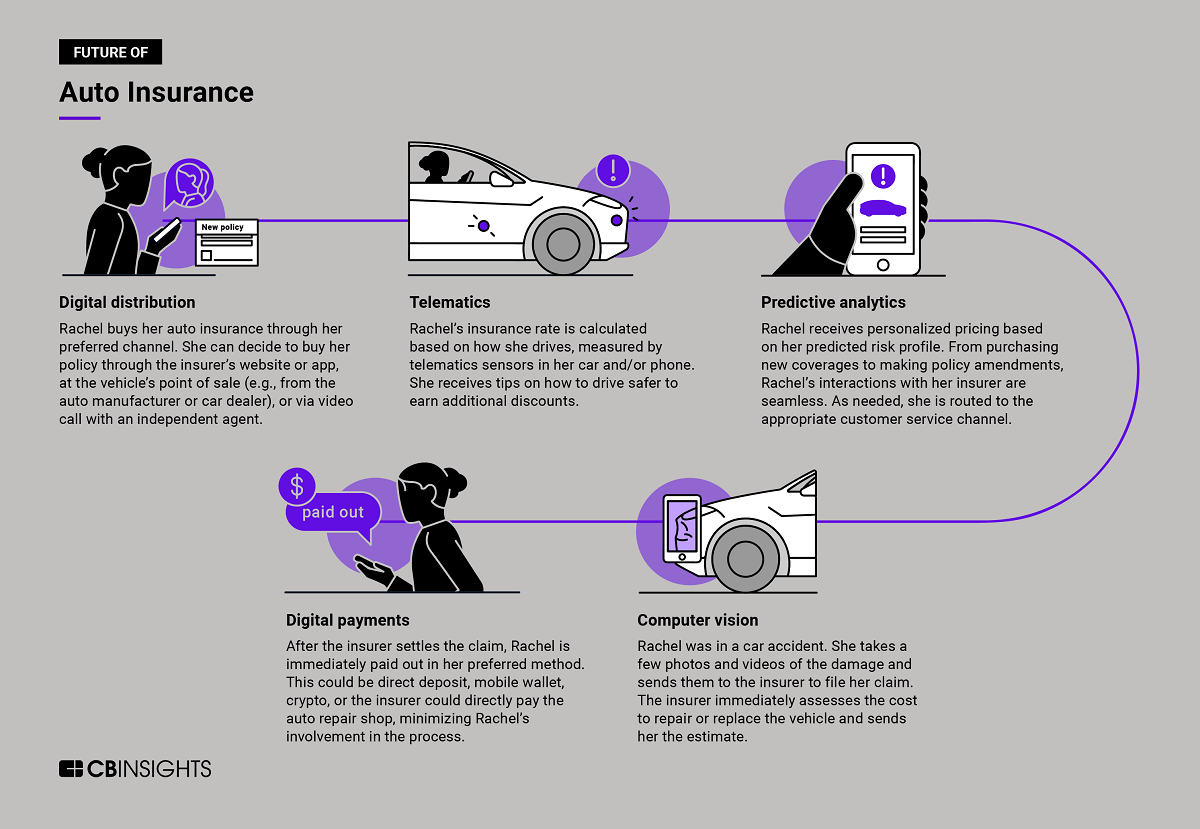

From telematics to predictive analytics, we dive into the evolution of auto insurance and the tech creating a more seamless and personalized customer experience.

From account opening to underwriting to claims disbursements, the auto insurance policy of the future will be built almost entirely on digital transactions.

The auto insurance industry has already seen significant advances in the last decade in terms of its digital sophistication. But there is still a long way to go.

The future of auto insurance will be built on key technologies such as:

- Digital distribution solutions to make the buying process easier.

- Telematics and other auto sensors that collect driving behavior data in real time.

- Predictive analytics that redefine how insurers underwrite policies, interact with customers, and maximize claims efficiency.

- Computer vision to streamline the claims process for both insurers and policyholders, enabling straight-through processing of claims.

- Digital payment platforms that make premium payments and claims disbursements easier and seamless.

Below, we dive into these technologies: how they work, who has an edge, and how they’re shaping the future of auto insurance.

What’s at stake?

WHY IT MATTERS

The auto insurance market is the largest line of business in the property & casualty insurance industry, reaching $766B in global premiums in 2020 per Swiss Re estimates. It is the main revenue driver for most of the largest insurance companies in the world.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.