AXA Venture Partners has invested in companies addressing some of the most pressing risks across insurance. We break down where the firm is placing its bets and what it means for the industry.

AXA S.A. is one of the world’s largest insurers, with a global presence spanning 6 continents. The firm is driving innovation across the insurance industry through AXA Venture Partners (AVP), its corporate venture capital (CVC) arm.

AVP has $1.2B of assets under management and invests in data-driven startups that can impact healthcare, customer experience, and underwriting performance. These areas represent opportunities that are relevant to the entire insurance industry.

For example, backing companies like Incepto Medical can give life and health insurers access to technology that supports underwriting and preventative care activities. Customer experience-related investments could help insurers sell more policies and improve customer retention. And companies with unique datasets can help insurers introduce new products.

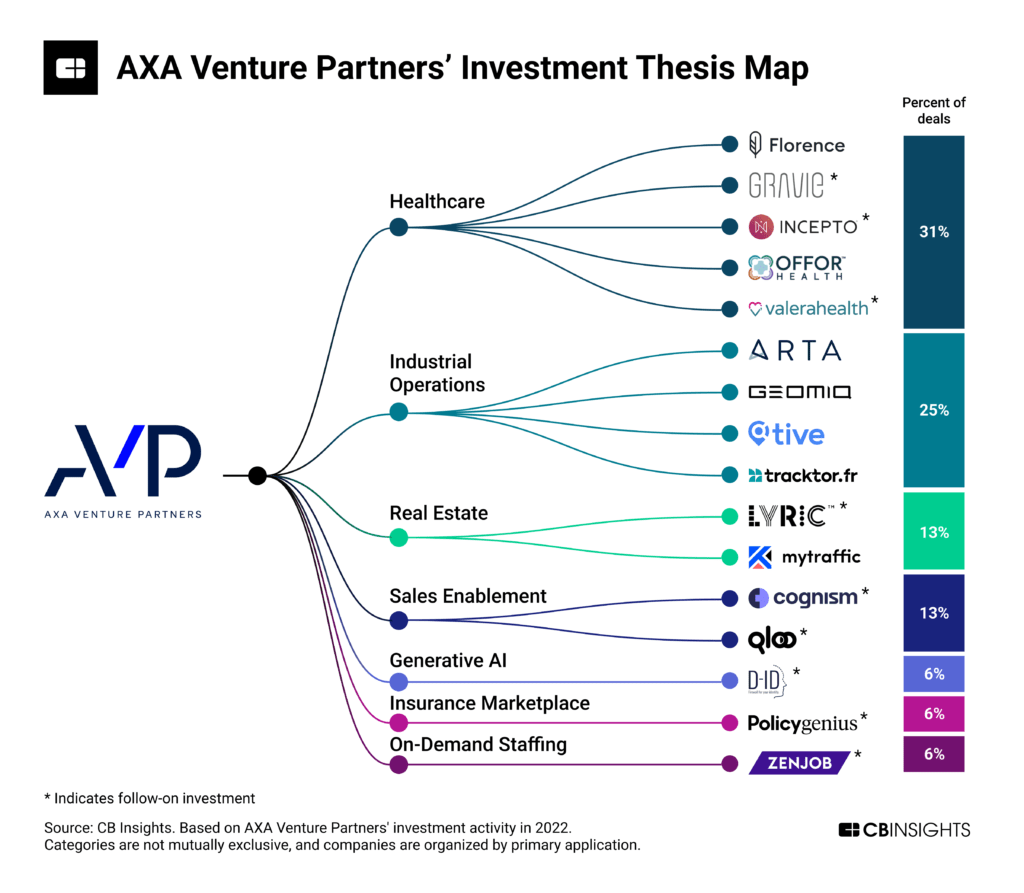

Using CB Insights data, we analyzed AVP’s 2022 investments and mapped them across categories like healthcare, industrial operations, real estate, and more.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.