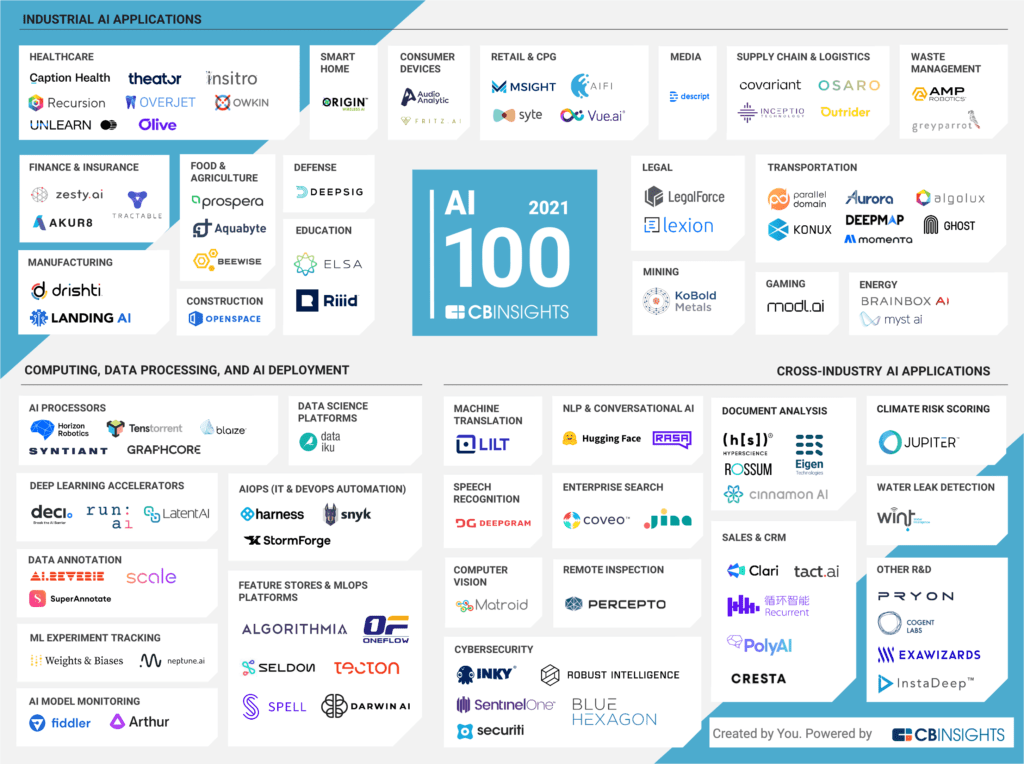

In April 2021, CB Insights announced our fifth annual AI 100 — a list of the 100 most promising AI startups across the globe. We take a look at where these companies are now.

In 2021, CBI analysts parsed through over 8,000 AI startups to determine the 100 most promising private AI companies.

The winning cohort worked on a wide array of applications, from drug R&D and hospital revenue cycle management to autonomous beekeeping and municipal waste sortation — highlighting the breadth and depth of AI’s impact across industries.

FREE DOWNLOAD: THE COMPLETE AI 100 LIST

Get an excel file with the entire AI 100 list including each company’s total funding, focus area, and more.

Since then, the AI 100 2021 cohort has gone on to do big things.

Here’s what they’ve achieved since April 2021:

- Nearly $6B in equity funding across 60+ deals — with an average deal size more than 5x that of the broader venture market

- 18 mega-rounds (deals worth $100M+), including a $600M round to an AI chip developer

- 9 exits, with winners being acquired by tech leaders like Meta and Nvidia

- 5 new entrants to the $1B+ unicorn club

- A plethora of new partnerships with industry leaders like Geico, Cisco, and Snowflake

Below, we look at how the 2021 cohort has fared since being selected to the AI 100.

FUNDING

Since April 2021, 50% of the winning startups disclosed equity rounds, amounting to $5.8B raised across 64 deals. During that time:

- Average deal size has clocked in at $108M, more than 5x the average deal size across venture in Q1’22.

- 17 startups have raised a total of 18 $100M+ mega-rounds, for a combined total of nearly $4.5B.

- The largest deal went to Horizon Robotics, which raised a $600M Series C at a $5B valuation.

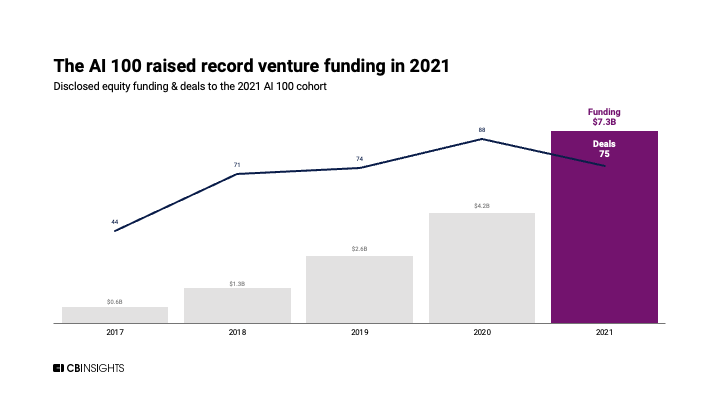

Across all of 2021, the AI 100 cohort raised a record 7.3B, up 74% YoY.

EXITS

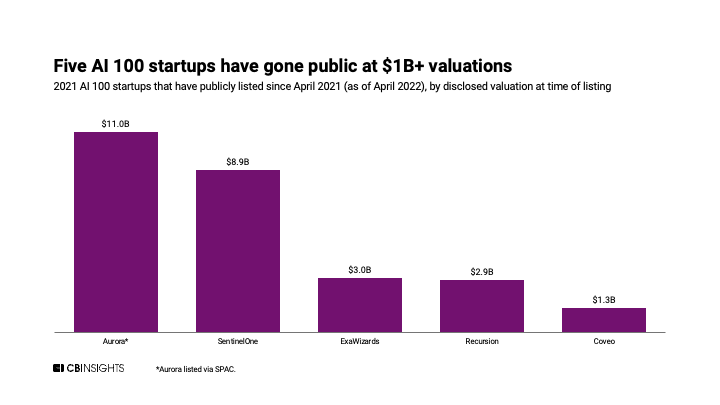

Nine AI 100 winners have exited in the past year, including both public exits and acquisitions. Since April 2021:

- 4 startups have been acquired by companies ranging from Meta to Nvidia to DataRobot. For instance, Facebook parent Meta acquired AI 100 winner AI.Reverie, which generates synthetic data, in October 2021. This is the third year in a row Meta has purchased an AI 100 winner.

- 4 startups IPO’d. The largest was SentinelOne, which debuted at an $8.9B valuation.

- Autonomous driving company Aurora went public via SPAC at an $11B valuation.

FREE DOWNLOAD: THE COMPLETE AI 100 LIST

Get an excel file with the entire AI 100 list including each company’s total funding, focus area, and more.

UNICORNS

On top of the existing 12 unicorns in the AI 100, five more startups became billion-dollars companies:

- Cresta, which uses speech recognition and AI to monitor call center conversations and guide agents. In March 2022, Cresta raised an $80M Series C at a $1.6B valuation from investors such as Andreessen Horowitz and Tiger Global, as well as contact center software companies Five9 and Genesys.

- TensTorrent, which develops chips and hardware to run deep learning systems. In May 2021, it raised a $200M Series B led by Fidelity at a $1B valuation.

- Owkin, which uses federated learning, a privacy-preserving technique, to build and train AI models that predict how patients will respond to treatments. The startup raised a $180M Series B from Sanofi Ventures at a $1B valuation in November 2021.

- Weights & Biases, which offers a platform for developers to more efficiently build machine learning models. In October 2021, Weights & Biases raised a $135M Series C from at a $1B valuation from Coatue Management, Insight Partners, and Felicis, among others.

- Tractable, which uses computer vision to rapidly appraise pictures of vehicle or home damage for insurance claims. It raised a $60M Series D co-led by Insight Partners and Georgian Partners at a $1B valuation.

Partnerships

Many of the winning companies have forged new strategic partnerships or client relationships since being selected to the AI 100. For example:

- Tractable added clients like Geico, Root Insurance, Covea, and Duck Creek Technologies, among others.

- Cresta added 2 major partners: Genesys and Five9, both of which backed its Series C.

- KoBold Metals, which uses machine learning to analyze geological data and predict promising mining sites, partnered with mining incumbents BHP and Bluejay Mining.

- AI-powered cybersecurity startup Securiti added Cisco and Snowflake as partners. The startup is helping both businesses protect against vulnerabilities in the cloud.