The Retail Tech 100 is CB Insights' annual ranking of the 100 most promising B2B retail tech companies in the world. This year’s winning companies include vendors working on hyper-personalized shopping experiences, blockchain-powered commerce, autonomous delivery, virtual shopping, and more.

CB Insights has unveiled the second annual Retail Tech 100 — a list of the top private companies using technology to reshape the shopping experience and make retail operations move faster and sell more.

The 2022 Retail Tech 100 cohort has raised approximately $25.4B in equity funding across 373 deals since 2017. The list includes startups at different investment stages of development, from early-stage companies to well-funded unicorns.

The companies were selected by CB Insights’ Intelligence Unit from a pool of over 7,000 companies, including applicants and nominees.

They were chosen based on several factors, including data submitted by the companies, company business models and momentum in the market, and Mosaic scores, CB Insights’ proprietary algorithm that measures the overall health and growth potential of private companies.

Clients can access the entire Retail Tech 100 list and interactive Collection here. (If you don’t have a CB Insights login, create one here.)

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

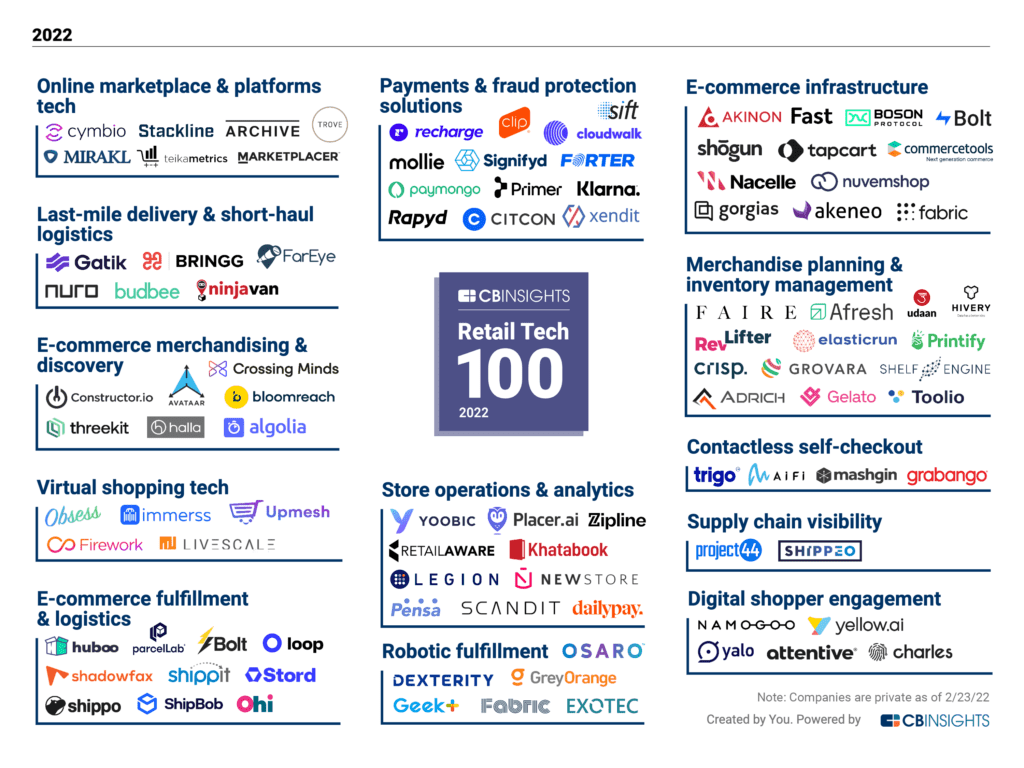

The market map above categorizes the Retail Tech 100 companies based on core area of focus. Categories are not mutually exclusive. Companies are private as of 2/23/22.

Table of contents

- Top retail tech companies 2022: Retail Tech 100 investment trends

- Category highlights

- Categories & most well-funded startups

- The Retail Tech 100 Class of 2020: Where are they now?

TOP RETAIL TECH COMPANIES 2022: RETAIL TECH 100 INVESTMENT TRENDS

- Funding trends: In 2021, these 100 private companies raised $13.1B in equity funding across 109 deals, triple the amount raised in 2020. So far in 2022, they have raised $2.3B across 15 deals (as of 3/8/22).

- Future market leaders: Nearly two-thirds of the companies on the list are early- or mid-stage companies. There are 20 early-stage companies (seed/angel and Series A) and 43 mid-stage firms (Series B or Series C) in this year’s cohort. The early-stage grouping includes Immerss and Obsess, which power virtual shopping experiences via video chat and virtual stores, as well as Halla and Constructor.io, which both make tech focused on hyper-personalizing online shopping.

- Global reach: 40% of the 2022 Retail Tech 100 is based outside the US. After the US, the UK and India follow with 6 companies each. Overall, this year’s winners span 19 countries, including Singapore, Australia, China, and the Netherlands. Companies from emerging markets where informal retail is still dominant — like India, Indonesia, the Philippines, and Mexico — are notable additions to this year’s list, as their inclusion indicates that tech companies in locations like these are making progress toward digitizing retail operations.

- Unicorns: Thirty-six of the 100 companies (36%) are valued at or above $1B as of their latest funding rounds. Among the most recently crowned are Scandit, which makes mobile computer vision technology for use across store operations; Fabric, which maintains small robotic fulfillment centers that are utilized by Walmart and Instacart; and Singapore-based Ninja Van, a provider of last-mile delivery services for companies in Southeast Asia.

- Top investors: Salesforce Ventures is the most active investor in this year’s Retail Tech 100, having made investments in 10 companies across 19 deals since 2017. Tiger Global Management and Insight Partners, which have both invested in 9 companies on the list, are tied for second. Among Salesforce’s investments is a Series B round for ThreeKit, which makes 3D content for e-commerce sites, in November 2021.

- Most well-funded companies: The biggest rounds of the year went to BNPL giant Klarna, which closed a $1B growth equity deal in March 2021, and online checkout player Mollie, which raised $800M in Series C funding in June 2021. Klarna is also the most well-funded company among the Retail Tech 100, having raised over $3B in funding. Autonomous delivery company Nuro follows with $2.1B in total funding.

Clients can access all 100 companies on the CB Insights platform here.

CATEGORY HIGHLIGHTS

The biggest categories in this year’s cohort point to the tech markets and areas of focus that will continue to gain momentum in 2022.

- Omnichannel tech stands out: The categories tied for most companies (13) in this year’s cohort — payments & fraud protection solutions and merchandising & inventory management — highlight solutions that digitize, automate, and simplify processes across in-store and online channels.

The companies in the 2 groups also highlight one of this cohort’s cross-category themes: the movement to digitize informal retail in emerging markets. Clip, CloudWalk, PayMongo, and Xendit, for instance, make it possible for small businesses in Latin America and Southeast Asia to accept digital payments. Meanwhile, platforms like ElasticRun and Udaan are simplifying and digitizing inventory procurement for small retailers in India. - E-commerce innovation continues: The e-commerce infrastructure category comes in second place with 12 companies. The group includes everything from headless tech providers to fast checkout platforms.

Shopify’s continued strength is reflected by the rise of Shogun Labs and Tapcart, which both specialize in helping businesses integrate with the giant’s e-commerce platform. Meanwhile, the inclusion of Boson Protocol, a company that powers decentralized commerce protocols, points to the potential for virtual goods and the metaverse to play a larger role in commerce.

Meanwhile, the activity demonstrated by the 7 companies in the online marketplace and platforms tech category highlights the growing impact of marketplaces on brands and retailers. In particular, white-label resale platforms Archive and Trove will gain traction as consumer appetite for recommerce continues to grow.

Overall, providers of tech that plays any role in enabling e-commerce make up nearly 40% of this year’s cohort (39 companies). - Workforce tools elevate store tech: The store operations and analytics category features 10 companies digitizing and automating processes around the store. Tech that improves the retailer-store associate relationship will remain crucial as labor shortages continue to pose a challenge. Zipline, YOOBIC, and Legion all help retailers communicate with employees, while DailyPay gives hourly workers easier access to their wages.

- Small businesses get a boost: The 10 companies in the e-commerce fulfillment & logistics category all play a role in helping merchants fill and ship e-commerce orders faster and more efficiently. A few of the companies target the needs of small online businesses, whose fulfillment needs continue to grow with the acceleration of e-commerce growth. ShipBob, for instance, serves direct-to-consumer brands with its fulfillment and shipping network. Shadowfax specializes in hyperlocal delivery for small retailers in India.

Retail Tech 100 (2022)

Track the 100 most promising retail tech innovators to watch in 2022 and beyond. Look for Retail Tech 100 (2022) in the Collections tab.

Track The 2022 Retail Tech 100 WinnersCATEGORIES AND MOST WELL-FUNDED STARTUPs

| Category | Company |

|---|---|

| Contactless self-checkout | Trigo |

| Digital shopper engagement | Attentive |

| E-commerce infrastructure | Bolt |

| E-commerce merchandising & discovery | BloomReach |

| E-commerce fulfillment & logistics | ShipBob |

| Last-mile delivery & short-haul logistics | Nuro |

| Merchandise planning & inventory management | Udaan |

| Online marketplace & platforms tech | Mirakl |

| Payments & fraud protection solutions | Klarna |

| Robotic fulfillment | Exotec |

| Store operations & analytics | dailypay |

| Supply chain visibility | project44 |

| Virtual shopping tech | Firework |

THE RETAIL TECH 100 CLASS OF 2020: WHERE ARE THEY NOW?

The 2020 Retail Tech 100 winners have gone on to do big things since December 2020:

- 6 winners have gone public (5 via IPO and 1 via SPAC)

- 14 members of the list were acquired (including one winner that bought another)

- 19 more have become unicorns (bringing the total Retail Tech 100 2020 unicorn herd to 38)

- 59 raised additional equity funding, totaling $17.1B across 91 deals

- 36 winners raised 48 mega-rounds (deals worth $100M+), generating a total of $16.1B.

If you want to learn more about the Retail Tech 100 Class of 2020, check out the full list of previous winners.

If you aren’t already a client, sign up for a free trial to learn more about our platform.