While quarterly insurtech funding increased in Q3'23, annual funding is on track to hit a multi-year low.

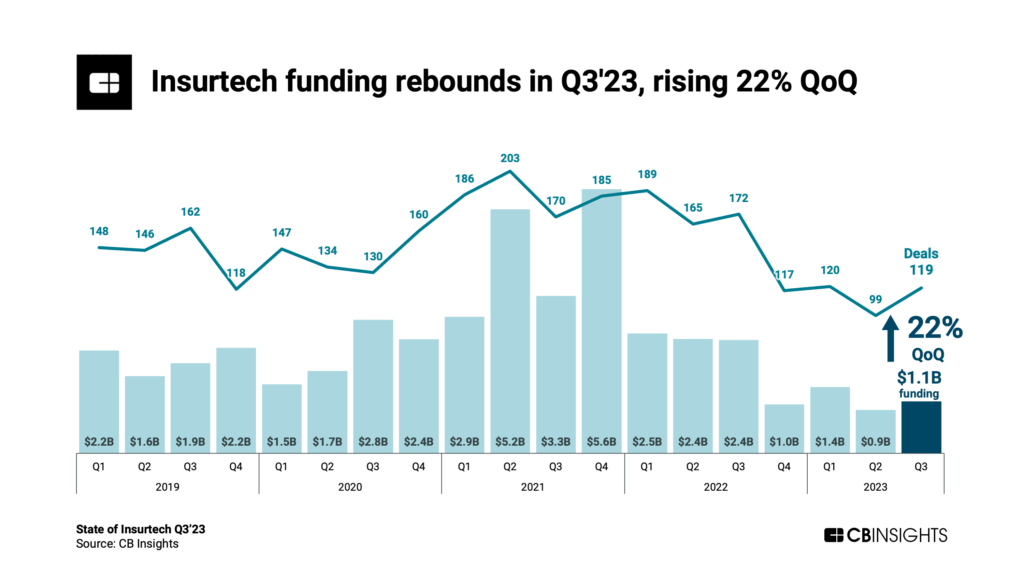

Insurtech funding rebounded in Q3’23, jumping by 22% quarter-over-quarter (QoQ) to hit $1.1B. However, funding is on track to hit its lowest annual total since 2017 this year.

Using CB Insights data, we dig into key takeaways from our State of Insurtech Q3’23 Report, including:

- Global insurtech funding rebounds QoQ in Q3’23 but remains below pre-pandemic totals.

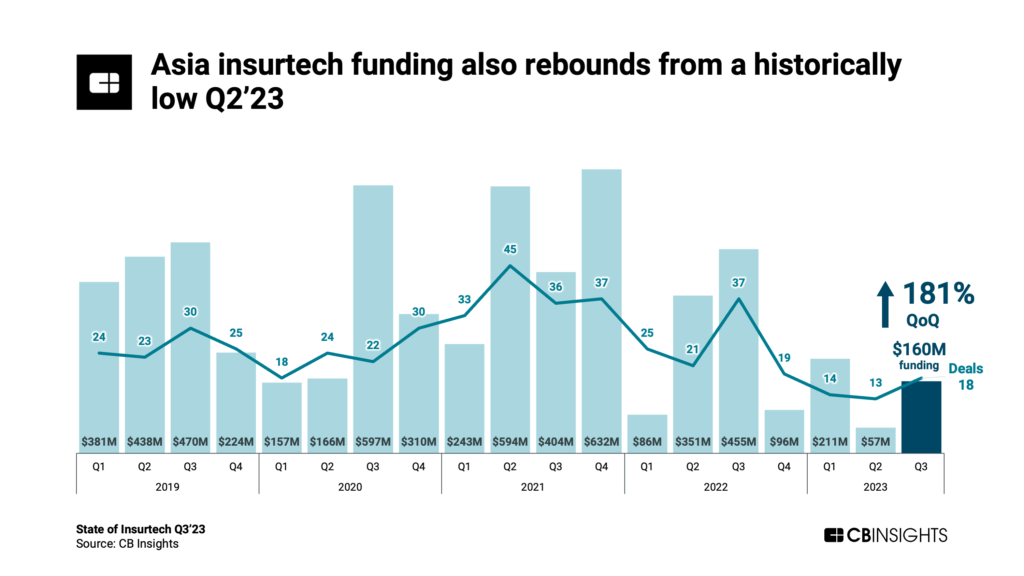

- Asia insurtech funding jumps 181% following a historically low quarter.

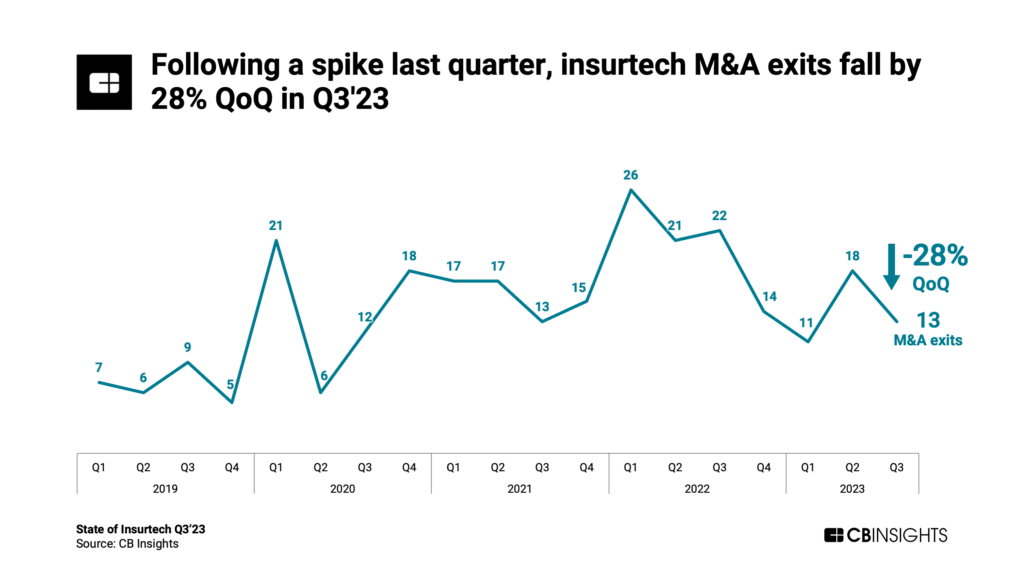

- Despite spiking in Q2’23, M&A exits drop by 28% QoQ in Q3’23.

Let’s dive in.

Insurtech funding bounced back in Q3’23, rising 22% QoQ to hit $1.1B across 119 deals. In terms of quarterly funding growth, insurtech performed better than the broader fintech (-3% QoQ) and venture (11% QoQ) markets in Q3’23.

However, despite the increase, quarterly insurtech funding remained below pre-pandemic totals in Q3’23. This highlights the uncertainty the market has faced in recent years.

As a result, annual insurtech funding is on track to hit $4.5B for all of 2023, which would mark the lowest annual total since 2017.

Following a historically low quarter, funding to insurtechs in Asia grew 181% QoQ to reach $160M in Q3’23. Deals also jumped from 13 in Q2 to 18 in Q3 — the highest quarterly count this year.

The largest deals in the region were raised by India-based agriculture insurtech Leads Connect ($63M), India-based auto insurtech RenewBuy ($40M), and Hong Kong-based life and health insurtech Bowtie ($35M).

Despite spiking in Q2’23, insurtech M&A exit count started to drop yet again in Q3’23, falling by 28% QoQ.

Tech companies drove some of Q3’23’s notable insurtech M&A deals. For example, Acturis acquired digital insurance forms provider Broker Buddha and Zillow acquired title insurance platform Spruce.

If you aren’t already a client, sign up for a free trial to learn more about our platform.