From computer vision to geospatial analytics, we break down how these insurance leaders are working with insurtechs to drive innovation and efficiency in claims analytics.

Tech solutions such as new data sets, advanced visualizations, and artificial intelligence (AI) are helping insurers streamline the claims analytics process — ultimately reducing costs and improving customer satisfaction.

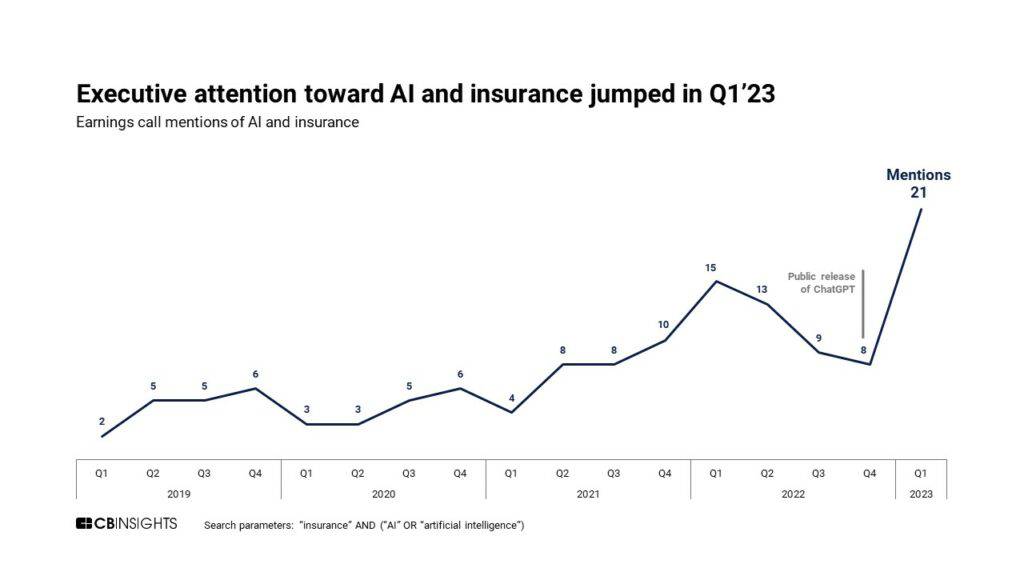

Executive interest in AI applications for insurance spiked in early 2023 following the public release of ChatGPT by OpenAI in Q4’22 and the subsequent boom in generative AI-related media attention.

To access and effectively leverage these tools, leading insurance companies Aon, MAPFRE, and Tokio Marine Holdings are turning to insurtechs.

In this brief, we explore the actions they have taken to adopt claims analytics technologies across their businesses.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.