Following a nearly 90% drop last year, weather risk intelligence funding is on track to hit a 5-year high. We assess the market's momentum.

Climate change is amplifying the frequency and severity of extreme weather events, which have proven to be costly. Last year, the planet was hit by 42 billion-dollar weather events, driving the total economic cost of natural catastrophes for the year up to $360B, according to Gallagher Re.

Companies offering weather risk intelligence solutions help organizations across industries — such as aerospace, agriculture, construction, government, insurance, and logistics — better assess and manage the risk of these weather events to ensure operational continuity and protect their assets. These solutions make use of AI, advanced analytics, and forecasting models, and they’re catching the eyes of investors.

Tomorrow.io recently raised an $87M Series E round after launching its second weather satellite into space. Five other weather intelligence companies — ClimateAi, Reask, Truweather Solutions, Salient, and PlanetIQ — have also raised funding in 2023 so far.

In this brief, we’ll assess the current state of the weather risk intelligence market, using CB Insights data such as:

- Total funding

- Valuations

- Business relationships

- Scorecard & testimonials

Total funding

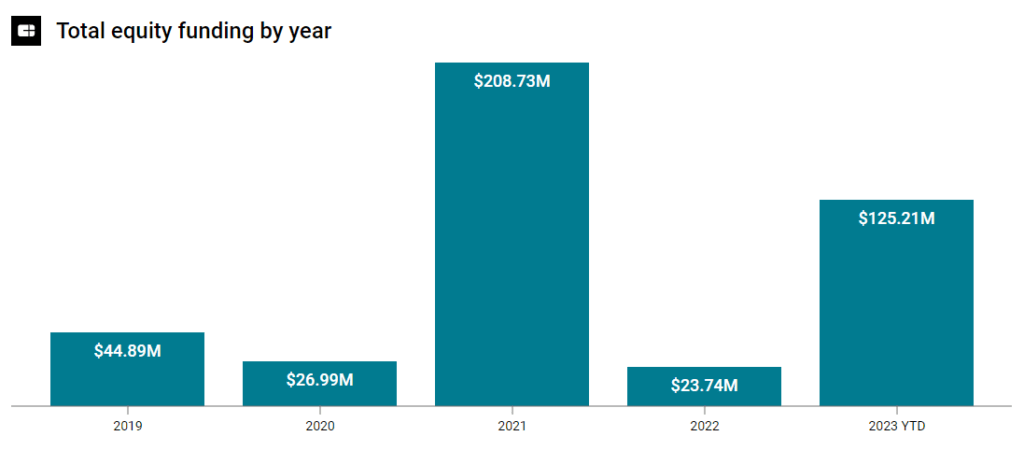

Weather risk intelligence equity funding hit $208M in 2021 before dropping down to $24M in 2022. However, funding activity has picked up again in 2023 so far and is on pace to exceed 2021 levels.

Data as of 06/29/23.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.