With new satellite internet entrants gaining attention and incumbents looking to build bigger moats, we look at investment trends and M&A data to assess the state of the market.

The satellite internet industry is undergoing a transformation as more players enter the market to take on SpaceX and its quickly expanding Starlink program.

For example, Astranis — a startup in the space — recently achieved a significant milestone by launching a low-cost satellite into geosynchronous orbit (which is much further out than Starlink’s constellation and normally requires significantly more expensive equipment to operate in) and successfully establishing a link to a remote part of Alaska.

In this brief, we look at the competitive landscape and assess the current state of the satellite market, focusing on:

- Total funding

- Valuations

- M&A

Total funding

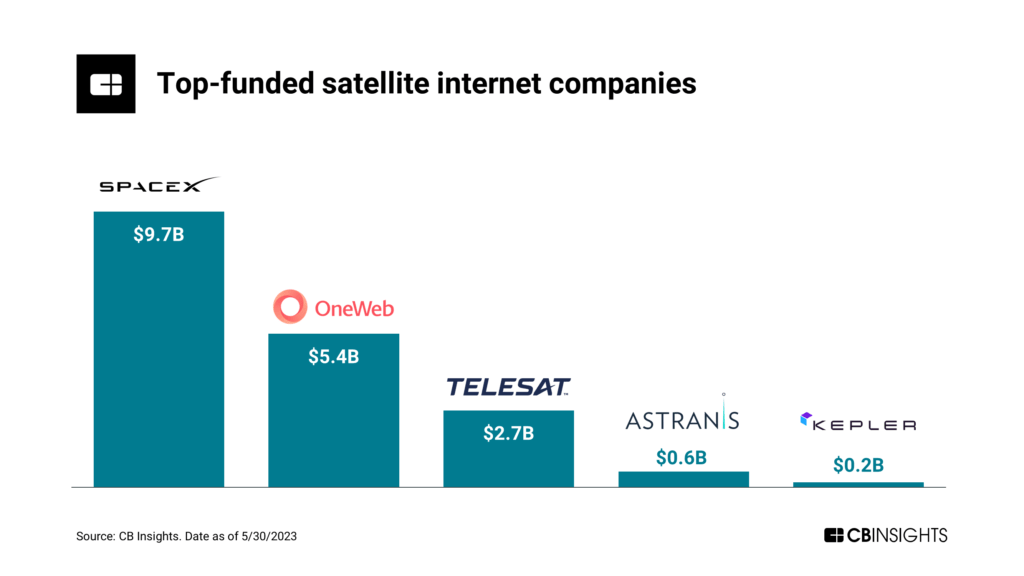

Companies in the satellite internet market have attracted a total of $18.7B in funding. While funding in 2023 so far is only at $92M, it reached above $2.4B in each of the past 4 years.

SpaceX remains the dominant player. The company has secured $9.7B to finance various endeavors, including its Starlink program. Starlink has experienced remarkable growth and has recently reported its first quarter of positive cash flow. It’s projected to become profitable by the end of 2023.

Meanwhile, Astranis has raised $563M since it was founded in 2015.

Valuations

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.