Facing commercial and regulatory hurdles, well-capitalized robotaxi startups like Cruise and Waymo will need to navigate a rocky road.

Investors have poured billions of dollars into robotaxi companies, with GM subsidiary Cruise and Alphabet’s self-driving unit Waymo bringing in the bulk of that funding.

But soaring costs and regulatory uncertainty have prevented these companies from fully commercializing their solutions, even with consolidation in the space. Former market leader Argo AI even shut down in October, despite billion-dollar investments from Ford and Volkswagen.

Most recently, GM’s Cruise reported disappointing numbers, losing $561M in Q1’23 on $30M in revenue. The results fuel growing concerns around the viability of robotaxis.

This uncertainty will likely drive valuations in the sector down, if recent down rounds are any indication.

In this brief, we use CB Insights data to analyze the market for robotaxi companies. We look at the following data points:

- Total funding

- Top-funded companies

- Valuations

Total funding & top-funded companies

There are 51 private companies developing full-stack self-driving solutions for passenger vehicle applications, along with the full vehicles themselves.

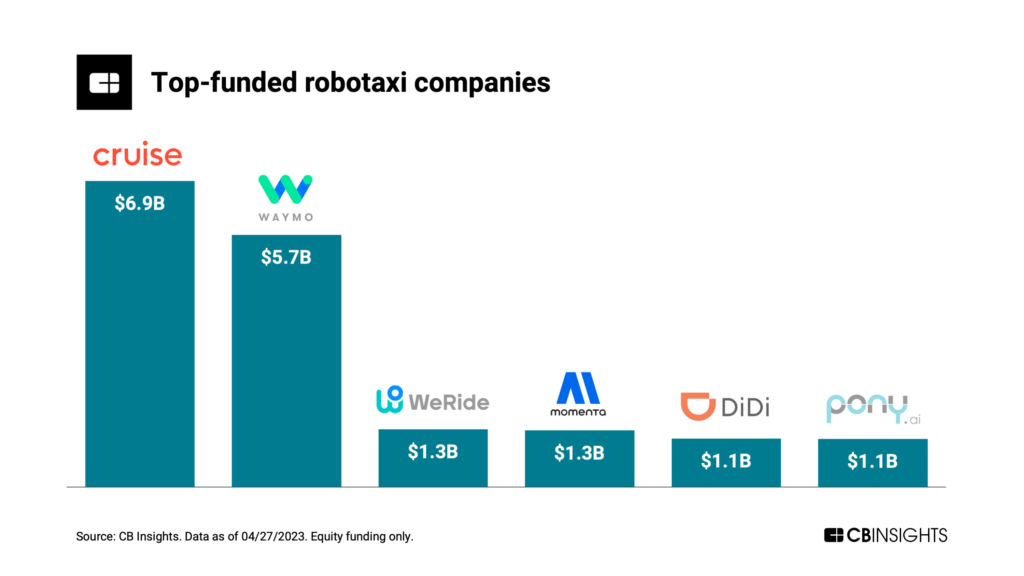

Collectively, companies in the space have raised more than $20B in equity funding — including 6 that have each raised over $1B.

In addition to Cruise, companies like Waymo, WeRide, Pony.ai, and May Mobility are developing robotaxis.

May Mobility, in particular, is looking to develop its robotaxis from the ground up, building the vehicles in-house. This approach, while more capital-intensive, results in vehicles that are built specifically for robotaxi applications, rather than relying on standard automaker designs.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.