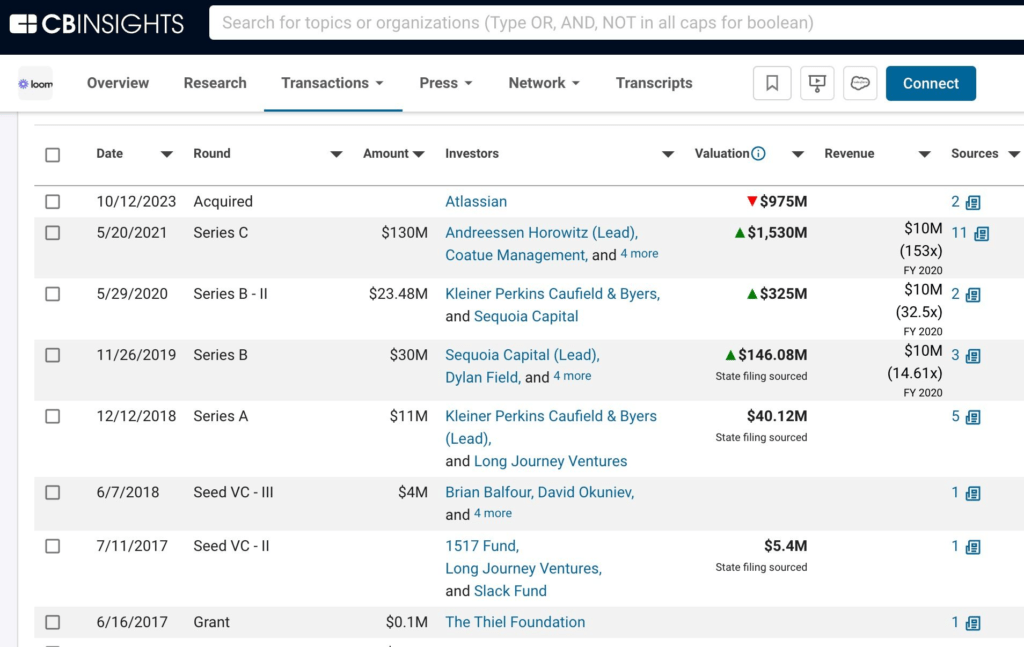

Kleiner Perkins, Sequoia Capital, Point Nine, Long Journey Ventures, and 1517 Fund among others were winners. We also use CB Insights data to estimate how much Loom’s founders made on the deal.

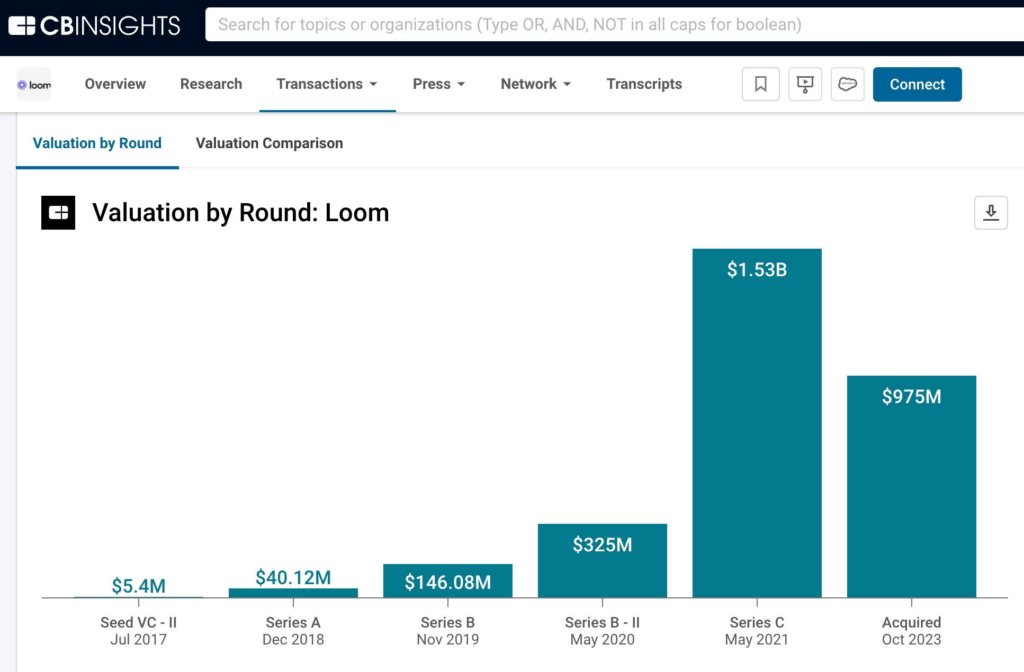

Loom’s acquisition by Atlassian in October 2023 was a great outcome for founders as well as early-to-mid-stage employees and investors.

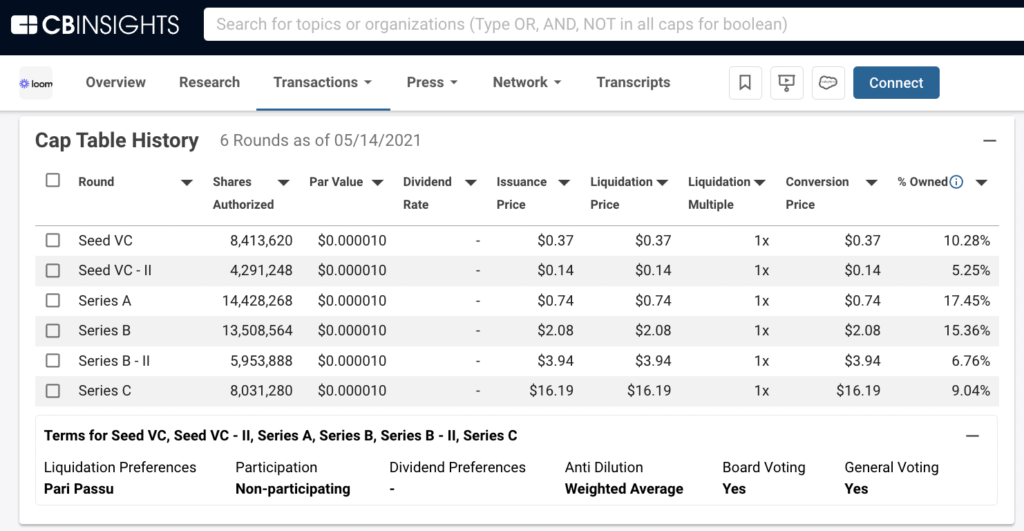

The liquidation preference on all rounds was 1x, so there were no onerous terms.

Which institutional and angel investors made money?

Everyone who invested in Loom’s Series B round or earlier won in this deal.

That includes:

- Kleiner Perkins (Series A investor)

- Sequoia Capital (Series B)

- Point Nine (Seed)

- General Catalyst (Seed)

- Long Journey Ventures (Seed)

- 1517 Fund (Seed)

- Slack Fund (Seed)

And that also includes a whole host of angel investors, as you can see in the investor table below from Loom’s CB Insights profile.

In the current climate, most unicorns would gladly take an outcome like this given the “great valuation reset” that is ongoing right now.

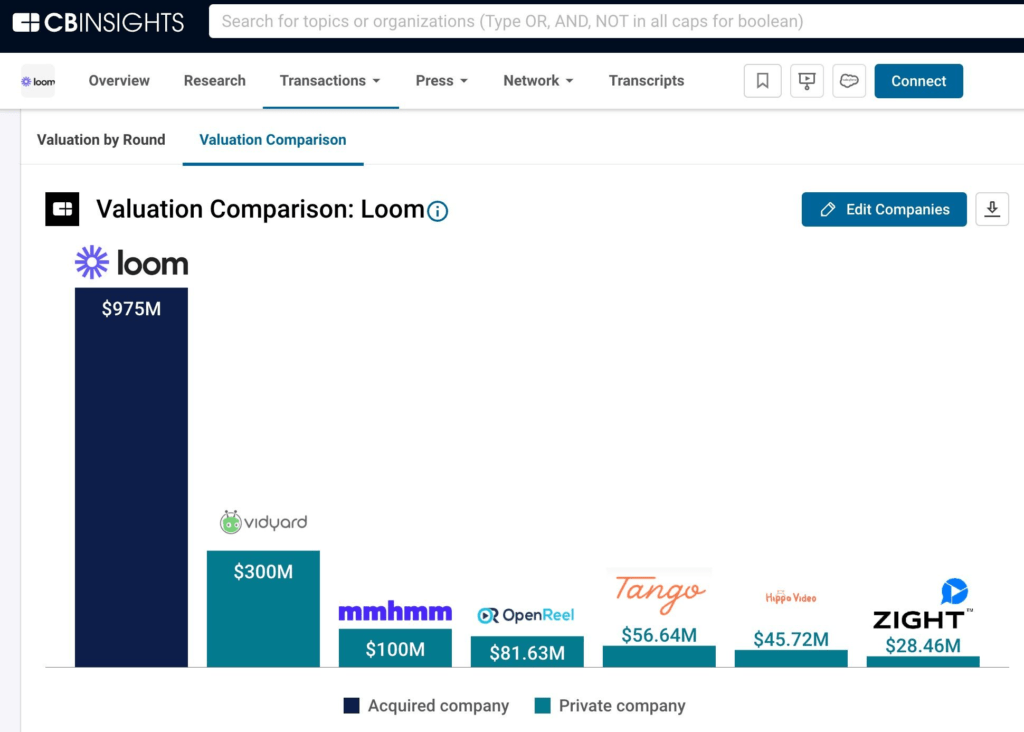

Who else might be worth a look in the video sharing/collaboration space?

Loom has many comps — and most have much smaller valuations, as the CB Insights chart below demonstrates.

So, how much did the Loom founders make as a result of the $975M acquisition by Atlassian? $56M each.

Here’s some napkin math.

Per CB Insights cap table data, the team owned ~40% of the company.

Let’s assume half of that is the option pool (20%).

That leaves 20% for founders.

Loom’s $130M Series C round came with a 1x liquidation preference. When that is taken out of the $975M acquisition price tag, $845M is left.

$845M x 20% = $169M.

There are 3 founders of Loom, so if they take an even split, that leaves $56M each.

Another notable detail is that the best “accelerator” in the world not named Y Combinator initially backed Loom. Learn more about the Thiel Fellowship’s remarkable success in this brief.

If you aren’t already a client, sign up for a free trial to learn more about our platform.