Investors are pouring money into buzzy Web3 tech. But how does Web3 work, and who's building it? From decentralized finance to play-to-earn games, we break down what Web3 is today and what it could mean for consumers and creators.

The hype surrounding Web3 — a decentralized internet built on an open, permissionless blockchain network — has transcended Silicon Valley coffee shops and Discord servers.

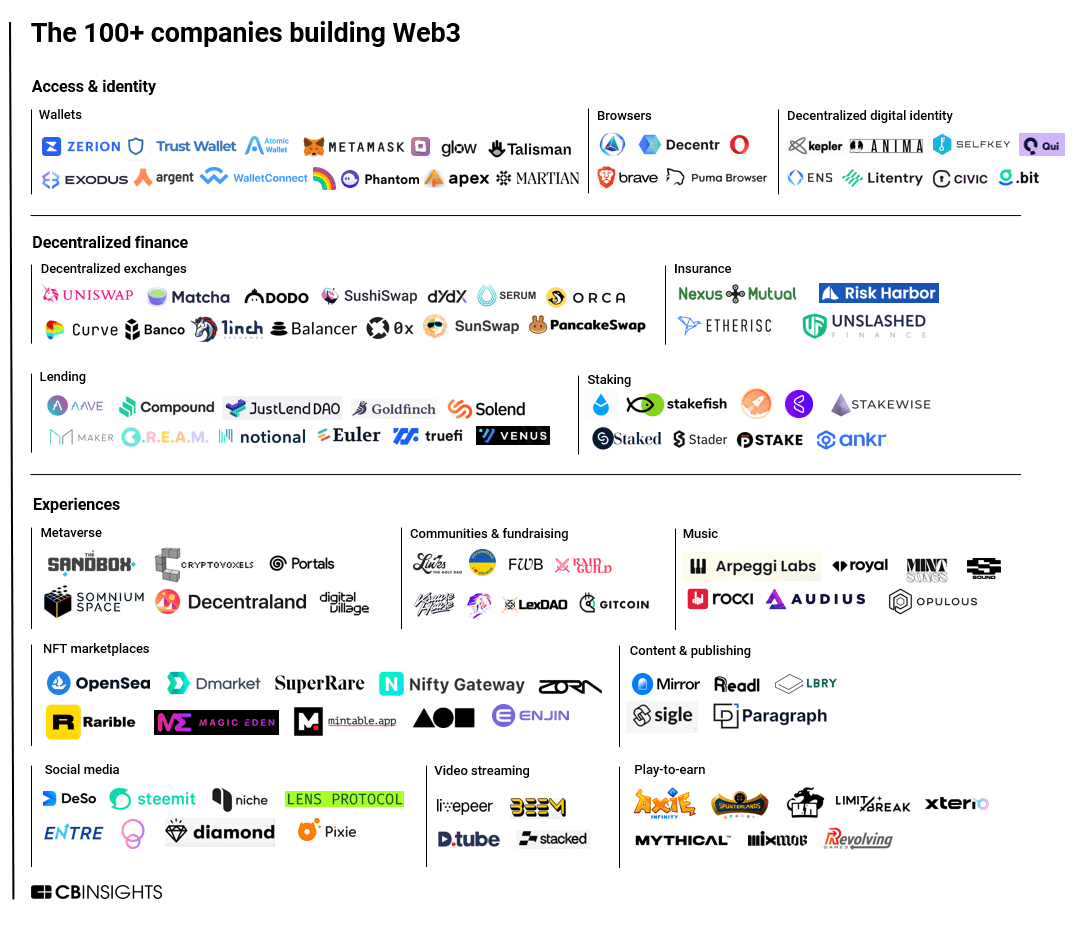

The tech is rapidly gaining investor attention as companies build applications to power an internet focused on empowering consumers. Web3 companies raised $13B in equity funding the first 3 quarters of 2022.

To Web3 evangelists, this momentum is unsurprising. A fully decentralized internet would change everything. Tech giants like Google and Meta would be unable to profit off personal data. Youtube creators and Spotify musicians would move to platforms that connect them directly to fans instead of being paid by tech middlemen.

But critics maintain that Web3 is little more than hype. Many believe that Web3 won’t be able to overcome the Blockchain Trilemma, the belief that blockchain networks cannot be secure, decentralized, and scalable all at once. Others, like Twitter and Block founder Jack Dorsey, say that decentralization itself is not achievable, and that Web3 will simply be “a centralized entity with a different label.”

Nonetheless, startups are already challenging major internet companies with solutions that promise to give consumers more ownership of their content, improve data privacy, and end fees taken by middlemen. In this brief, we break down the layers of Web3 and highlight key players laying the foundation for a consumer-owned internet.

Access & identity

The access and identity layer enables consumers to access and prove their identity to decentralized applications (dApps).

Many companies in this space are also building tools to help consumers control their data, including verifying identities without having to share personal information, controlling what data consumers share with dApps, and interacting with dApps completely anonymously.

Wallets

Web3 wallets have two key characteristics:

- Access: They give users unique addresses that act as both username and password for dApps.

- Storage: They store digital assets such as NFTs, crypto, and even personal data.

To access a Web2 application, such as a game or email, users may be asked to enter their username and password. In Web3, the unique wallet address replaces these login credentials. For example, wallets like MetaMask are used to automatically login to decentralized applications such as games, decentralized finance, metaverse apps, and more. MetaMask is one of the most popular Web3 wallets, boasting about 21M monthly active users and integrating with nearly 4,000 Web3 applications. It’s also developing a web plugin where users can access dApps through the familiar format of websites.

Meanwhile, Web3 wallet storage is key to decentralization and interoperability. A Web2 game might allow users to make in-app purchases, but these purchases only exist within the confines the game. To sell, buy, or receive payment for in-game items, a player will need to log back in.

In a Web3 game, in-app purchases appear as non-fungible tokens (NFTs) in a player’s wallet. As a result, the player can buy, sell, or trade these NFTs without being in the game itself. The NFTs can be listed on marketplaces like OpenSea or Rarible, which exist entirely outside of the game.

As interoperability improves, players may also be able to take NFTs from one game and access them in another. While it’s unclear how Web3 will address issues like in-game item fidelity or value, wallets enable players to automatically prove the assets they own across decentralized applications. For instance, some Web3 communities require users to own specific NFTs or crypto, which can be validated through Web3 wallets.

Browsers

Currently, internet browsers like Chrome, Firefox, and Explorer cannot connect to all aspects of the decentralized internet. For example, an internet user can play Web3 metaverse games as a guest on a Web2 browser, but they couldn’t receive items or make in-game trades.

Web3 browsers, on the other hand, either integrate with Web3 wallets or provide their own in-browser wallets, facilitating access to the decentralized internet. For example, Acent is developing a Web3 browser that can connect with multiple wallets. It’s also developing its own wallet, Metawallet, and a dApp store to help users discover Web3 applications.

Other wallets are differentiating themselves through unique rewards systems.

For example, Brave’s browser blocks advertisements, but users can choose to view ads for a reward. If they opt to see ads, the users are matched with a personalized advertisement based on local machine learning (this means Brave does not ever take data away from where it’s created into any private or central server). From there, users receive 70% of the revenue generated from the ad in the form of Basic Attention Tokens (BATs), which are automatically deposited into the users’ wallets.

Decentralized digital identity

These companies are developing platforms and wallets that allow users to control their personally identifiable information (PII) as they access decentralized applications.

In Web2, some applications give users persistent identities across platforms. For example, Google Sign-in allows users to connect to a multitude of applications using a single identity — their Google account. In this scenario, Google has ownership over the information and data that can verify a user’s identity. Sometimes centralized Web2 identifiers can access and monetize consumers’ PII. They are also prone to cyberattacks due to the large troves of data they store.

Decentralized digital identity companies store and protect PII data for users. Several Web3 browsers and wallets are building decentralized digital identity solutions. Some are also developing identity platforms that integrate with popular existing wallets.

In April 2022, Spruce raised a $34M Series A funding round led by Andreessen Horowitz to develop decentralized identity solutions. These include its consumer-facing product, Kepler, which integrates with Web3 wallets to help consumers define how their data can be used, where it can be stored, and who can access it.

Decentralized finance (DeFi)

DeFi refers to the ecosystem of financial services provided on an open, peer-to-peer blockchain, including borrowing, lending, and exchanging assets.

DeFi is often mistaken for any financial service that involves crypto. This is not the case — DeFi is decentralized because of its blockchain network and smart contracts, which can automate transactions.

For consumers, DeFi could reduce fees by eliminating the need for financial intermediaries like banks. At its best, DeFi would not only cut out the middleman in many financial transactions, but also provide a faster, more transparent way for individuals to access financial services.

Decentralized exchanges (DEXs)

Decentralized exchanges (DEXS) are crypto and token marketplaces that use smart contracts to enable consumers to buy, sell, or trade tokens.

Centralized exchanges partner with financial intermediaries — referred to as market makers — such as banks or hedge funds to ensure liquidity, or high trade volumes. In cases where liquidity is low (e.g., where there is a disproportionate number of buyers or sellers), prices can be volatile and trade times long. As a result, financial intermediaries complete almost all transactions for centralized exchanges on the backend.

Centralized exchanges then have to pay market makers for providing liquidity and taking on risk. This payment to market makers is often in the form of a spread (meaning market makers will sell assets for a slightly higher price and buy them for slightly less), fees, or both. Some of this burden is passed on to consumers.

DEXs use liquidity pools to eliminate financial middlemen. Liquidity pools are caches of cryptocurrency that act as the market makers in centralized exchanges. Instead of trading with a market maker, consumers can swap their assets with the ones in the liquidity pool. These transactions are known as automatic market makers (AMMs) because they are priced by algorithms and trades fulfilled automatically by smart contracts.

To incentivize people to engage with liquidity pools, DEXs offer liquidity pool tokens as rewards. The tokens act as digital receipts of a consumer’s share of the pool, and denote interest gained for providing liquidity.

Because they don’t use intermediaries, transactions on DEXs are a cheaper alternative to centralized exchanges. In 2021, KPMG tested various exchanges and found DEX Uniswap charged a 0.05% transaction fee for a $100,000 trade while centralized exchanges Coinbase and Kraken charged 0.1% and 0.2%, respectively.

Lending

DeFi lending uses a peer-to-peer token system powered by smart contracts instead of financial intermediaries.

With DeFi, any consumer can become a lender. Protocols like Aave, and Compound reward users for depositing assets (often stablecoins) into lending pools for others to borrow. Transactions are automatically executed and enforced by smart contracts. After a period of time, the smart contract issues interest to the lender, often in the form of the protocol’s native token. The interest is part of the fees paid by the borrower — DeFi lending interest rates can fall anywhere between 1% and 20%.

These loans may also be cheaper for borrowers. Financial institutions charge higher premiums on loans that are riskier. In crypto, most loans need to be overcollateralized. In the event a person defaults on a crypto loan, smart contracts will automatically compensate the lender. Lower risk often means lower interest rates for the borrower.

Still, currently, overcollateralized loans are not necessarily ideal for borrowers. People who need money to run a business or pay for an education are unlikely to have collateral worth well over 100% of the loan they’re asking for. In these cases, financial institutions are better suited to assess creditworthiness and take on risk. However, some protocols are experimenting with ways to prove creditworthiness on the blockchain and offer undercollateralized loans.

In the future, this technology could be used to support undercollateralized crypto lending. This would also mean a major increased risk for DeFi lenders.

Insurance

This category includes two types of Web3 insurance companies: those using decentralization to power traditional insurance, from flight delay to crop insurance, and those developing insurance to protect digital assets, such as crypto and NFTs.

Etherisc falls into the first category. In 2022, the Germany-based company announced the release of its blockchain-based travel delay and cancelation insurance, called FlightDelay. The product uses smart contracts to provide payouts for delays beyond 45 minutes. It covers around 80 airlines and provides payouts in cryptocurrency.

In 2021, Unslashed Finance raised a $2M seed round to help develop smart contracts that automatically pay out Web3 users affected by exchange hacks, wallet exploits, smart contract failures, and more.

Staking

These Web3 companies offer yield generation for consumer investors through staking, where crypto assets are allocated to process transactions and secure protocols (e.g., Ethereum) in exchange for rewards.

Providers run nodes, which help process, verify, and record transactions as they happen on the blockchain. While this is helpful to developers, running nodes can require large amounts of crypto. For example, an Ethereum node requires 32 ETH (approximately $40,000 currently). Managing a node also requires technical overhead, from buying the correct hardware to setting up and managing software.

Staking services allow consumers globally to pool their crypto together and receive staking rewards for validating and securing blockchain networks. For example, a person can use a staking service and contribute 0.1 ETH to a node instead of contributing the total 32 ETH required to operate a node. This person would then receive rewards on their 0.1 ETH, unlocking the benefits of staking for anyone. These services also eliminate the technical overhead required to run nodes.

Staking services are likely seeing increased demand now that the Ethereum network has fully transitioned to a proof-of-stake consensus mechanism. Lido Finance hosts over $6B in staked assets across 200,000 stakers, 97% of which is Ethereum. In 2022, Web3 staking platform Stader received a $12.5M seed round at a $450M valuation.

Experiences

This layer highlights the experiences that will either be augmented or made possible by a Web3 internet, from earning token rewards for gaming to selling NFTs to interacting with the metaverse.

METAVERSE

Web3 metaverses, or decentralized virtual worlds, are environments where users can participate in and build interactive experiences, from games to spaces to hangout.

Decentraland and The Sandbox are two of the most well known decentralized worlds. Inhabitants to buy, sell, and create goods and experiences; however, these transactions are all based on each world’s unique cryptocurrency. In-world items or land are traded as NFTs, which act as decentralized proof-of-ownership certificates for digital assets.

The decentralized aspect of blockchain could boost interoperability between games and other platforms. For example, in the future, a person may be able to “move” their NFT yacht from one decentralized world to another.

Decentralized worlds also tend to use a different business model than their centralized counterparts. They generate revenue from selling virtual land, crypto, and other digital assets instead of taking a percentage of the profit generated by in-world creators. Compare this to centralized virtual world Roblox, which pays creators 29 cents on every dollar they generate.

Some decentralized virtual worlds even let their inhabitants help govern via a decentralized autonomous organization (DAO) approach. These setups — backed by smart contracts — typically grant users voting rights proportional to the in-world crypto assets they own, allowing them to have a say on in-world rules and regulations.

NFT marketplaces

These startups support commerce in decentralized worlds by developing platforms where users can buy and sell NFTs of everything from virtual land to avatar clothing to virtual yachts.

Non-fungible tokens (NFTs) are not exclusively a metaverse concept — people can buy and sell NFTs of tweets, videos, and more without ever participating in the metaverse. However, NFTs are emerging as the backbone of economic activity in decentralized virtual worlds because they provide proof of ownership for metaverse-based property.

NFTs for metaverse items can also be listed on external NFT marketplaces. For example, marketplaces like OpenSea or Rarible already support the sale of virtual real estate and items from Decentraland and The Sandbox. Similarly, startups like DMarket are developing NFT marketplaces specifically catered to trading goods for decentralized worlds and games.

Social media

Web3 social media companies aim to improve user experiences by helping creators own and monetize their content and giving them more control their data.

For many social media companies, end-users are also the product. Instagram, Facebook, and Reddit all generate revenue from advertising, but to accurately advertise, these companies tap into on-platform data to push relevant content to users. The users do not receive any compensation for actively engaging with the platform and fueling the social media companies’ access to data and advertising revenue.

Web3 communities like Steemit are looking to change this. Steemit, described as the Web3 version of Reddit, rewards users with tokens for liking and posting social media content. As users earn more tokens, they also earn a better reputation on the app, which allows their activity to carry more weight. A “like” from a highly reputable account is worth more than a fresh account.

Web3 social media platforms are also turning to alternative revenue sources to survive without data harvesting and advertising. Web3 browser Brave allows users to earn tokens by watching ads; this could become the norm for Web3 social media companies. Meanwhile, platforms like Entre and Diamond allow users to purchase tokens they can use to tip their favorite creators.

Developers are also building entirely new blockchain infrastructures to enable Web3 social platforms. For example, DeSo is creating decentralized protocols that support the infrastructure needed for Web3 social media, including interoperability between platforms, decentralized messaging, and token rewards for creators. The company raised $200M from investors including Andreessen Horowitz, Sequoia Capital, and Coinbase Ventures in September 2021.

While the idea of an ad-free social media platform where user data is protected sounds enticing, it’s not entirely clear how successful Web3 companies will be in convincing users to invest time and money into earning tokens when Web2 social media platforms are mostly free.

Communities & fundraising

Web3 is also transforming how communities come together and raise money for shared goals by using decentralized autonomous organizations (DAOs).

DAOs are blockchain-based governing bodies. To join a DAO, a person needs to become a stakeholder — which requires them to acquire the DAO’s token. These tokens use smart contracts to give stakeholders voting rights, allowing them to influence how the organization will operate. By giving members voting power, communities can feel more engaged.

LinksDAO is a community of golf enthusiasts that are pooling money to purchase and run an exclusive golf course. LinksDAO’s goal is to build a golf experience rich with benefits only exclusive members can access. In the future, DAO members may also be able to receive the profits that come from operating a successful golf course.

While this may sound far fetched, LinksDAO sold over 9,000 memberships and raised over $10M in 24 hours. Other DAOs have even more ambitious goals: Krause House DAO is building a community to purchase an NBA team (full ownership of an NBA team costs well over $1B).

DAOs are also gaining traction within philanthropy. For example, UkraineDAO raised over $6M through NFT sales to aid Ukrainian civilians and military. Supporters claimed the DAO was needed since many crowdfunding platforms do not support military fundraising, and relevant charities weren’t moving fast enough. Many of the largest crowdfunding platforms also stake small fees to pay for site operations (GoFundMe charges 2.9%) while DAOs ensure almost all money goes directly to the intended beneficiaries.

But DAOs are not perfect. ConstitutionDAO raised around $40M to win a bid on the US Constitution. When it lost its bid, the money was seemingly locked in the DAO. Finding and returning money to relevant parties turned into an arduous, manual process. While most of the money has been refunded at this point, millions of dollars have been lost in gas fees, the price associated with transferring crypto.

Video streaming services

Web3 video streaming services aim to empower creators by giving them ownership of content and profits while protecting users’ privacy and data. They are also exploring the use of blockchain protocols to reduce friction in the video streaming service.

For example, Livepeer uses the Ethereum blockchain to cut the costs associated with hosting and transcoding live video by sharing processing power across a blockchain-based network of computers. Anyone can join the network by contributing computer resources (CPU, GPU, and bandwidth). In return, the contributors are rewarded with cryptocurrency.

In January 2022, Livepeer raised a $20M Series B round from investors like Digital Currency Group and Tiger Global Management. More recently, the startup released a toolkit to help Web3 developers incorporate live streaming and video NFT minting to projects.

Music

Web3 aims to give creators a better way to monetize their music and engage with audiences without tech middlemen and labels or distributors.

Music streaming service Spotify takes about a 30% cut of streaming revenue. Further, music can only be published to platforms like Spotify or Apple Music through a label or with an independent distributor. Some may only charge a flat fee, but some distributors and labels also take a percentage from streaming revenue.

Web3 music streaming company Audius looks to solve this dilemma for artists. The platform allows creators to upload without distributors or labels and receive 90% of streaming revenue.

In September 2021, Audius raised $5M from a group of music celebrities, including Katy Perry, Disclosure, Steve Aoki, and The Chainsmokers. Audius is also backed by investors like General Catalyst, Lightspeed Venture Partners, and Kleiner Perkins Caulfied & Byers.

Web3 music platforms are also changing the way artists and fans interact.

Andreessen Horowitz-backed Royal allows fans to invest in an artist by buying tokens that automatically earn back streaming profits. Royal was founded by the artist 3lau, who used the platform to release 333 free NFTs that represented 50% of his streaming revenue on one of his new singles. The tokens have since generated over $6M.

Content & publishing

As personal blogs and newsletters have taken off, Web3 companies are looking to help creators better monetize and own their content.

Web3 startup Mirror publishes content on the blockchain. While the content is free, creators can monetize their work by minting writings as NFTs, allowing them to generate revenue from readers and fans. In June 2021, Mirror raised a $10M seed round from Andreessen Horowitz and Union Square Ventures at a $100M valuation.

Play-to-earn

In play-to-earn (P2E) communities, gamers are rewarded for playing games with tokens.

The most popular play-to-earn game to date is Axie Infinity. Players can battle, breed, and eventually sell “Axies,” collectible monsters in the forms of NFTs. Axie marketed itself as a game that empowered players — instead of a game studio collecting all profits, the profits could be shared among players.

However, the crypto and NFT crash has put many play-to-earn games in a precarious position as users dwindle and company revenue falls short of expectations. Critics point out that most members of P2E games were only interested in speculative purposes — players were really just investors, and there was no real demand for game-issued NFTs.

While the future of P2E is not entirely clear, VCs are not shying away. Axie raised a $150M round in April 2022 after it lost $600M in a hack. Meanwhile, blockchain game studio Mythical Games raised $150M at a $1.3B valuation in November 2021 to build Web3 games like Blankos Block Party.

In a Web3 internet, players will not only experience games, but also be rewarded for the time they spend in-game.

If you aren’t already a client, sign up for a free trial to learn more about our platform.