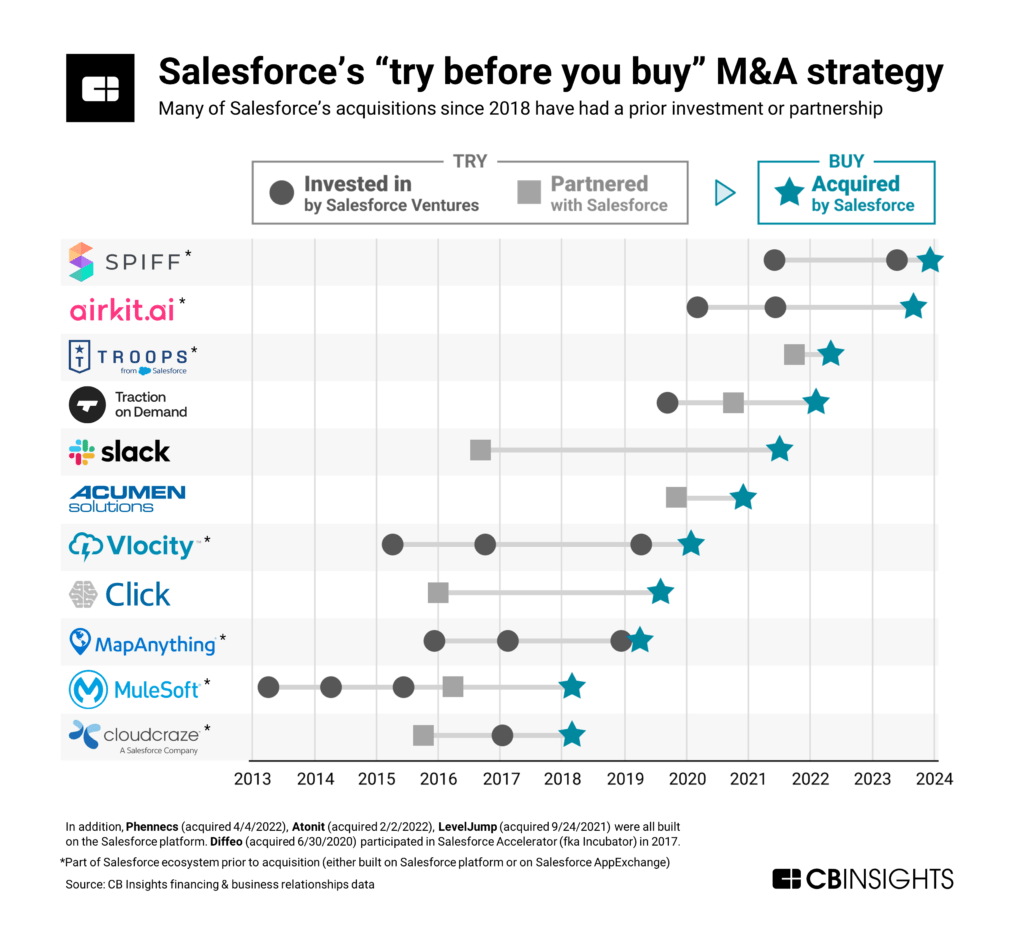

We mined Salesforce’s commercial transaction, investment, and M&A data from CB Insights to uncover a clear pattern in its M&A strategy. Prior investment by Salesforce Ventures and participation in its platform ecosystem are where Salesforce’s future M&A targets are found.

Salesforce is a key player in both enterprise tech M&A and investing.

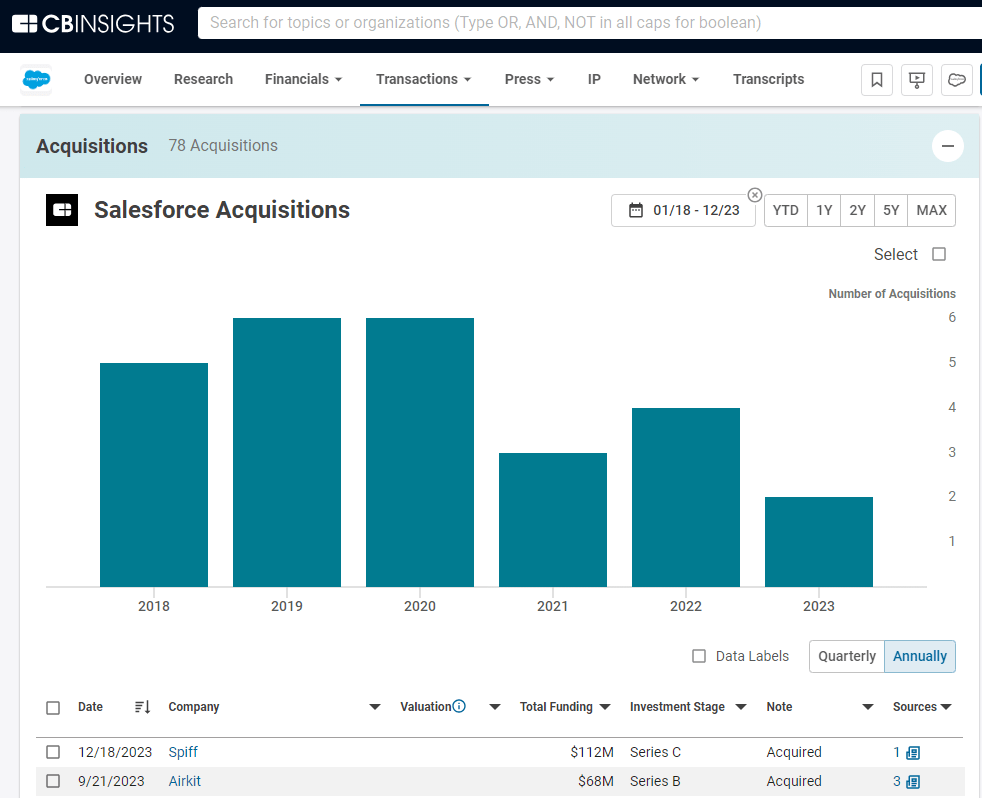

Since 2018, the CRM giant has backed over 300 companies and acquired 25 companies. This includes big-ticket purchases like MuleSoft ($6.9B in 2018), Tableau ($15.7B in 2019), and Slack ($27.7B in 2021).

Under pressure to improve profitability, Salesforce disbanded its M&A committee in March 2023, tapping the brakes on large deals.

Since then, the company has scooped up mid-stage startups Airkit and Spiff. In both cases, the acquisitions were preceded by investment from Salesforce’s venture arm, Salesforce Ventures.

Mining CB Insights data reveals that nearly half of Salesforce’s 25 acquisitions since 2018 had partnered with or received an investment from Salesforce — and many more were in its platform ecosystem.

We dive into its “try before you buy” strategy below.

We then share 3 companies that appear to be aligned with Salesforce’s strategy and could be on its corporate development radar in the near future.

We also discussed partnerships as a predictor of M&A for Visa here.

Analyzing Salesforce’s M&A and partnership history

Salesforce Ventures’ portfolio is a key part of Salesforce’s M&A pipeline.

In aggregate, 7 out of 25 (28%) of Salesforce’s M&A targets since 2018 had a prior disclosed investment from Salesforce Ventures. This includes MuleSoft, which Salesforce Ventures backed in its Series E, F, and G rounds before acquiring the company a year after it went public.

On average, the time from first investment to M&A is a bit over 3 years. This timeline shortens when looking at last investment to acquisition — which averages 1 year and 5 months for the 5 M&A targets that raised successive rounds from Salesforce’s venture arm.

This suggests that follow-on rounds from Salesforce Ventures confirm a high degree of conviction in the company (the “try” period) before Salesforce moves to buy.

Salesforce has also concentrated its M&A activity on startups in its ecosystem — 9 out of 25 (36%) were either built natively on Salesforce or were available on Salesforce’s AppExchange.

Notable partnerships that resulted in M&A deals took the form of business development, joint product release, or product co-creation relationships. For example, Salesforce and Slack announced in 2016 a “deep product partnership” to enable more seamless data sharing between the two platforms.

In summary, backing from Salesforce Ventures — combined with the company already being in the Salesforce ecosystem — is a clear indicator of M&A potential.

3 M&A predictions for Salesforce

Each of our predictions below are a) in Salesforce Ventures’ portfolio, b) integrated with Salesforce in some capacity, and c) AI-enabled.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.