We break down how headcount, valuation, and revenue metrics are trending for business communications platforms like Twilio, MessageBird, and Sendbird.

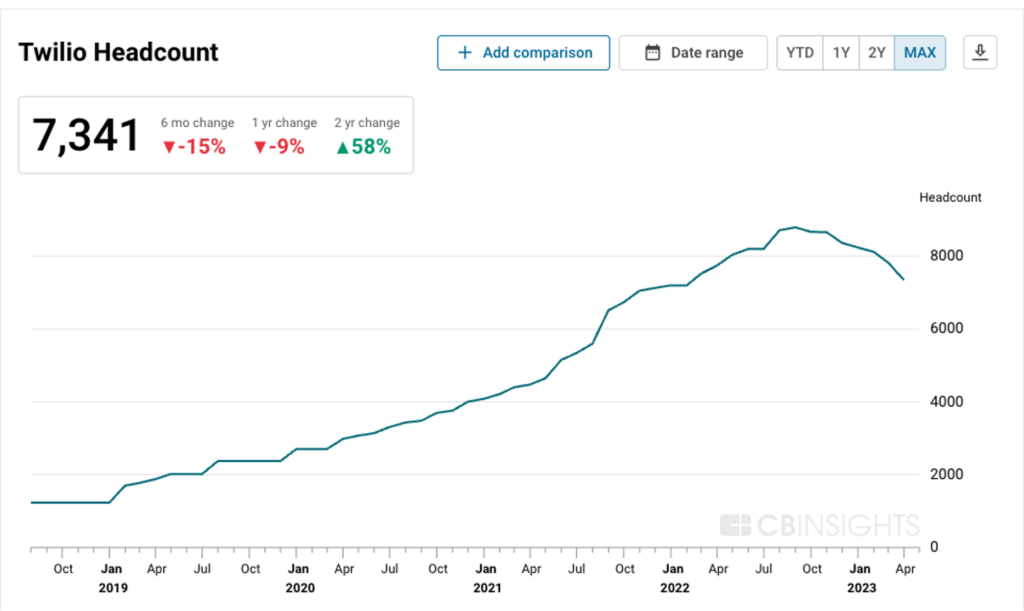

Twilio, a leading player in the communications platform-as-a-service (CPaaS) space, recently underwent 2 rounds of layoffs.

The company has been downsizing to reduce costs after multiple acquisitions and a hiring spree drove Twilio’s headcount up to nearly 9,000 employees in summer 2022. That figure has since dropped 15% over the past 6 months.

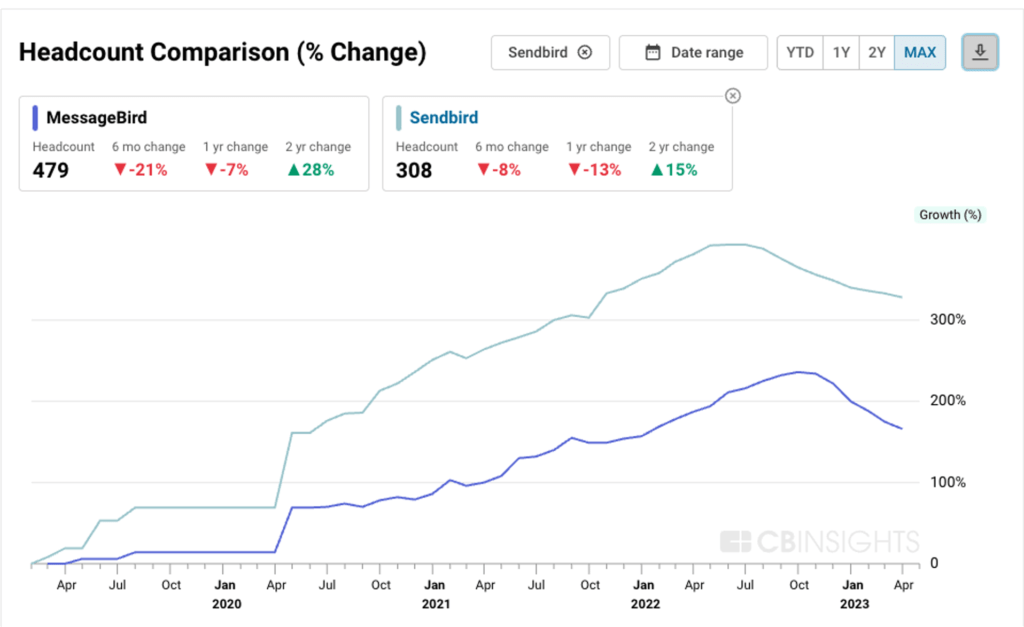

Other CPaaS players such as MessageBird and Sendbird — both unicorns with $1B+ valuations — have also been reducing their headcount recently. This raises questions about whether or not they can maintain their current valuations.

In this brief, we’ll take a look at headcount trends in the CPaaS space — including breakdowns of valuation and revenue per employee — to assess whether these players deserve their current valuations.

Headcount trends

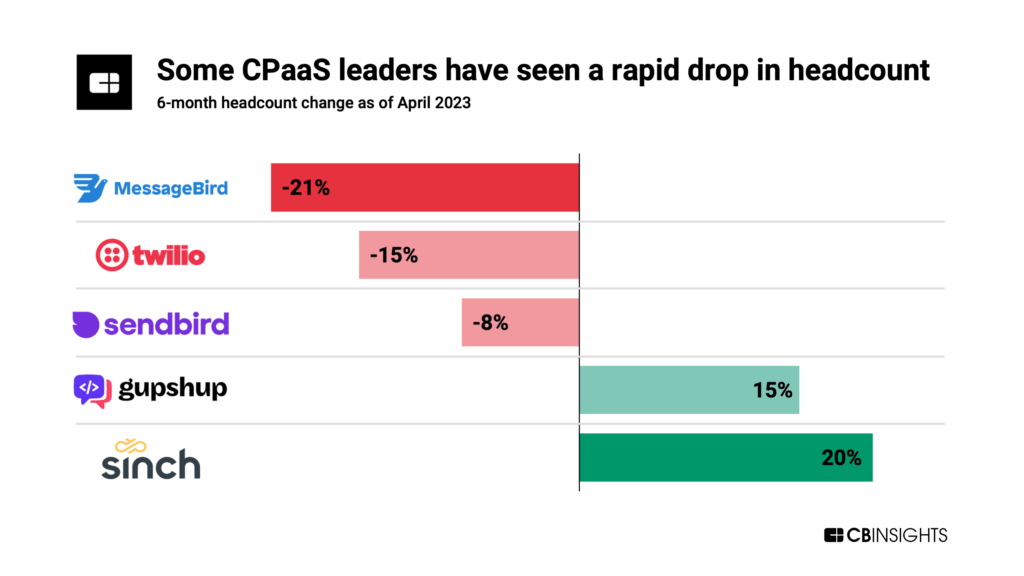

Twilio, MessageBird, and Sendbird — along with many other tech companies — have recently seen dramatic headcount reductions.

But other CPaaS players have kept hiring.

Both GupShup and Sinch, for instance, have seen strong headcount growth in the past 6 months.

In fact, from April 2021 to April 2023, GupShup quadrupled its number of employees to nearly 900. Sinch doubled its workforce to over 2,900 during the same time frame.

Valuation per employee

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.