Customer feedback management solutions have seen strong market momentum and substantial industry leader activity in the customer service space — making them a technology worth prioritizing.

Clients can download the full Customer Service for Consumer & Retail Leaders report at the top left sidebar.

Brands and retailers are increasingly investing in tech-enabled customer service solutions that can help support and convert customers — either online or in stores — in a timely and cost-efficient manner.

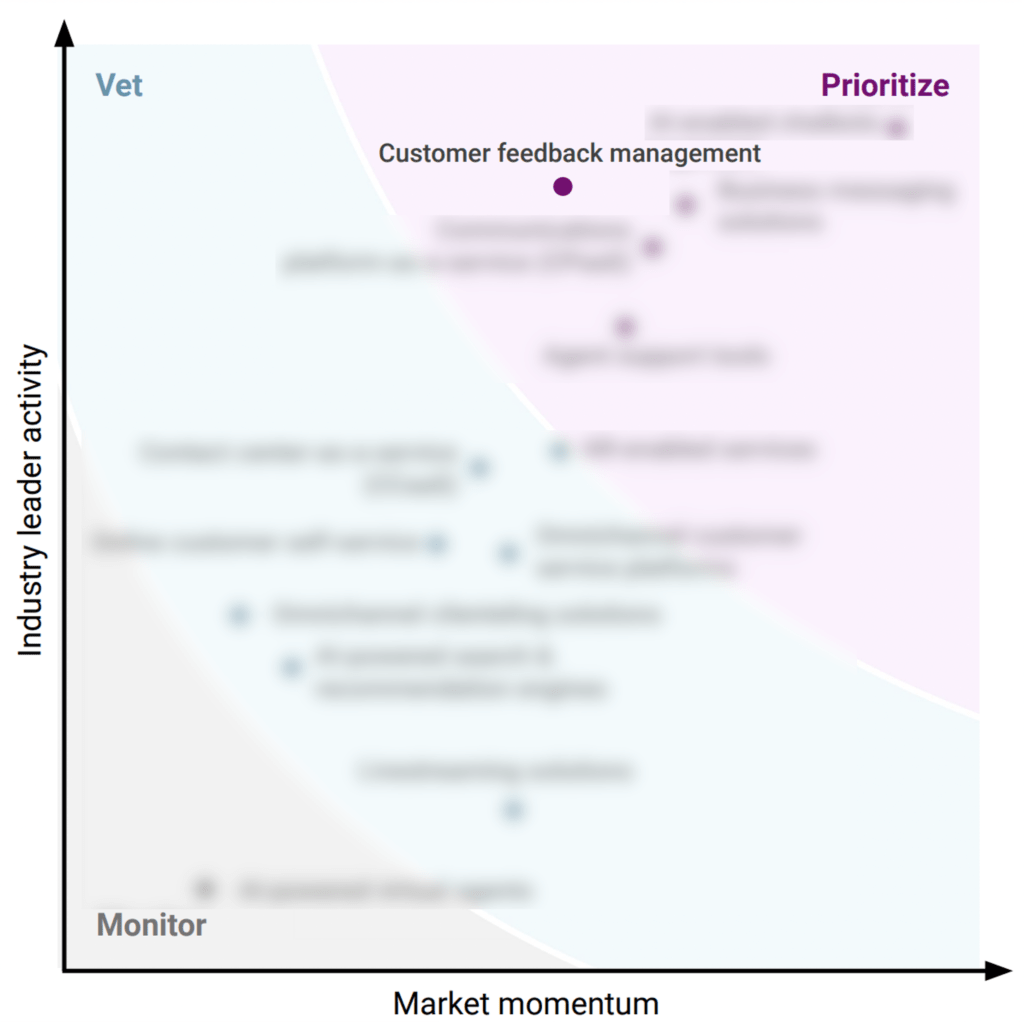

Using CB Insights data, we examined tech markets across customer service for consumer & retail leaders and ranked them across two metrics — market momentum and industry leader activity — to help companies decide whether to monitor, vet, or prioritize these technologies.

Customer feedback management earned a recommendation to prioritize based on the market’s strong market momentum and industry leader activity.

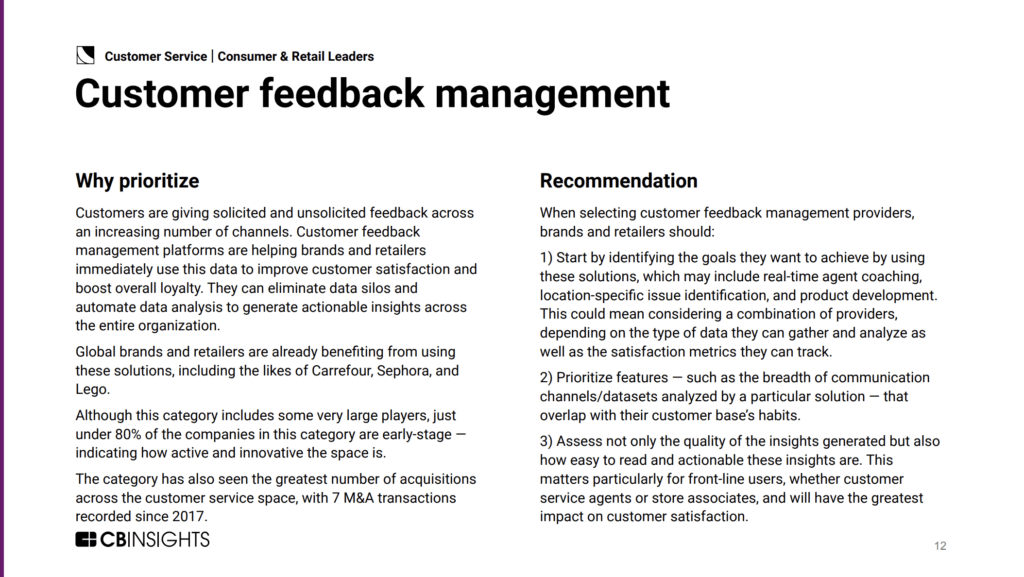

Customer feedback management platforms gather and analyze direct and indirect customer feedback across channels.

These platforms facilitate and accelerate collection of both structured and unstructured, solicited and unsolicited customer feedback across channels. They also contribute to unifying and automatically analyzing this data to help brands and retailers prioritize insights, develop new products, and identify potential issues faster to improve customer satisfaction and boost overall loyalty.

When selecting customer feedback management providers, brands and retailers should start by identifying the goals they want to achieve by using these solutions, which may include real-time agent coaching, location-specific issue identification, and product development.

This could mean considering a combination of providers, depending on the type of data they can gather and analyze as well as the satisfaction metrics they can track.

FACTS & FIGURES: Customer feedback management

- Exits: The category has seen a number of acquisitions, with 7 M&A transactions recorded since 2017. For instance, Medallia was acquired by private equity firm Thoma Bravo in October 2021 for $6.4B, while Clarabridge was acquired by fellow customer feedback management platform Qualtrics in July 2021 for $1.1B.

- Stage: Although this category includes some very large players, just under 80% of the companies in this category are early-stage — indicating how active and innovative the space is.

- Top-funded companies: Top-funded companies in the space include Qualtrics ($400M in disclosed equity funding), Medallia ($325M), and Reputation ($267M).

- Geography: While the majority of deals in this space go to companies based in the US (55%), Finland (16%) and Canada (13%) also attract a number of deals.

Clients can dive into customer feedback management and more in our complete MVP Technology Framework: Customer Service for Consumer & Retail Leaders report.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.