Valuations, funding, and headcount are climbing for a number of industrial drone developers. We break down the competitive landscape.

The industrial drone market is taking off.

In 2023, global drone shipments are expected to reach 2.4M. Insider Intelligence estimates this total is increasing at a 67% compound annual growth rate (CAGR).

Already this year, funding to the inspection & job site mapping drone market has reached a 5-year high. Percepto, a startup in this space, recently raised a $67M Series C (in equity and debt), following 4 other equity funding rounds from its peers this year.

Below, we dive into the competitive landscape and current state of the industrial drone inspection market, focusing on:

- Total funding & top-funded companies

- Valuations

- Headcount

- How players rank against each other

- Looking ahead

Total funding & top-funded companies

Funding for inspection & job site mapping drones in 2023 year-to-date has reached $349M. Funding has risen steadily since 2019, excluding a dip in 2022, which was the lowest funding total during this period.

Multiple factors are driving demand.

For one, the Federal Aviation Administration (FAA) gave the green light to new industrial drone use cases in 2016, which has allowed drone developers to expand into new areas. Drones have also demonstrated an up to 85% improvement in inspection efficiency, and they are becoming more capable with additional features like spectral analysis and thermal imaging.

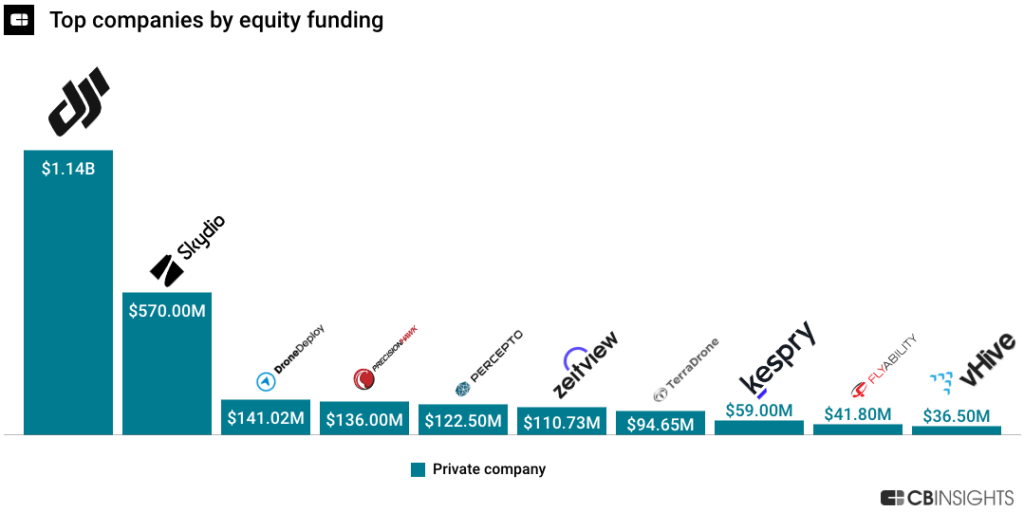

For example, DJI — the top-funded company in this market with over $1B in equity funding — offers drones with sensors for monitoring crop yields, as well as surveying drones for industries such as construction, insurance, and oil & gas.

Another leading startup, Skydio, offers drones for many use cases, including military applications. Percepto serves many of these same areas.

Valuations

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.