After decades of development, 3D printing tech still faces remarkably low adoption among manufacturers. For some firms, consolidation may be the key to achieving scale.

3D printing (also known as additive manufacturing) allows manufacturers to print components with a variety of materials, such as metals, polymers, composites, ceramics, and even electronics.

However, 3D printing adoption has been slower than anticipated, accounting for just 0.1% of the total value of manufacturing output today.

Instead of mass production, manufacturers have been using it for applications like rapid prototyping or the production of components with unique geometries that are otherwise impossible to create with more traditional methods.

One significant challenge, however, is scale. 3D printing developers may specialize in certain materials or sizes, but each use case requires different systems and software platforms, thus adding complexity.

As a result, the space has seen significant M&A activity among industry leaders as they try to broaden their product offerings. For instance:

- In 2022, Markforged acquired Teton Simulation, a provider of part performance validation and optimization software, and Digital Metal, the creator of a binder jetting solution to increase the throughput of metal parts.

- Stratasys has acquired 5 companies since 2020, including manufacturers of 3D printers, printer components, and digital scanning systems.

The M&A activity hasn’t been limited to public players, either. Private companies like Carbon and Nexa3D — both leaders in our polymer-based 3D printing ESP — have made recent moves:

- Carbon, a polymer 3D printer developer, acquired ParaMatters in 2022 to expand its additive manufacturing design software.

- Nexa3D acquired Addifab and the laser sintering business of XYZprinting, both in 2023.

Private players are also fundraising substantially, in part to fuel additional acquisitions.

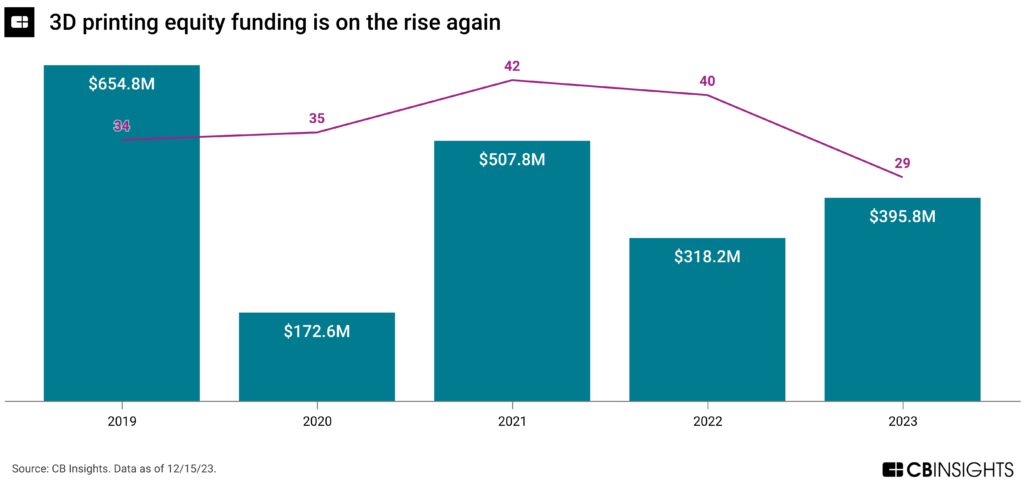

While levels are down from their peak of $655M in 2019, equity investment has exceeded $170M each year since, including rebounding to reach nearly $400M this year.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.