The rise of electric vehicles is driving demand for high-performance semiconductors. We look at the areas within this space gaining the most momentum.

The semiconductor industry is currently grappling with oversupply challenges — and declining venture funding — after widespread shortages during the pandemic led to a production boom, but the adoption of electric vehicles (EVs) is providing new opportunities.

For example, the growing popularity of EVs has also increased demand for high-performing semiconductors like silicon carbide (SiC) and gallium nitride (GaN), which can handle high-power applications more efficiently than traditional silicon chips — useful for increasing the driving range of EVs. Bosch, one of the leading automotive parts suppliers globally, recently doubled down on the silicon carbide space by acquiring TSI Semiconductors and announcing plans to invest $1.5B in upgrading one of its facilities to produce SiC semiconductors.

This trend towards efficient and high-performing semiconductors in the EV industry is likely to continue as automakers seek ways to improve vehicle performance and range.

Using CB Insights data, we analyzed the EV semiconductor market across:

- Total funding

- Top-funded companies

- Acquisitions

- Next-gen semiconductor startups

Total funding

The semiconductor industry is vast, with thousands of companies worldwide producing everything from design software to production fabs to AI chips.

Collectively, companies in the space have raised over $16.3B in 2022, an 18% decline from 2021. But SiC and GaN semiconductor companies are still gaining momentum and are raising significant amounts of funding.

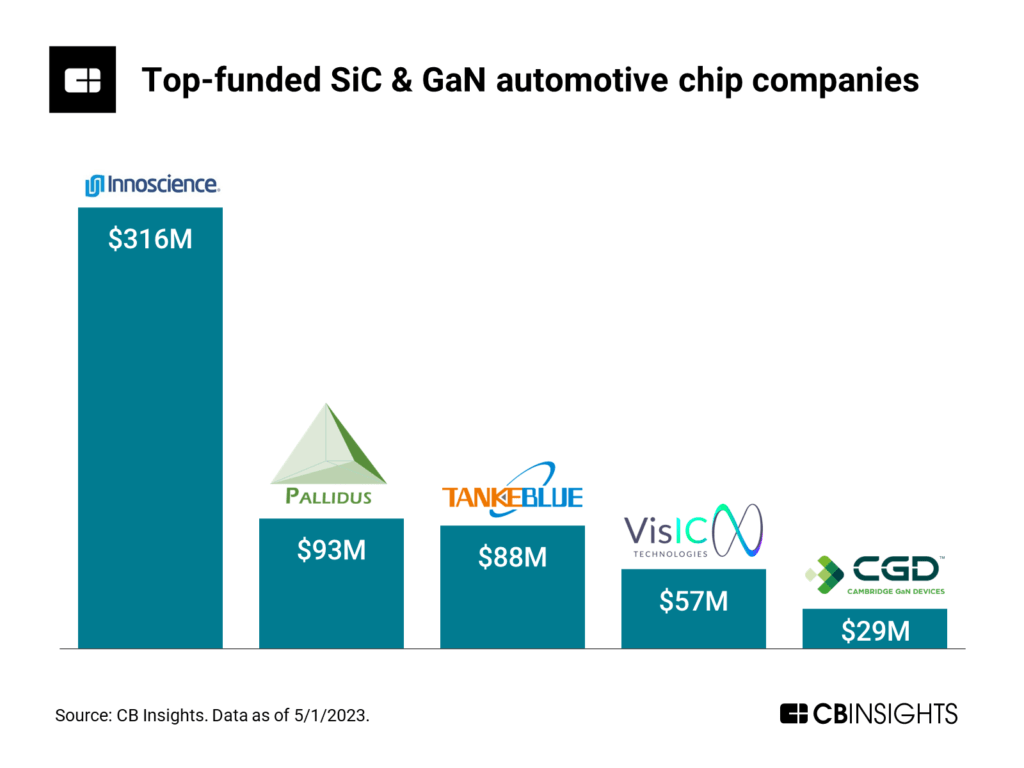

Innoscience is the most well-funded private GaN semiconductor company. Other top-funded GaN producers include VisIC Technologies and Cambridge GaN Devices. The most well-funded SiC producer is Pallidus, followed by TankeBlue.

M&A

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.