We break down the retail tech landscape across funding trends, M&A, key sectors, and more.

Retail tech investment is showing some signs of life.

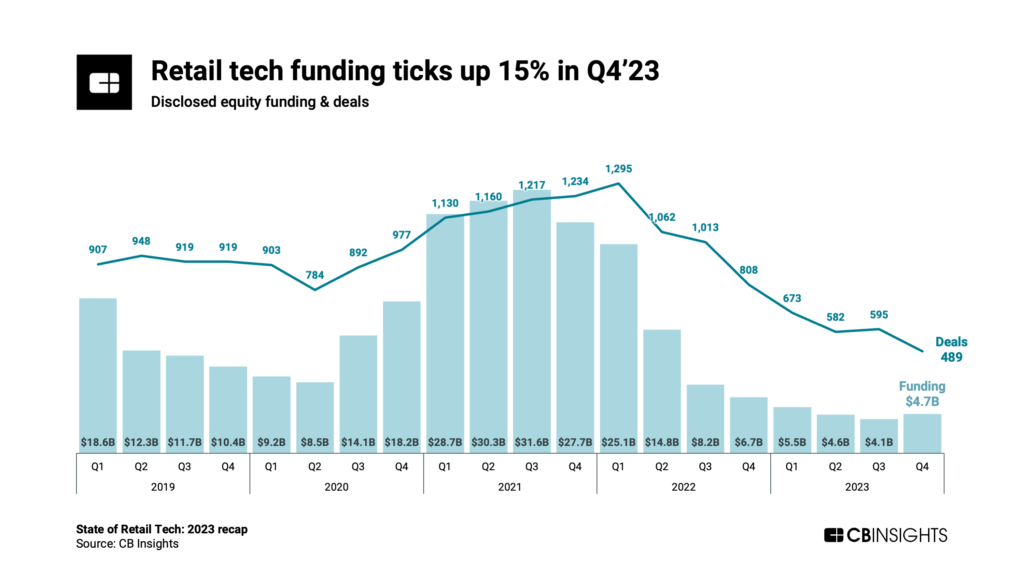

Across 2023, retail tech fundraising followed the overall venture slowdown: retail tech startups grabbed $19B in equity funding — just a third of the 2022 total ($55B) and 84% lower than the peak in 2021 ($118B). Deals also declined in 2023, down 44% YoY to 2,339.

But as the year closed out, some quarterly indicators turned positive. For instance, retail tech saw 10 mega-rounds (deals worth $100M or more) in Q4’23 — up from 6 the prior quarter. M&A activity continued its upswing after hitting a recent low in Q2’23. And funding to store tech companies more than doubled quarter-over-quarter (QoQ) in Q4’23.

Using CB Insights data, we dug into these and other key data points across the retail tech landscape. Below, we cover:

- Quarterly equity funding picks up

- More $100M+ mega-rounds and the top deals of the quarter

- A mixed bag for dealmaking in Asia

- Momentum for M&A and IPOs

- Key retail tech sectors mature

- Looking ahead

Quarterly equity funding picks up

Retail tech funding rose 15% in Q4’23 to $4.7B. The rebound put a stop to 8 straight quarters of decline.

On a quarterly basis, the funding rebound set retail tech apart from the broader venture market, which saw funding decline 24% QoQ.

However, retail tech deals declined by 18% QoQ in Q4’23, bringing the count to 489 — the lowest quarterly level since 2014.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.