One of the largest grocery fulfillment players could be seeking an exit. We look at how its valuation, revenue, and IP stack up against competitors.

Rumors that Amazon could be looking to acquire UK-based online grocery platform Ocado sent the company’s stock price up 30% last week.

In his most recent letter to shareholders, CEO Andy Jassy announced that the e-commerce behemoth has shifted from national to regional fulfillment networks to reduce costs and speed up deliveries. This new strategy could make an acquisition of Ocado more compelling to the tech giant, given Ocado’s position as a leader in localized grocery microfulfillment centers (MFCs) and robotics.

But would Amazon be getting value for money were it to buy the company?

Using CB Insights data, we assess the potential acquisition by comparing Ocado’s valuation, revenue, and IP against its rivals and looking at Amazon’s M&A history.

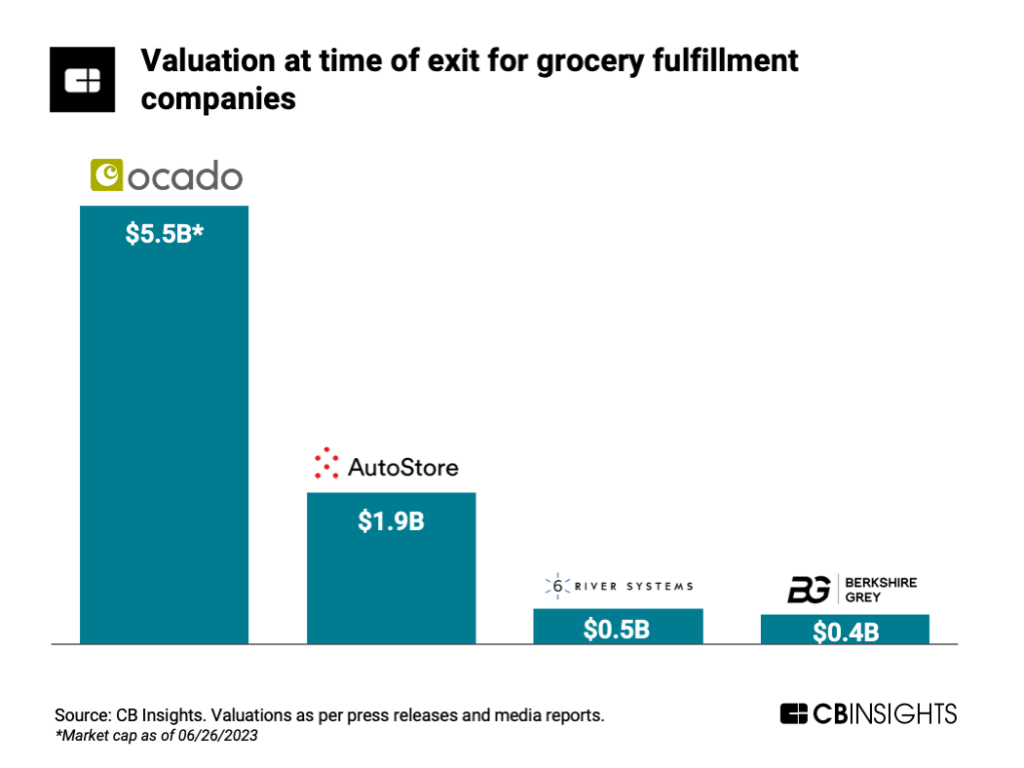

How much is Ocado worth compared to its peers?

We identified 3 comparable exits to Ocado:

- AutoStore was acquired by Thomas H. Lee Partners at a $1.9B valuation in 2019. (The company went public in 2021 at a $12.4B valuation.)

- 6 River Systems was acquired by Shopify at a $450M valuation in 2019. (The company was then acquired by Ocado in 2023 but the terms of the transaction were not disclosed.)

- SoftBank announced it was acquiring Berkshire Grey for $375M (at a 24% premium to its stock price) in 2023.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.