The grocery leader has been an early adopter of omnichannel fulfillment tech, which helps it prepare and deliver online orders more efficiently and to more customers. We break down its moves in key areas like microfulfillment and on-demand delivery.

Kroger, the largest supermarket chain in the US, has been looking to expand into new markets.

In 2021, Kroger launched its first Customer Fulfillment Center to serve e-commerce shoppers outside its geographical footprint. Then, in late 2022, the grocer made moves to acquire Albertsons — which is one of its largest competitors and has a stronger presence in the West and Northeast — for $24.6B.

Kroger’s ambitions to grow its supermarket empire don’t stop there.

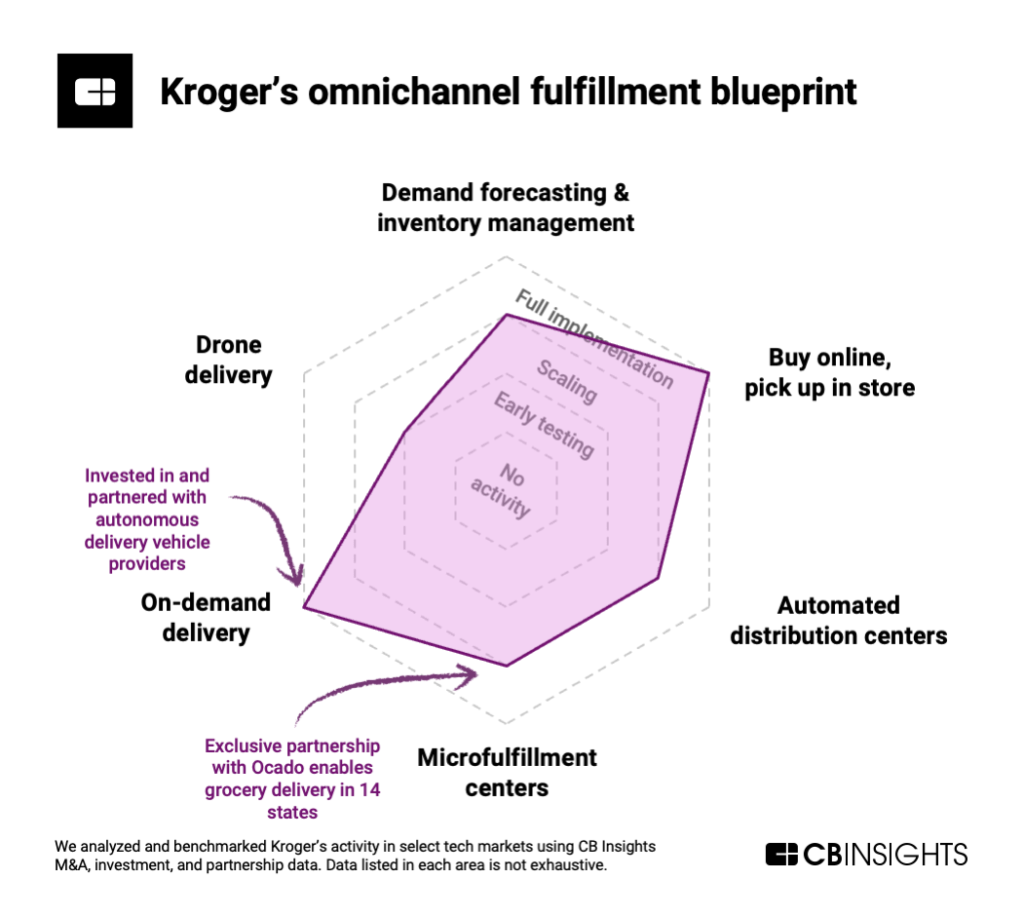

With a focus on grocery e-commerce, Kroger has entered into strategic partnerships to up its omnichannel capabilities in demand forecasting & inventory management, microfulfillment, and on-demand delivery.

Below, we use the CB Insights platform to benchmark Kroger’s activity across key areas of omnichannel fulfillment.

Key takeaways

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.