Investors poured over $12B into companies that promised to deliver groceries in under 30 minutes. Now consolidation is slashing their returns.

The ultrafast (less than 30 minutes) grocery delivery space might be in trouble.

After raising billions of dollars in funding in 2021 and seeing sky-high valuations, stalling growth and widening losses have led to several companies shutting down or being acquired.

For example, ultrafast delivery leader Getir is reportedly in talks to acquire rival Flink. This comes just 6 months after it purchased Gorillas, another big player in the space, at a significant discount to the company’s last valuation.

Will consolidation bring more reasonable valuations to the ultrafast delivery space? And who will the survivors be?

In this brief, we use CB Insights data to assess the current state of the ultrafast delivery space.

Ultrafast delivery funding plummets as quickly as it peaked

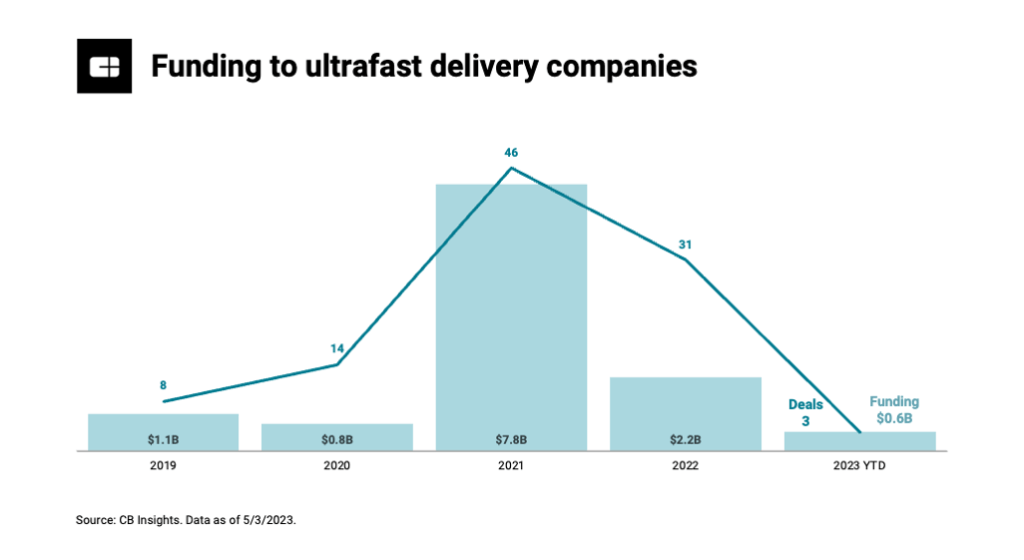

In the wake of the Covid-19 pandemic, funding to the ultrafast delivery space peaked in 2021 with $7.8B raised — almost one third of all food & meal delivery funding that year — across 46 deals.

But investors’ sudden appetite for the business model was short-lived, with funding dropping by 72% in 2022.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.