Retail banking leaders are looking for ways to respond to heightened threats. From threat intelligence to identity verification, we take a look at the technologies leaders should focus on to protect their customers and reduce costs.

Retail banks are tasked with protecting their customers and businesses from fraud, financial crime, cyber threats and other risks in order to preserve the well-being of their organizations and the global financial system.

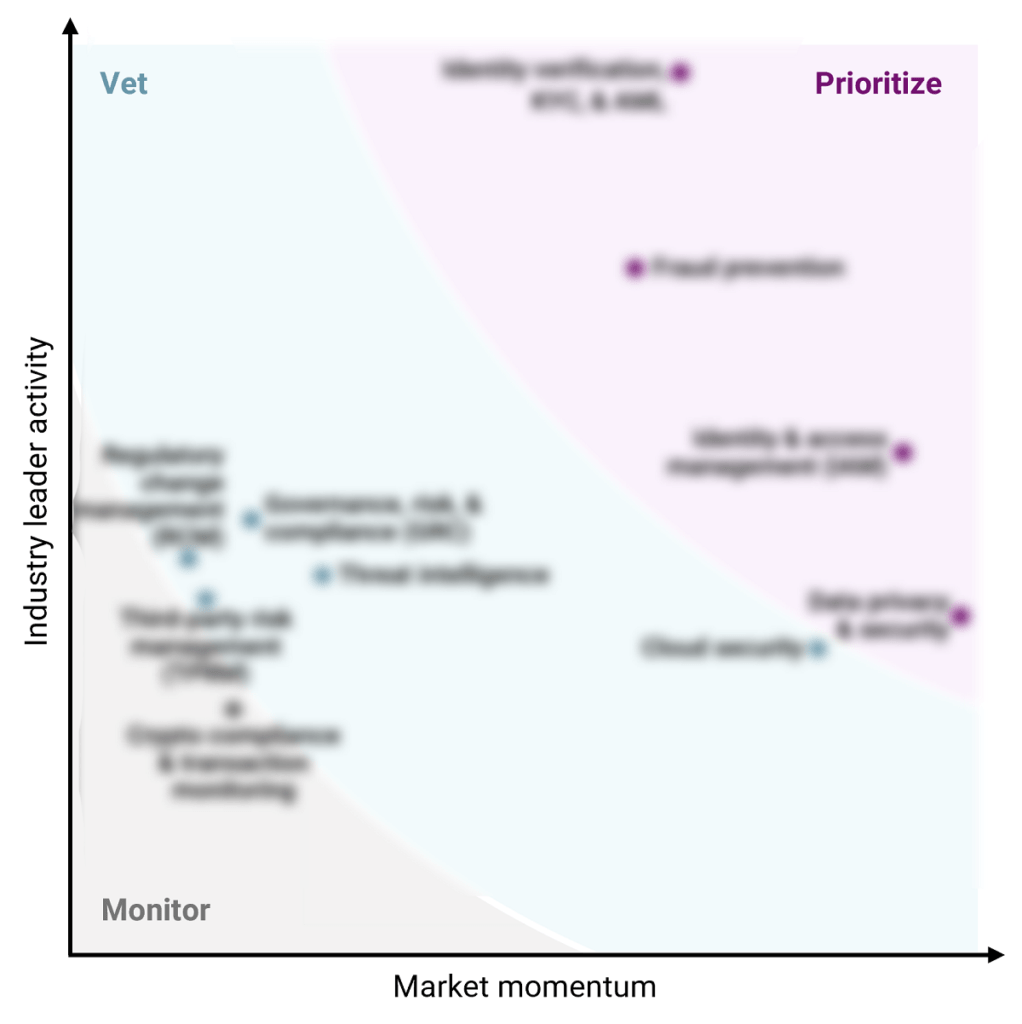

In this report, we evaluate 10 tech markets that retail banking leaders should monitor, vet, and prioritize toward this effort, including:

- Cloud security

- Crypto compliance & transaction monitoring

- Data privacy & security

- Fraud prevention

- Governance, risk, & compliance (GRC)

- Identity & access management (IAM)

- Identity verification, KYC, & AML

- Regulatory change management (RCM)

- Third-party risk management (TPRM)

- Threat intelligence

This report examines tech markets across retail banking using the MVP framework. This methodology scores top tech markets across two metrics:

Market momentum — Measures private market activity as a signal of the degree of overall market potential. Signals include the number of startups, the amount of capital invested, and the relative maturity of startups in the space, among others.

Industry leader activity — Assesses the degree of tech market involvement among established industry players. Signals include CVC activity, industry and executive chatter, and patent filings, among others.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.