Identity verification, KYC, & AML solutions have garnered strong market momentum and notable industry leader activity in the fraud prevention & compliance space — making them a technology worth prioritizing.

Clients can download the full Fraud Prevention & Compliance for Payments Leaders report at the top left sidebar.

Payments leaders face compounding challenges of combating fraud and financial crime, securing consumer and payment card data, and complying with regulatory mandates to protect their businesses and customers — all while ensuring a frictionless user experience.

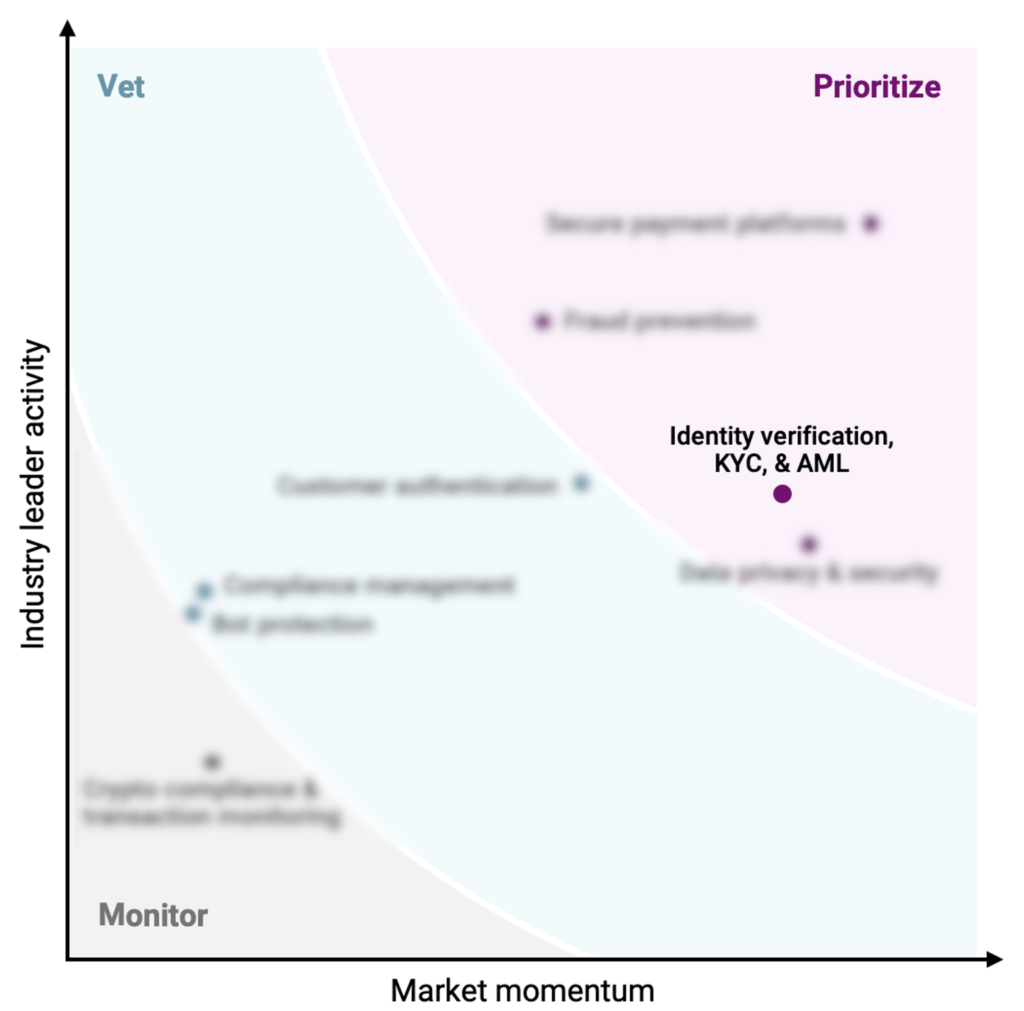

Using CB Insights data, we examined tech markets across fraud prevention & compliance for payments leaders and ranked them across two metrics — market momentum and industry leader activity — to help companies decide whether to monitor, vet, or prioritize these technologies.

Identity verification, KYC, & AML earned a recommendation to prioritize based on the market’s high market momentum and industry leader activity.

Identity verification, KYC, & AML solutions verify customers’ identities to protect organizations from malicious actors and help them comply with regulation.

Typical functions offered within identity verification, KYC, & AML solutions include customer onboarding, continuous transaction monitoring, biometric verification, customer authentication, fraud prevention, and APIs connecting to credit bureaus, global watchlists, government agencies, and other identity databases.

Banks, payment providers, and fintechs are required by law to comply with know your customer (KYC), anti-money laundering (AML), and countering the financing of terrorism (CFT) regulations. Failing to comply can result in substantial penalties and fines.

Identity verification is an urgent priority for banks and fintechs because of these regulations. But it’s also a must-have for all other payments organizations. These platforms seek to increase customer approval rates, reduce false positives, and improve fraud detection rates at the same time. When comparing vendors, payments leaders should be aware of how these success metrics differ and the technology used (e.g., AI and machine learning).

FACTS & FIGURES: Identity verification, KYC, & AML

- Funding: Identity verification, KYC, & AML companies evaluated in this report raised a record $2.7B in 2021, up over 300% YoY.

- Deal size: In 2021, these companies’ average deal size jumped to $56M — up 273% YoY — while median deal size doubled to reach $10M.

- Top-funded companies: Top-funded companies in the space include Socure ($647M in disclosed equity funding), Trulioo ($470M), and EBANX ($460M).

- Geography: While companies based in the US attract the most deals in this space (29%), the UK (18%) and China (4%) also draw a number of deals.

Clients can dive into identity verification, KYC, & AML and more in our complete MVP Technology Framework: Fraud Prevention & Compliance for Payments Leaders report.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.