This report looks at the underwriting data companies serving life insurance companies.

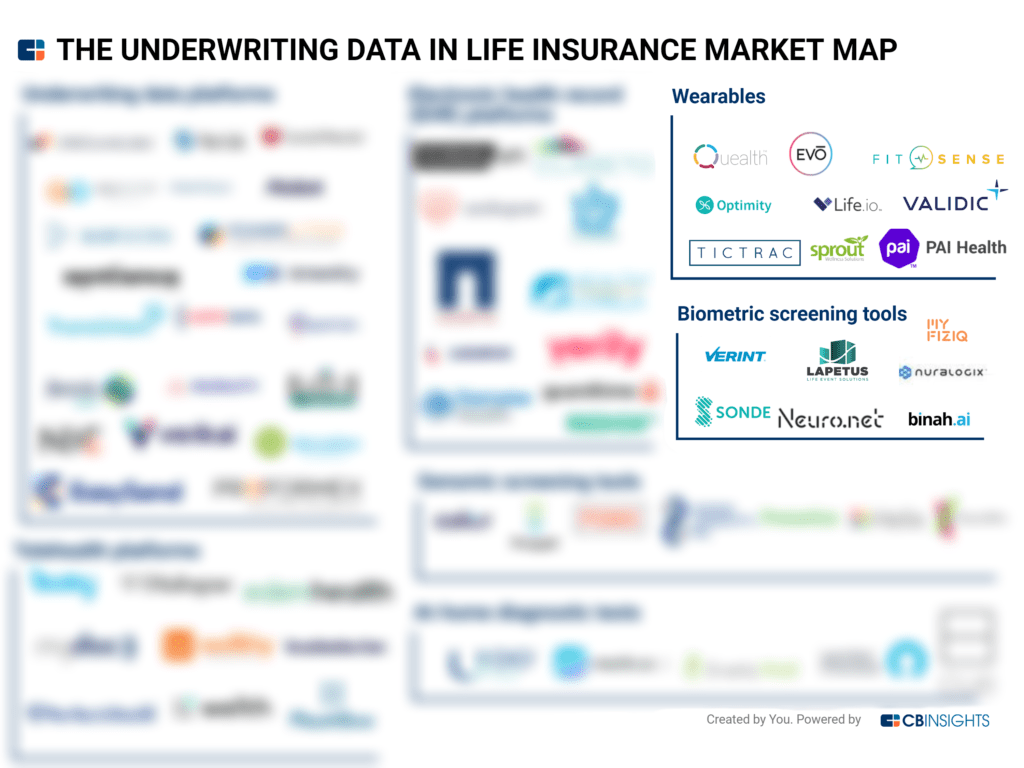

CB Insights identified 60+ underwriting data companies addressing 7 technology priorities, from wearables to genomic screening tools, that life insurance companies face. The purpose of the analysis is to provide technology buyers with an overview of the technology landscape and its market participants.

Key themes explored in this report include:

- Automated underwriting: New digitized data sources and API connectivity are enabling insurers to instantly issue simple products — without the need for review by a human underwriter — at accurate prices.

- Product personalization: Insurers are using new technologies to provide more attractive and personalized products for their customers. For example, wearables can allow insurers to provide rewards for healthy living or even enable continuously underwritten products.

- Artificial intelligence: Artificial intelligence is central to many of these technologies, such as biometric screening tools. As AI matures, expect underwriters to gain even more value from their tech investments.

Download the Tech Market Map report using the sidebar to see our overview of this technology market.

Think that your company should be on this map? Submit an Analyst Briefing to get on our radar.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.