We break down the recent deals and how FIS' recently acquired Bond compares with other top players in the space.

Despite a slowdown in the overall fintech market, VCs, banks, and tech companies are opening their checkbooks to invest in or acquire banking-as-a-service (BaaS) providers.

BaaS providers use application programming interfaces (APIs) to enable banks, fintechs, and companies outside of financial services to offer banking and payment products to end users. BaaS is also referred to as embedded finance or embedded fintech.

The financial technology behemoth FIS — which provides core banking, payments acceptance, and other services to banks and retailers around the world — recently acquired BaaS provider Bond for an undisclosed amount.

Using CB Insights data and our banking-as-a-service market report, we break down the rise in BaaS deals and evaluate the top providers to see how FIS’ Bond stacks up.

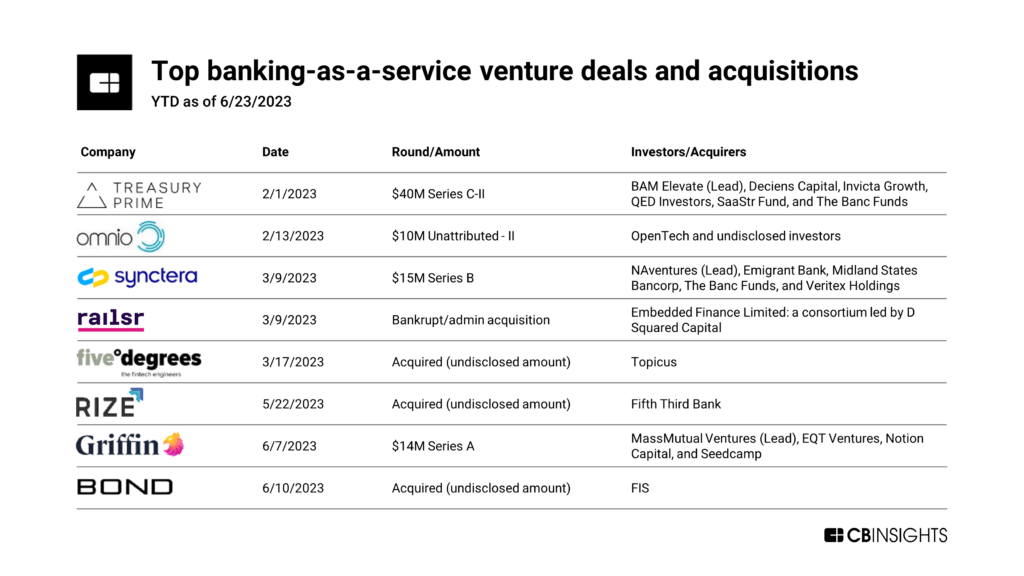

Banking-as-a-service venture deals and acquisitions are hot in 2023 so far

Here’s a timeline of some of the largest venture deals and acquisitions in the BaaS market so far in 2023. Notably, the 8 deals listed below all occurred within a 5-month period.

These recent BaaS deals reflect that there is a wide variety of investors and acquirers interested in a stake in the BaaS market: VCs, CVCs, private equity firms, banks, and financial technology providers.

But it hasn’t been entirely smooth sailing for BaaS in 2023. UK-based Railsr was acquired in March as part of a prepackaged bankruptcy, and its subsidiary is now losing its e-money license in Europe.

However, a common theme runs through the 3 other highlighted acquisitions — they were all made by large corporations operating in banking and technology: Topicus, Fifth Third Bank, and FIS. The size and pedigree of the buyers signal a shared belief by legacy players in BaaS’ potential for future revenue.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.