We break down India-based fintech valuations and revenue multiples with a focus on payments companies like PhonePe, Paytm, and CRED.

With a population of over 1.4B people and strong economic tailwinds despite the global slowdown, India’s fintech ecosystem could be poised for growth.

That’s at least the thinking of General Atlantic and the other investors who’ve pumped $850M in funding into PhonePe, one of India’s leading fintechs, since the start of this year. The company’s mobile payments super app enables its 460M registered users to send money, pay bills, and shop online.

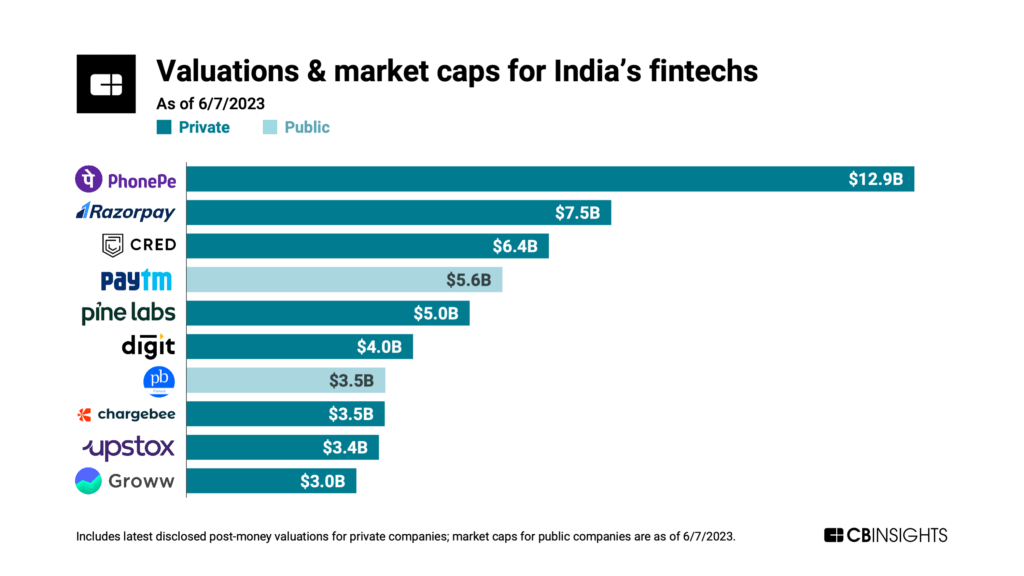

PhonePe is majority-owned by Walmart and now has a post-money valuation of $12.9B. But is that price justified? That’s the highest valuation of any fintech in the country and more than double the market capitalization of its public competitor Paytm.

Using CB Insights data, we break down India’s 10 most valuable fintech companies to better understand the market. We look at valuations, revenues, revenue multiples, and growth to see who might be over- or undervalued compared to their peers.

Valuations: The 5 most valuable India-based fintechs are in payments

After PhonePe, the next 4 most valuable fintechs in India are all payments companies, with valuations ranging from $5B to $7.5B: Razorpay, CRED, Paytm, and Pine Labs.

Razorpay and Pine Labs develop payment acceptance platforms for businesses, CRED offers rewards for credit card bill payments, and Paytm is a mobile payment super app competing directly with PhonePe.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.