We analyze investments, partnerships, and exits in the biometric payments space to understand how the market is evolving.

Biometric technology is revolutionizing the financial and retail sectors. Established players and innovative disruptors are embracing biometric payments — which verify and process payments using a customer’s physical features (e.g., face or palm) — to provide transactions that are more secure, efficient, and personalized.

Tech giants like Apple and Google have already introduced facial recognition for payments. The space has also seen major investments from Mastercard and Alipay.

Now, Starbucks is piloting Amazon One’s palm payment system to enhance speed and convenience at the point of sale. Convenience stores like Energy Mart and Yahoo Japan are also exploring the potential of biometric payments through Amazon One and facial recognition technologies. Meanwhile, JP Morgan is experimenting with biometric payments in collaboration with select retailers.

In this brief, we use CB Insights data to assess the biometric payments market‘s maturity, key players, valuations, and more. We look at the following data points in the space:

- Total funding

- Top-funded companies & exits

- Valuations

- Business relationships

Total funding

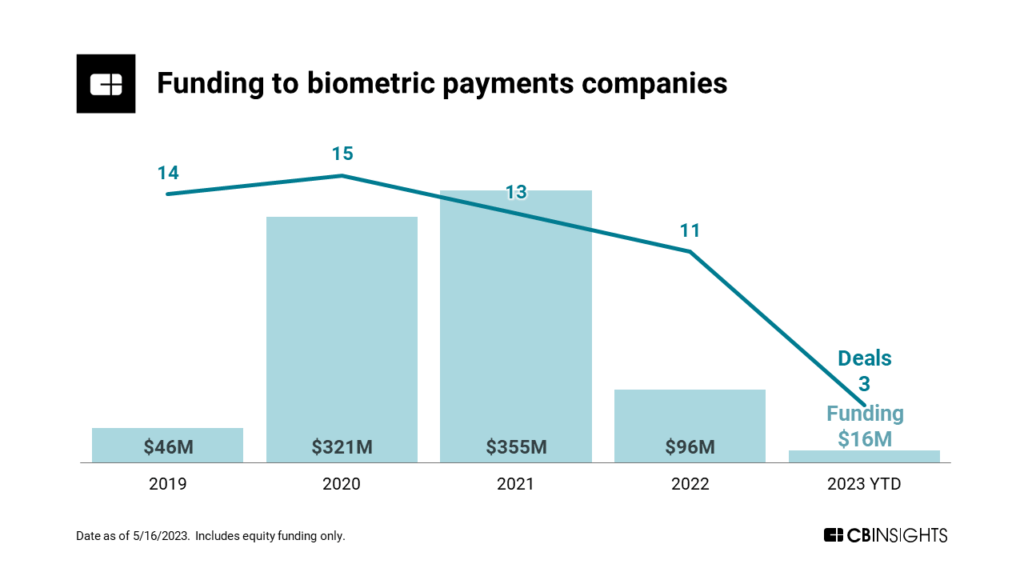

Funding for the sector has been somewhat subdued recently, with a total investment of less than $1B since 2019. After reaching a high of $355M in 2021, annual funding has seen a decline, mirroring a broader trend of venture capital and fintech retrenchment.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.