There's a disconnect between Robinhood’s challenges and the lofty valuations of private retail investing apps. We take a look at why Trade Republic, Acorns, and other unicorns are at risk of valuation resets.

Robinhood’s Q1’23 earnings paint a grim picture of the profitability and growth challenges that retail investing apps and other fintechs face today:

- Net losses are compounding

- Active users are at a fraction of previous peaks

- Transaction-based revenues are up and down from one quarter to the next but aren’t growing over time

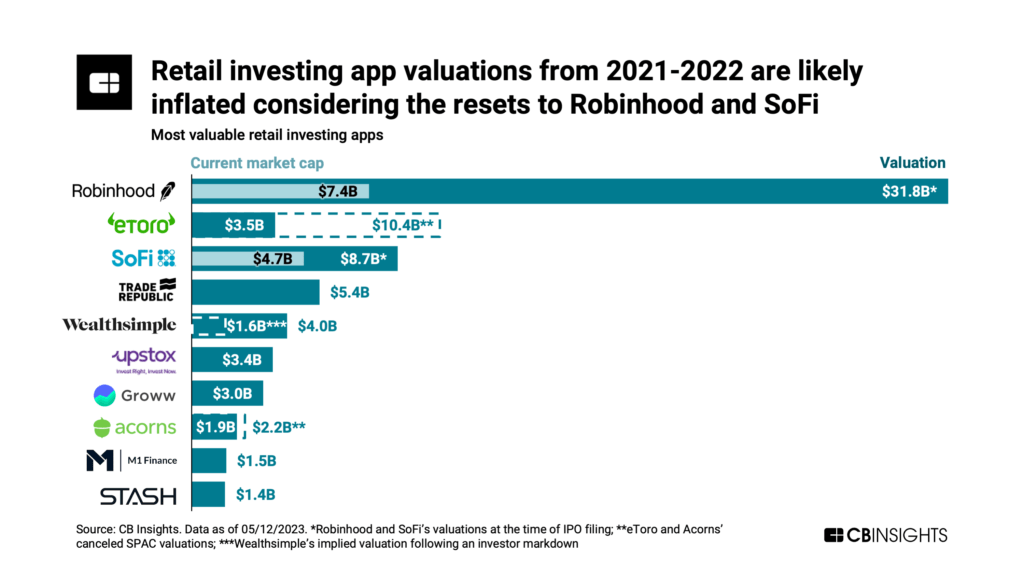

This is old news to the public markets, as Robinhood’s market capitalization is down 77% compared to its exit valuation at IPO in July 2021.

But in the private markets, startup competitors that raised funding at unicorn ($1B+) valuations in 2021 and 2022 — like Trade Republic, Upstox, and Acorns — have yet to see that kind of reset.

Below, we explore why the valuations of private retail investing apps are likely inflated — and what’s next for this breed of fintech unicorns — using the following data points:

- Public market caps and private valuations

- Revenues and revenue multiples

- Employee headcount

Valuations will be corrected for later-stage retail investing unicorns

The valuations that many retail investing platforms earned in 2021 and 2022 don’t reflect the challenges that they and their biggest competitor, Robinhood, face in today’s market.

The sector’s pain points include heavy operating expenses, stalling or falling user growth, and transaction volumes reaching a plateau.

Meanwhile, competition from legacy players is as intense as it’s ever been. In Q1’23, Charles Schwab reported over 1M new brokerage accounts — the most in the last 4 quarters. Fidelity’s total retail accounts were up 10% year-over-year.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.