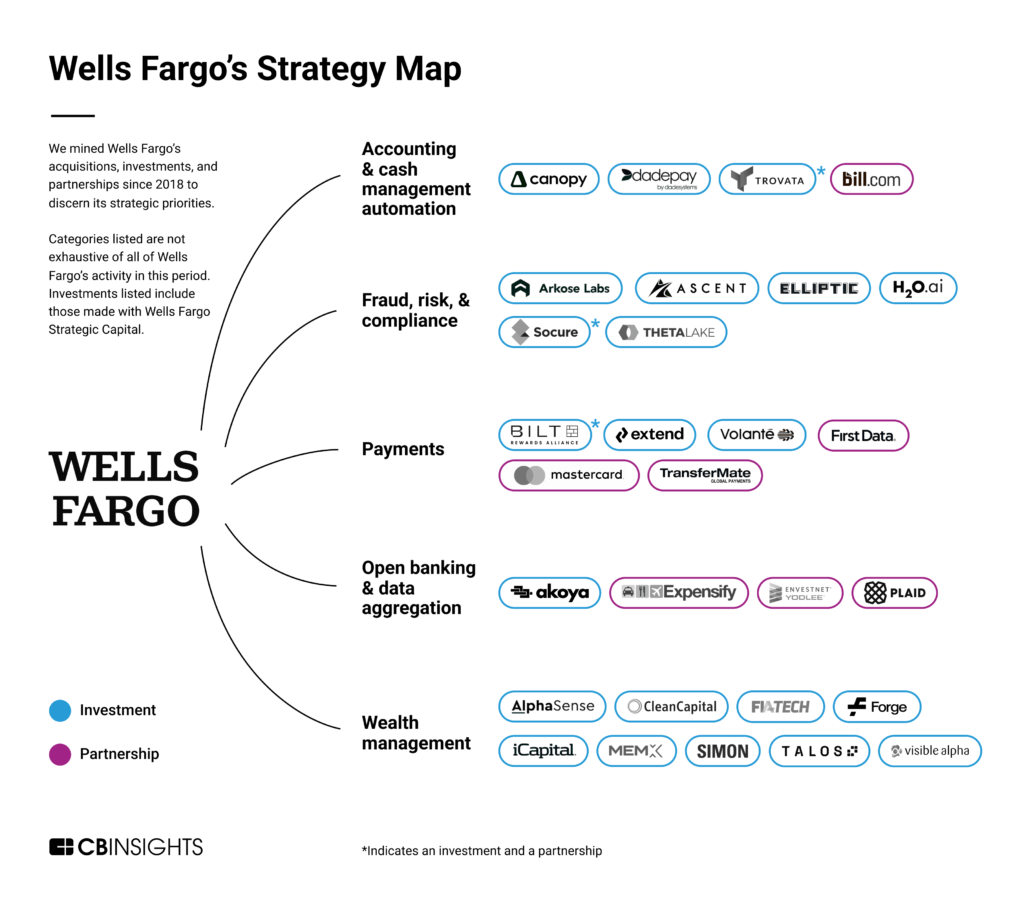

We mined Wells Fargo’s investments and partnerships to discern the bank’s strategic priorities within financial services.

Wells Fargo is the fourth-largest bank in the US by total assets, with a market capitalization of around $138B. Its customer base of over 70M spans across 8,700+ locations worldwide.

Over the last few years, the company has turned to fintech startups to help meet customer demand for secure, seamless, and customized banking experiences. Its recent investments and partnerships have targeted solutions that enhance its offerings to business banking and wealth management clients.

For example, Wells Fargo and its primary investment arm, Wells Fargo Strategic Capital, have backed several cash and spend management automation fintechs to better address the needs of business clients. On the wealth management side, Wells Fargo’s partnerships have allowed it to embed AI and natural language processing (NLP) into its back-end processes, such as market intelligence research and user onboarding.

The banking giant is also investing to amp up its core processes, focusing on quick cross-border transfers and virtual card offerings.

Using CB Insights data, we uncovered 5 of Wells Fargo’s most important strategic priorities highlighted by its investments and partnerships since 2018. We then categorized companies by their business relationships with Wells Fargo across these priorities:

- Wealth management

- Fraud, risk, & compliance

- Payments

- Accounting & cash management automation

- Open finance & data aggregation

These designations are not exhaustive of Wells Fargo’s investment and partnership activity in the analyzed period.

Accounting & cash management automation

Wells Fargo has leveraged investments and partnerships to ramp up its cash management and automation offerings for its business banking clients.

After leading a $20M Series A round to US-based cash automation software startup Trovata in 2021, Wells Fargo rolled out Trovata as its strategic cash positioning and forecasting tool, making the solution available to its business and corporate clients. The bank’s other investments in this category include the accounts receivable (AR) automation software DadeSystems in 2020, and the accounting practice solution Canopy in 2018.

On the AR/AP side, Wells Fargo partnered with Bill.com in 2020 to launch Bill Manager, an automation solution that integrates into the bank’s digital banking platform and streamlines back-office financial operations for Wells Fargo’s SMB clients.

Fraud, risk, & compliance

Wells Fargo has primarily backed companies that leverage AI to ensure fraud prevention and compliance. These include AI/ML-powered supervision and threat detection solutions ThetaLake and H2O.ai, and regulatory text-scanning solution Ascent AI. The deals reinforced Wells Fargo’s current fraud prevention strategy, which leverages FICO’s AI/ML-powered Falcon Fraud Manager solution.

Digital ID verification and authentication is also a focus area for the bank. For example, Wells Fargo has invested in Arkose Labs, which offers a user authentication solution, and ID verification startup Socure. Wells Fargo also partnered with Socure to fight synthetic identity fraud, in which a made-up name, date of birth, mailing address, email account, and phone number are applied to a real person’s Social Security number.

Finally, while Wells Fargo doesn’t offer any crypto-based products, it made two repeat investments into the UK-based Elliptic, a crypto transaction monitoring software that aims to accelerate the institutional adoption of crypto.

Payments

Most of Wells Fargo’s activity in this space focused on faster cross-border payment processing, followed by virtual card solutions.

In 2021, Wells Fargo made a $10M growth equity investment in the cross-border payment processing and financial messaging fintech Volante. Later in 2022, the bank partnered with Volante to modernize its payments strategy, and migrate to the new ISO 20022 financial messaging standards.

Within card payments, Wells Fargo made two investments in the virtual card issuer and virtual card-platform-as-service provider Extend, including an incubator/accelerator round in 2020. The same year, the bank launched its own one-time virtual card payment offering, called WellsOne, to ensure safe transactions for its commercial clients.

The banking giant also entered strategic partnerships with payments providers TransferMate and Bilt Rewards. In 2019, Wells Fargo partnered with TransferMate to speed up international payments for its business customers. Later in March 2022, the bank partnered with Bilt Rewards and Mastercard to issue the first credit card that helped users earn points on their rent payments.

Overall, the bank’s investments and partnerships here focused on ensuring regulatory compliance, and high customer satisfaction.

Open finance & data aggregation

As the broader banking industry shifted toward API-based data aggregation, Wells Fargo followed suit. In 2021, it joined the open finance platform Akoya’s Data Access Network, which allowed fintechs and data aggregators to access Wells Fargo’s data for mutual customers. As of 2020, Wells Fargo also became one of the joint owners of Akoya — along with Fidelity, The Clearing House Payments Co, and 10 other banks.

The bank has also entered a number of data-sharing agreements with fintechs such as Expensify, Envestnet Yodlee, and Plaid in an effort to enhance Wells Fargo customers’ control over their financial data, and streamline their access to services offered by fintech companies. In 2020, the bank launched its own open API channel, Wells Fargo Gateway, which allowed corporate clients and partners to embed Wells Fargo products and services into their own digital experiences and offerings.

Wealth management

Wells Fargo has invested heavily in wealth management solutions, targeting both alternative and traditional asset trading, as well as analytics and customer experience. CEO Charlie Sharf says that wealth management is a significant source of growth for the bank, and he aims to increase digital engagement for Wells Fargo’s 2.6M wealth management clients.

The bank invested in the institutional-grade digital asset trading solution Talos, along with alternative investment platforms Forge Global and iCapital. On the market intelligence side, Wells Fargo invested in the AI-powered research and insight engine AlphaSense in 2021, and the financial market analysis software Visible Alpha in 2018. Wells Fargo’s investments here signaled the banks’ prioritization of AI and NLP in equity research and insight generation

Following these investments, the banking giant has also expanded its own wealth management offerings. In early 2023, Wells Fargo announced the rollout of its net-worth management and financial planning mobile app tool LifeSync. The year before, in an effort to appeal to the new generation of investors, the bank redesigned its robo-advisor Intuitive Investor to be more intuitive, and lowered its required minimum deposit to $500, down from $5,000.

If you aren’t already a client, sign up for a free trial to learn more about our platform.