More automakers and charging station operators are adopting Tesla's charging standard (NACS). We assess the current state of the EV charging market and its top players.

The electric vehicle (EV) charging landscape is undergoing a significant shift as automakers and charging station operators increasingly adopt Tesla‘s North American Charging Standard (NACS).

This could give the EV maker a leg up on its competition in the charging market and even edge out the Combined Charging System (CCS) standard currently used by nearly all non-Tesla EVs sold in North America.

Volvo recently joined Ford, GM, and Rivian in committing to switching over to Tesla’s charging connector in the coming years. Meanwhile, prominent EV charging station manufacturers and operators ChargePoint, EVgo, and Electrify America have all announced plans to offer NACS connections.

In this brief, we use CB Insights data to assess the current state of the EV charging market, focusing on:

- Total funding in the space

- Top-funded companies

- Most valuable companies

- M&A activity

Total funding in the space

Funding activity in the EV charging infrastructure market reached a record-high $1.1B in 2022, bucking the downward trend in the broader venture market, where funding fell 35% year-over-year in 2022.

Investment into EV charging infrastructure providers remains strong in 2023 so far at over $400M.

This trend can largely be attributed to a heightened focus on sustainability from businesses and consumers alike, coupled with government support for the sector through legislation such as the Inflation Reduction Act (IRA).

Notably, Tesla’s Supercharger network — introduced over a decade ago and now touting over 45,000 chargers globally — poses direct competition to the companies in this market.

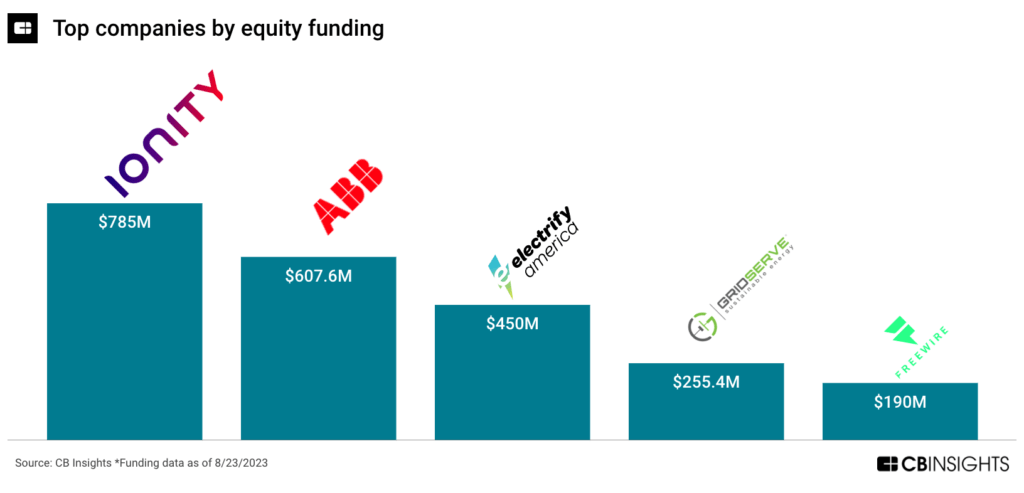

Top-funded companies

EV charging companies have raked in substantial capital over the past 3 years. Much of this has been driven by large funding rounds to major automakers’ joint ventures (IONITY, Electrify America), as well as corporate subsidiaries (ABB E-Mobility).

The top-funded private companies that have not been acquired include IONITY ($785M), ABB E-Mobility ($608M), Electrify America ($450M), Gridserve ($255M), and FreeWire Technologies ($190M).

Most valuable companies

ABB E-Mobility is the highest-valued private company here, with a valuation of $3.3B as of February 2023.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.