Instacart

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.861BDate of IPO

9/19/2023Market Cap

9.74BStock Price

39.87Revenue

$0000About Instacart

Instacart (NASDAQ: CART) provides online food delivery services. It offers a platform allowing users to order grocery products, meat products, alcoholic beverages, and more. It also provides coupons and gift cards. The company was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Instacart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Instacart named as Leader among 15 other companies, including Amazon, DoorDash, and Deliveroo.

Loading...

Research containing Instacart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Instacart in 24 CB Insights research briefs, most recently on Jan 25, 2024.

Jan 4, 2024 report

State of Venture 2023 Report

Nov 21, 2023

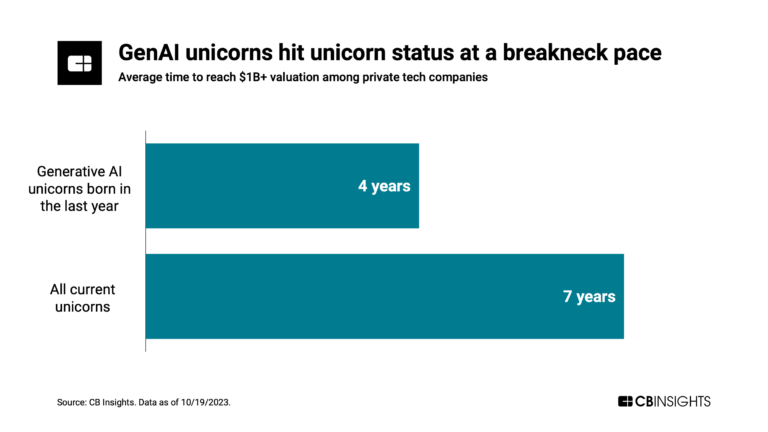

Has the global unicorn club reached its peak?

Nov 20, 2023 report

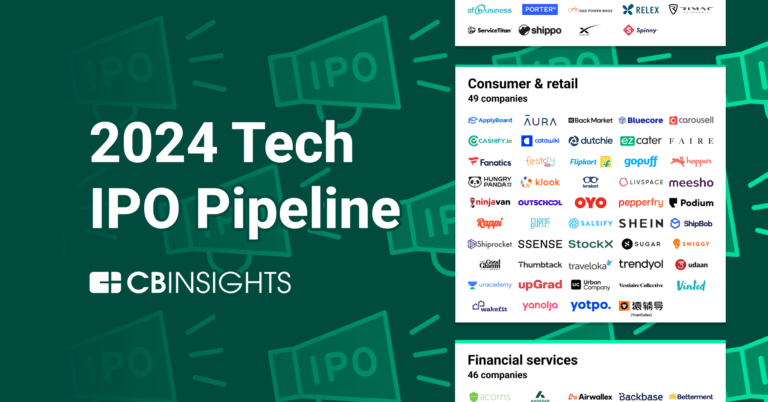

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 ReportExpert Collections containing Instacart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Instacart is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,627 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Tech IPO Pipeline

568 items

Food & Meal Delivery

1,531 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Conference Exhibitors

5,302 items

Latest Instacart News

Sep 19, 2024

This report highlights different factors and opportunities prevailing in the Global Food Basket Market. According to the report, the Global Food Basket Market was valued at USD 10.52 billion, and is expected to grow at a CAGR of 4.76% during 2025-2030. The market has grown substantially due to the increasing demand for convenient and healthy meal solutions, advancements in food delivery and packaging technologies, and the rising trend of home cooking. The market is driven by the growing demand for time-saving and nutritious meal options, as well as the convenience of home delivery. One of the primary drivers of the market is the rising interest in home cooking and healthy eating. Consumers are increasingly looking for ways to enjoy fresh, home-cooked meals without the hassle of meal planning and grocery shopping. Food baskets offer a convenient solution, providing all the necessary ingredients and easy-to-follow recipes, making cooking accessible to individuals with varying levels of culinary skills. The growth of the e-commerce and food delivery sectors has also played a crucial role in the market's expansion. The increasing adoption of online platforms and mobile apps for food basket subscription services has made it easier for consumers to access a wide variety of meal options. The flexibility of meal kit subscriptions, which allow customers to customize their meals based on dietary preferences and portion sizes, has further boosted the market. Geographical Insights Americas represent the largest market for Food Baskets, driven by a high demand for convenient meal solutions, a strong e-commerce infrastructure, and significant consumer interest in healthy eating. The United States is a key market, with a wide range of food basket service providers and a high level of consumer awareness. In the Americas, the market benefits from a mature food delivery sector, the presence of major meal kit companies, and a growing focus on sustainability and reducing food waste. The increasing adoption of plant-based and specialty diet meal kits further supports market growth. Asia Pacific is expected to witness the highest growth rate, driven by rapid urbanization, increasing disposable incomes, and changing consumer lifestyles. Countries like China, Japan, and Australia are key markets, with expanding food delivery services and a rising interest in home cooking. Market Segmentation Reasons to buy this report: In-Depth Comparative Assessment of Top 20 Markets in the Food Basket Market: Comparative assessment of 20 leading countries highlighting the total addressable market, opportunities, lucrative segments and competitive positioning of leading companies. Comprehensive Historical, Present, and Future Analytics of the Food Basket Market: A deep dive in the historical (2020-2023), current (2024) and forecast (2025-2030) market analytics of Food Basket Market. Detailed Analysis of Food Basket Market By Material, End-user, and Sales Channel Across 20 Countries. Gain insights specific to new entrants or new market areas to tap: The study provides detailed market entry strategies, including analysis of barriers to entry, pricing strategies, opportunities, trends, drivers, and challenges and product positioning using the Opportunity Portfolio Matrix (OPM). Strategic Company Movements: Tracking Competitive Developments and Key Players in the Market: The report covers competitive strategies, mergers & acquisitions, new developments, future plans and market share analysis of ~15 top companies. For more information about this report visit https://www.researchandmarkets.com/r/vsx66x About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. Tags

Instacart Frequently Asked Questions (FAQ)

When was Instacart founded?

Instacart was founded in 2012.

Where is Instacart's headquarters?

Instacart's headquarters is located at 50 Beale Street, San Francisco.

What is Instacart's latest funding round?

Instacart's latest funding round is IPO.

How much did Instacart raise?

Instacart raised a total of $2.861B.

Who are the investors of Instacart?

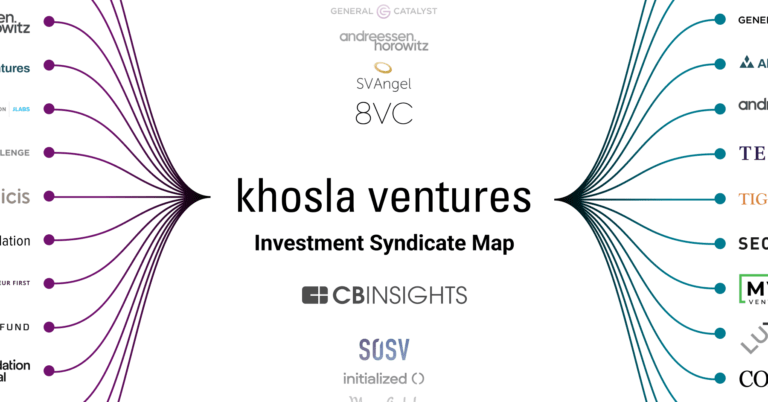

Investors of Instacart include PepsiCo, Sequoia Capital, D1 Capital Partners, Andreessen Horowitz, T. Rowe Price and 32 more.

Who are Instacart's competitors?

Competitors of Instacart include Good Eggs, Gopuff, Thirstie, Halla, Shadowfax and 7 more.

Loading...

Compare Instacart to Competitors

Shadowfax caters logistics platform that operates in the hyper-local, on-demand delivery sector. The company provides a range of services including delivery, retail deliveries, and e-commerce solutions such as forward and reverse shipments. It primarily serves sectors such as e-commerce, food, pharma, and groceries. It was founded in 2015 and is based in Bengaluru, India.

Ninja Van is a tech-enabled logistics company specializing in e-commerce express logistics. The company offers a suite of solutions for parcel delivery, including digital and full-funnel marketing services to enhance shippers' sales. Ninja Van's network extends to various sectors, including e-commerce and business-to-business inventory restocking. It was founded in 2014 and is based in Singapore, Singapore.

Huolala is an internet logistics platform. It provides same-city and cross-city freight transportation, enterprise logistics services, less-than-truckload (LTL) transportation, car rental and after-sales services, and more. It was formerly known as EasyVan. The company was founded in 2013 and is based in Guangzhou, China.

Rappi operates as a tech company focusing on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

Gopuff operates an instant commerce delivery platform for foods and beverages. The company also provides an application that allows customers to choose from the products such as alcohol delivery service, over-the-counter medications, groceries, snacks, drinks, and more. It was founded in 2013 and is based in Philadelphia, Pennsylvania.

Jokr is a platform specializing in instant grocery and retail delivery. The platform offers a shopping experience, delivering products including groceries, pharmaceuticals, and exclusive local items. The company was founded in 2021 and is based in Grand Duchy of Luxembourg, Luxembourg.

Loading...